Jeep Wrangler Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

How much is insurance on a Jeep Wrangler? While this answer will depend on the vehicle year, such as whether you are looking for 2017, 2007, or 2005 Jeep Wrangler insurance costs, the average Jeep Wrangler insurance rates are $104 per month or $1,256 annually.

Is insurance on a Jeep Wrangler expensive compared to other SUVs on the market? Fortunately, this reliable vehicle proves to cost less to insure than other similar vehicles. If you are looking for cheap car insurance, we can help. Read through our complete guide to see how your Jeep insurance rates are impacted by your driver demographics, the Jeep Wrangler safety and crash test ratings, as well as insurance loss probability details.

Ready to learn what you can do to save on your Jeep Wrangler car insurance rates? To start finding affordable Jeep car insurance prices right now, simply enter your ZIP code into our free quote tool above.

Estimated insurance rates for a Jeep Wrangler are $1,244 a year for full coverage. Comprehensive costs around $256 each year, collision costs $358, and liability costs around $450. Liability-only coverage costs as low as $518 a year, with high-risk coverage costing around $2,660. Teenage drivers pay the most at $4,764 a year or more.

Average premium for full coverage: $1,244

Premium estimates for type of coverage:

These estimates include $500 policy deductibles, 30/60 split liability limits, and includes both medical and UM/UIM coverage. Rates include averaging for all states and Wrangler models.

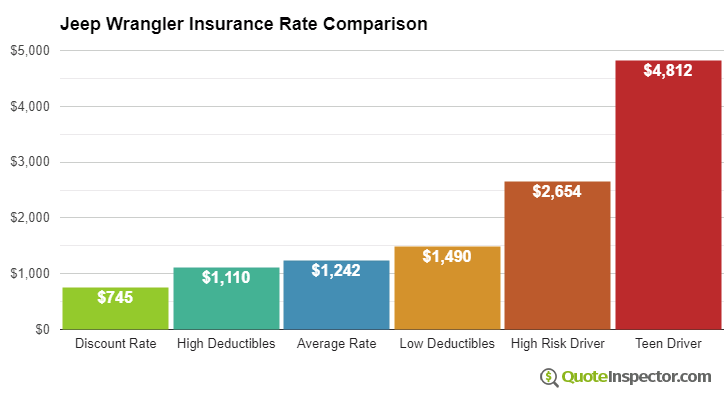

Insurance Price Range by Risk and Coverage

For an average driver, insurance rates for a Jeep Wrangler go from as low as $518 for basic liability insurance to a high rate of $2,660 for a high-risk insurance policy.

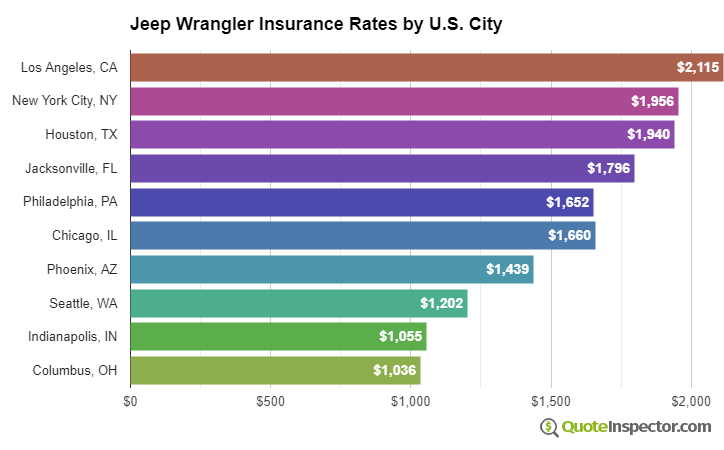

Insurance Price Range by Location

Where you live can have significant affects on auto insurance rates. Areas with sparse population are statistically proven to have a lower frequency of accident claims than densely populated cities.

The graphic below illustrates the effect of geographic area on auto insurance rates.

These rate differences show why all drivers should compare prices for a specific zip code and risk profile, instead of using average rates.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Rate Comparisons

The chart below shows estimated Jeep Wrangler insurance rates for additional coverage choices and driver risks.

- The best discount rate is $747

- Using higher $1,000 deductibles will save about $138 a year

- The average rate for a 40-year-old good driver using $500 deductibles is $1,244

- Using low deductibles for physical damage coverage will increase the cost to $1,512

- Drivers who are prone to accidents and violations could pay at least $2,660 or more

- An auto insurance policy for full coverage for a teen driver can be $4,764 or more

Insurance prices for a Jeep Wrangler also have a wide range based on your driving characteristics, the trim level of your Wrangler, and deductibles and policy limits.

More mature drivers with a clean driving record and high deductibles may pay as little as $1,200 a year, or $100 per month, for full coverage. Prices are much higher for drivers in their teens, where even good drivers can expect to pay as much as $4,700 a year. View Rates by Age

Where you choose to live has a huge impact on Jeep Wrangler insurance prices. A driver around age 40 might see prices as low as $820 a year in states like Idaho, Maine, and Iowa, or be forced to pay as much as $1,780 on average in Michigan, Louisiana, and New York.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,126 | -$118 | -9.5% |

| Alaska | $954 | -$290 | -23.3% |

| Arizona | $1,034 | -$210 | -16.9% |

| Arkansas | $1,244 | -$0 | 0.0% |

| California | $1,418 | $174 | 14.0% |

| Colorado | $1,188 | -$56 | -4.5% |

| Connecticut | $1,278 | $34 | 2.7% |

| Delaware | $1,410 | $166 | 13.3% |

| Florida | $1,556 | $312 | 25.1% |

| Georgia | $1,150 | -$94 | -7.6% |

| Hawaii | $894 | -$350 | -28.1% |

| Idaho | $844 | -$400 | -32.2% |

| Illinois | $928 | -$316 | -25.4% |

| Indiana | $940 | -$304 | -24.4% |

| Iowa | $840 | -$404 | -32.5% |

| Kansas | $1,182 | -$62 | -5.0% |

| Kentucky | $1,696 | $452 | 36.3% |

| Louisiana | $1,842 | $598 | 48.1% |

| Maine | $770 | -$474 | -38.1% |

| Maryland | $1,028 | -$216 | -17.4% |

| Massachusetts | $994 | -$250 | -20.1% |

| Michigan | $2,160 | $916 | 73.6% |

| Minnesota | $1,042 | -$202 | -16.2% |

| Mississippi | $1,494 | $250 | 20.1% |

| Missouri | $1,104 | -$140 | -11.3% |

| Montana | $1,338 | $94 | 7.6% |

| Nebraska | $980 | -$264 | -21.2% |

| Nevada | $1,494 | $250 | 20.1% |

| New Hampshire | $896 | -$348 | -28.0% |

| New Jersey | $1,392 | $148 | 11.9% |

| New Mexico | $1,102 | -$142 | -11.4% |

| New York | $1,312 | $68 | 5.5% |

| North Carolina | $718 | -$526 | -42.3% |

| North Dakota | $1,020 | -$224 | -18.0% |

| Ohio | $860 | -$384 | -30.9% |

| Oklahoma | $1,278 | $34 | 2.7% |

| Oregon | $1,140 | -$104 | -8.4% |

| Pennsylvania | $1,186 | -$58 | -4.7% |

| Rhode Island | $1,660 | $416 | 33.4% |

| South Carolina | $1,128 | -$116 | -9.3% |

| South Dakota | $1,050 | -$194 | -15.6% |

| Tennessee | $1,088 | -$156 | -12.5% |

| Texas | $1,500 | $256 | 20.6% |

| Utah | $922 | -$322 | -25.9% |

| Vermont | $852 | -$392 | -31.5% |

| Virginia | $744 | -$500 | -40.2% |

| Washington | $960 | -$284 | -22.8% |

| West Virginia | $1,142 | -$102 | -8.2% |

| Wisconsin | $862 | -$382 | -30.7% |

| Wyoming | $1,110 | -$134 | -10.8% |

Using high physical damage deductibles could cut prices by as much as $410 every year, whereas increasing liability limits will increase prices. Going from a 50/100 limit to a 250/500 limit will cost up to $448 more per year. View Rates by Deductible or Liability Limit

If you have a few violations or tend to cause accidents, you could be paying at least $1,400 to $2,000 extra annually, depending on your age. Insurance for high-risk drivers can be as much as 42% to 125% more than a normal policy. View High Risk Driver Rates

With such a large range in prices, the only way to know your exact price is to do a rate comparison and see which company has the best price. Each insurance company uses a different method to calculate prices, so the prices will be substantially different from one company to the next.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Jeep Wrangler Sport 4WD 2-Dr | $1,104 | $92 |

| Jeep Wrangler Sport Islander Package 4WD 2-Dr | $1,158 | $97 |

| Jeep Wrangler Unlimited Sport 2WD 4-Dr | $1,270 | $106 |

| Jeep Wrangler Sahara 4WD 2-Dr | $1,170 | $98 |

| Jeep Wrangler Unlimited Sport 4WD 4-Dr | $1,282 | $107 |

| Jeep Wrangler Rubicon 4WD 2-Dr | $1,214 | $101 |

| Jeep Wrangler Unlimited Sahara 2WD 4-Dr | $1,296 | $108 |

| Jeep Wrangler Unlimited Sport Islander Package 4WD 4-Dr | $1,296 | $108 |

| Jeep Wrangler Unlimited Sahara 4WD 4-Dr | $1,338 | $112 |

| Jeep Wrangler Unlimited Rubicon 4WD 4-Dr | $1,380 | $115 |

Rates assume 2023 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Jeep Wrangler | $268 | $362 | $440 | $1,250 |

| 2023 Jeep Wrangler | $256 | $358 | $450 | $1,244 |

| 2022 Jeep Wrangler | $248 | $350 | $470 | $1,248 |

| 2021 Jeep Wrangler | $240 | $336 | $486 | $1,242 |

| 2020 Jeep Wrangler | $226 | $324 | $500 | $1,230 |

| 2019 Jeep Wrangler | $218 | $300 | $510 | $1,208 |

| 2018 Jeep Wrangler | $208 | $282 | $514 | $1,184 |

| 2017 Jeep Wrangler | $200 | $254 | $520 | $1,154 |

| 2016 Jeep Wrangler | $188 | $234 | $520 | $1,122 |

| 2015 Jeep Wrangler | $180 | $218 | $524 | $1,102 |

| 2014 Jeep Wrangler | $176 | $204 | $534 | $1,094 |

| 2013 Jeep Wrangler | $164 | $190 | $534 | $1,068 |

| 2012 Jeep Wrangler | $158 | $172 | $540 | $1,050 |

| 2011 Jeep Wrangler | $148 | $158 | $534 | $1,020 |

| 2010 Jeep Wrangler | $140 | $142 | $534 | $996 |

| 2009 Jeep Wrangler | $134 | $128 | $530 | $972 |

| 2008 Jeep Wrangler | $132 | $126 | $520 | $958 |

| 2007 Jeep Wrangler | $130 | $120 | $510 | $940 |

| 2005 Jeep Wrangler | $116 | $108 | $500 | $904 |

Rates are averaged for all Jeep Wrangler models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Find Cheap Jeep Wrangler Insurance

Finding better rates on car insurance requires avoiding accidents and claims, maintaining good credit, not filing small claims, and insuring your home and auto with the same company. Take the time to compare rates at least every other year by quoting rates from direct carriers like Progressive, GEICO, and Esurance, and also from local insurance agents.

The points below are a brief summary of the car insurance concepts covered in the above illustrations.

- Higher risk drivers that tend to have accidents or serious violations may be required to pay an average of $1,420 more every year to insure a Jeep Wrangler

- Drivers can save up to $140 per year simply by quoting online in advance

- Increasing policy deductibles can save around $400 each year

- Policyholders who may need increased liability limits will pay an extra $500 each year to increase from 30/60 bodily injury limits to 250/500 limits

How much does Jeep Wrangler insurance cost?

How much is car insurance for a 2020 Jeep Wrangler? That will likely cost your around $1,256 per year. However, many factors impact your rates, such as driver age and experience. So, how much is insurance on a Jeep Wrangler for a 16-year-old? That annual total is more like $6,694 per year.

How much does Jeep Wrangler insurance cost for an 18-year-old? Most 18-year-olds will pays $5,622 per year for car insurance. However, the good news is that as long as you maintain a clean driving record, teenager Jeep Wrangler insurance decreases by about 8 percent per year until the driver is 20 years old.

You might be wondering, do Jeep Wranglers have a lot of problems? According to the National Highway Traffic Safety Administration (NHTSA), steering wheel problems and airbag problems were the most common issues found in the Wrangler. The Jeep Wrangler also had a major recall at one point specifically for airbags.

The best Jeep Wrangler car insurance company will provide you with competitive rates without compromising your coverage. Is State Farm insurance for a Jeep Wrangler available? Yes, State Farm offers Jeep Wrangler car insurance. The company covers all personal vehicle types.

Is it expensive to insure a Jeep Wrangler? Not usually, the Jeep Wrangler proves to be a reliable and low-cost SUV to insure. If you have a poor driving record, your rates might be higher than average. Fortunately, shopping around for insurance quotes for a Jeep Wrangler will help you save money in the long run.

So if you want to find 2018 or 2016 Jeep Wrangler insurance costs or even insurance for a 2013 Jeep Wrangler, start by getting quotes by entering your five-digit ZIP code into our free tool below.

Compare Quotes From Top Companies and SaveFree Car Insurance Comparison

Secured with SHA-256 Encryption

What are the Jeep Wrangler safety ratings?

How much does average insurance cost for a Jeep Wrangler? Your jeep insurance costs will depend partially on the safety features and ratings of your vehicle. Luckily, the Jeep Wrangler has some great safety features including airbags, brake assist, rollover protection system, traction control, and more.

The Insurance Institute for Highway Safety (IIHS) gave the 2020 Jeep Wrangler the following safety ratings:

- Small overlap front (driver-side): Marginal

- Moderate overlap front: Good

- Side: Good

- Roof strength: Good

- Head restraints and seats: Good

Good is the highest rating given by the IHS, so most of the safety ratings for the Jeep Wrangler are excellent. While a marginal small overlap front test result is not ideal, you should not actually see any substantial increases in your insurance rates.

What are the Jeep Wrangler crash test ratings?

The Jeep Wrangler crash test ratings will also affect your car insurance rates. Take a look at the table below to see how different model years of the Jeep Wrangler have performed during crash tests performed by the National Highway Traffic Safety Administration.

Jeep Wrangler Crash Test Ratings

Vehicle Make and Model Overall Crash Test Ratings Frontal Crash Test Ratings Side Crash Test Ratings Rollover Crash Test Ratings

2020 Jeep Wrangler Unlimited SUV 4WD N/R 4 stars N/R 3 stars

2020 Jeep Wrangler Unlimited DIESEL SUV 4WD N/R N/R N/R 3 stars

2020 Jeep Wrangler SUV 4WD N/R 4 stars N/R 3 stars

2019 Jeep Wrangler Unlimited 4 DR 4WD N/R 4 stars N/R 3 stars

2019 Jeep Wrangler 2 DR 4WD N/R N/R N/R N/R

2018 Jeep Wrangler Unlimited JK 4 DR 4WD Early release N/R 3 stars N/R 3 stars

2018 Jeep Wrangler Unlimited 4 DR 4WD Later Release N/R N/R N/R 3 stars

2018 Jeep Wrangler JK 2 DR 4WD Early release N/R N/R N/R 3 stars

2018 Jeep Wrangler 2 DR 4WD Later Release N/R N/R N/R 3 stars

2017 Jeep Wrangler Unlimited 4 DR 4WD N/R 3 stars N/R 3 stars

2017 Jeep Wrangler 2 DR 4WD N/R N/R N/R 3 stars

2016 Jeep Wrangler 4DR 4WD N/R N/R N/R 3 stars

2016 Jeep Wrangler 2DR 4WD N/R N/R N/R 3 stars

Overall, the Jeep Wrangler’s crash test ratings could use improvement. However, the scores still fall within the average range for an SUV.

As you can see, depending on your Jeep’s model year and trim level, your vehicle could have better or worse crash test results. For example, the Jeep Wrangler Unlimited insurance cost will be a little higher as it only scored 3 stars in the rollover test.

Our professional advice is to always check the crash test and safety details for your specific Jeep Wrangler model to ensure the most accuracy.

What are the Jeep Wrangler insurance loss probability ratios?

Understanding the Jeep Wrangler insurance loss probability ratios will help you estimate your potential car insurance costs. A lower insurance loss probability means you will have lower Jeep Wrangler insurance rates, while a higher loss probability means you will have higher insurance rates.

See the details of the 2020 Jeep Wrangler insurance loss probability ratios in the table below.

Jeep Wrangler Insurance Loss Rates

Insurance Coverage Categories Loss Rates

Collision -46%

Property Damage 34%

Comprehensive -29%

Personal Injury -43%

Medical Payment -48%

Bodily Injury 2%

Wondering how much is the average liability insurance for a Jeep Wrangler? Liability insurance will be pricy if the Jeep Wrangler, a mid-size SUV, has poor liability losses. Unfortunately, the IIHS rated the property damage liability losses for the four-door Jeep Wrangler as substantially worse than average.

While the property damage loss ratio for the Jeep Wrangler is substantially worse than average, this SUV fares well in every other category. Overall, these numbers help keep your car insurance rates low and will help balance out the pricier liability rates.

Read on to see how the Jeep Wrangler’s rates compare to other vehicles.

Should you compare the Jeep Wrangler against other vehicles in the same car class?

Comparing the Jeep Wrangler to other similar vehicles in the same car class can help you determine if this type of car really is the right match for you and your needs.

Officially, the Jeep Wrangler is considered to be a midsize SUV.

To see how Jeep Wrangler insurance rates compare to other midsize SUVs, take a look at the SUVs below.

You are now an expert on securing affordable Jeep Wrangler car insurance. Whether you are looking for Jeep Rubicon insurance rates or car insurance for a Jeep Wrangler Unlimited, remember that getting multiple quotes is one of the best ways to save.

Are you ready to buy Jeep Wrangler car insurance? Simply enter your ZIP code in our free online quote tool to find cheap Jeep Wrangler car insurance quotes from multiple insurance companies near you.

References:

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $4,764 |

| 20 | $2,832 |

| 30 | $1,284 |

| 40 | $1,244 |

| 50 | $1,140 |

| 60 | $1,116 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,512 |

| $250 | $1,390 |

| $500 | $1,244 |

| $1,000 | $1,106 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,244 |

| 50/100 | $1,480 |

| 100/300 | $1,604 |

| 250/500 | $1,928 |

| 100 CSL | $1,529 |

| 300 CSL | $1,803 |

| 500 CSL | $2,003 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $6,742 |

| 20 | $4,492 |

| 30 | $2,702 |

| 40 | $2,660 |

| 50 | $2,538 |

| 60 | $2,512 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $64 |

| Multi-vehicle | $64 |

| Homeowner | $20 |

| 5-yr Accident Free | $81 |

| 5-yr Claim Free | $77 |

| Paid in Full/EFT | $50 |

| Advance Quote | $56 |

| Online Quote | $85 |

| Total Discounts | $497 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area