Nissan Frontier Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: May 13, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

When the time comes to secure a quality car insurance policy, drivers are often left with more questions than answers. In order to alleviate that stress, we are here to provide you with accurate information so you know exactly how much Nissan Frontier insurance costs and how those rates are calculated.

This comprehensive article is structured in a way to give you detailed information about the class, liability rates, safety features, MSRP value, and repair estimates of the Nissan Frontier. By reading through it, you will be able to discover for yourself if getting a cheap insurance policy is myth or reality.

To get started, simply read the information we prepared for you in the article below. Once you’re ready to compare quotes, use our free online tool for instant results.

The average insurance rates for a Nissan Frontier are $1,382 a year with full coverage. Comprehensive costs around $280 a year, collision costs $482, and liability is $440. Buying just liability costs around $510 a year, with insurance for high-risk drivers costing around $2,976. Teen drivers cost the most to insure at $5,232 a year or more.

Average premium for full coverage: $1,382

Policy rates for type of insurance:

Price estimates include $500 physical damage insurance deductibles, liability limits of 30/60, and includes medical and UM/UIM coverage. Prices are averaged for all U.S. states and Frontier trim levels.

Price Range Variability

For a driver around age 40, Nissan Frontier insurance rates go from the low end price of $510 for just liability insurance to a high of $2,976 for a driver that may need high-risk insurance.

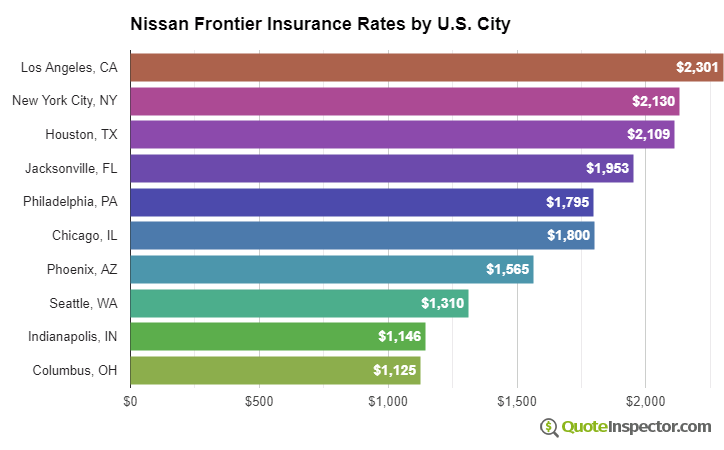

Urban vs. Rural Price Range

Choosing to live in a large city can have significant affects on insurance rates. Areas with sparse population are shown to have lower incidents of collision claims than larger metro areas.

The diagram below illustrates the difference between rural and urban areas on auto insurance rates.

The examples above demonstrate why it is important to compare rates quotes for a specific zip code, instead of using price averages.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

More Rate Details

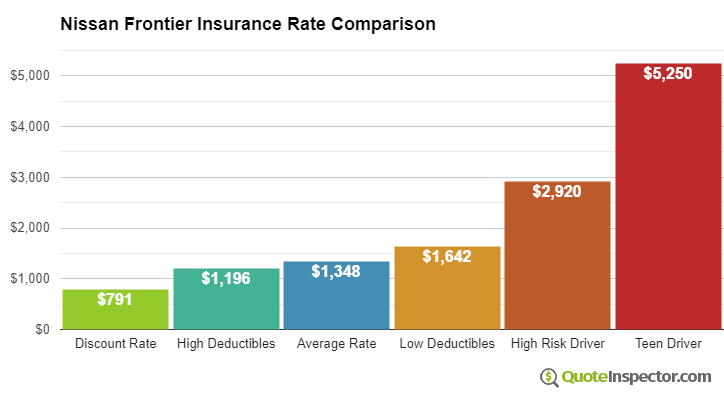

The chart below details estimated Nissan Frontier insurance rates for additional coverage choices and driver risks.

- The lowest rate with discounts is $810

- Raising to $1,000 deductibles will save about $1,210 annually

- The estimated price for a good driver age 40 using $500 deductibles is $1,382

- Choosing low $100 deductibles bumps up the cost to $1,716

- At-risk drivers with multiple violations and an at-fault accident could pay at least $2,976 or more

- Policy cost that insures a teen driver can be $5,232

Insurance rates for a Nissan Frontier also range considerably based on the trim level of your Frontier, your age and driving habits, and deductibles and policy limits.

If you have a few points on your driving record or you caused an accident, you may be forking out at least $1,600 to $2,300 extra every year, depending on your age. A high-risk auto insurance policy is expensive and can cost as much as 44% to 129% more than average. View High Risk Driver Rates

Older drivers with a clean driving record and higher comprehensive and collision deductibles may pay as little as $1,300 every 12 months on average, or $108 per month, for full coverage. Rates are highest for teenagers, since even teens with perfect driving records can expect to pay as much as $5,200 a year. View Rates by Age

Your home state also has a big influence on Nissan Frontier insurance prices. A middle-age driver might find rates as low as $1,000 a year in states like New Hampshire, Ohio, and Utah, or as much as $1,870 on average in Florida, Michigan, and New York.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,248 | -$134 | -9.7% |

| Alaska | $1,060 | -$322 | -23.3% |

| Arizona | $1,148 | -$234 | -16.9% |

| Arkansas | $1,382 | -$0 | 0.0% |

| California | $1,574 | $192 | 13.9% |

| Colorado | $1,318 | -$64 | -4.6% |

| Connecticut | $1,418 | $36 | 2.6% |

| Delaware | $1,564 | $182 | 13.2% |

| Florida | $1,728 | $346 | 25.0% |

| Georgia | $1,276 | -$106 | -7.7% |

| Hawaii | $992 | -$390 | -28.2% |

| Idaho | $936 | -$446 | -32.3% |

| Illinois | $1,028 | -$354 | -25.6% |

| Indiana | $1,042 | -$340 | -24.6% |

| Iowa | $932 | -$450 | -32.6% |

| Kansas | $1,310 | -$72 | -5.2% |

| Kentucky | $1,882 | $500 | 36.2% |

| Louisiana | $2,046 | $664 | 48.0% |

| Maine | $854 | -$528 | -38.2% |

| Maryland | $1,140 | -$242 | -17.5% |

| Massachusetts | $1,102 | -$280 | -20.3% |

| Michigan | $2,400 | $1,018 | 73.7% |

| Minnesota | $1,154 | -$228 | -16.5% |

| Mississippi | $1,656 | $274 | 19.8% |

| Missouri | $1,228 | -$154 | -11.1% |

| Montana | $1,486 | $104 | 7.5% |

| Nebraska | $1,092 | -$290 | -21.0% |

| Nevada | $1,656 | $274 | 19.8% |

| New Hampshire | $996 | -$386 | -27.9% |

| New Jersey | $1,546 | $164 | 11.9% |

| New Mexico | $1,222 | -$160 | -11.6% |

| New York | $1,456 | $74 | 5.4% |

| North Carolina | $796 | -$586 | -42.4% |

| North Dakota | $1,132 | -$250 | -18.1% |

| Ohio | $954 | -$428 | -31.0% |

| Oklahoma | $1,418 | $36 | 2.6% |

| Oregon | $1,266 | -$116 | -8.4% |

| Pennsylvania | $1,316 | -$66 | -4.8% |

| Rhode Island | $1,844 | $462 | 33.4% |

| South Carolina | $1,252 | -$130 | -9.4% |

| South Dakota | $1,166 | -$216 | -15.6% |

| Tennessee | $1,210 | -$172 | -12.4% |

| Texas | $1,664 | $282 | 20.4% |

| Utah | $1,022 | -$360 | -26.0% |

| Vermont | $946 | -$436 | -31.5% |

| Virginia | $826 | -$556 | -40.2% |

| Washington | $1,066 | -$316 | -22.9% |

| West Virginia | $1,268 | -$114 | -8.2% |

| Wisconsin | $954 | -$428 | -31.0% |

| Wyoming | $1,230 | -$152 | -11.0% |

Choosing high deductibles can reduce rates by up to $510 every year, while buying higher liability limits will increase rates. Moving from a 50/100 bodily injury protection limit to a 250/500 limit will raise rates by up to $351 more per year. View Rates by Deductible or Liability Limit

Because rates have so much variability, the best way to find out your exact price is to get quotes and see which company has the best rate. Every auto insurance company uses a different rate calculation, so the rates will be varied.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Nissan Frontier XE King Cab 2WD | $1,296 | $108 |

| Nissan Frontier SE King Cab 2WD | $1,338 | $112 |

| Nissan Frontier SE Crew Cab 2WD | $1,424 | $119 |

| Nissan Frontier LE King Cab 2WD | $1,468 | $122 |

| Nissan Frontier Pro-4X King Cab 2WD | $1,468 | $122 |

| Nissan Frontier LE Crew Cab 2WD | $1,510 | $126 |

| Nissan Frontier Pro-4X Crew Cab 2WD | $1,510 | $126 |

| Nissan Frontier SE King Cab 4WD | $1,250 | $104 |

| Nissan Frontier SE Crew Cab 4WD | $1,294 | $108 |

| Nissan Frontier LE King Cab 4WD | $1,336 | $111 |

| Nissan Frontier Pro-4X King Cab 4WD | $1,336 | $111 |

| Nissan Frontier LE Crew Cab 4WD | $1,380 | $115 |

| Nissan Frontier Pro-4X Crew Cab 4WD | $1,380 | $115 |

Rates assume 2023 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Nissan Frontier | $294 | $500 | $420 | $1,394 |

| 2023 Nissan Frontier | $280 | $482 | $440 | $1,382 |

| 2022 Nissan Frontier | $270 | $478 | $450 | $1,378 |

| 2021 Nissan Frontier | $260 | $466 | $470 | $1,376 |

| 2020 Nissan Frontier | $250 | $446 | $486 | $1,362 |

| 2019 Nissan Frontier | $238 | $430 | $500 | $1,348 |

| 2018 Nissan Frontier | $228 | $400 | $510 | $1,318 |

| 2017 Nissan Frontier | $218 | $376 | $514 | $1,288 |

| 2016 Nissan Frontier | $210 | $338 | $520 | $1,248 |

| 2014 Nissan Frontier | $190 | $292 | $524 | $1,186 |

| 2012 Nissan Frontier | $172 | $252 | $534 | $1,138 |

| 2011 Nissan Frontier | $166 | $228 | $540 | $1,114 |

| 2008 Nissan Frontier | $142 | $170 | $530 | $1,022 |

| 2007 Nissan Frontier | $140 | $166 | $520 | $1,006 |

| 2006 Nissan Frontier | $136 | $160 | $510 | $986 |

| 2005 Nissan Frontier | $126 | $152 | $504 | $962 |

| 2004 Nissan Frontier | $120 | $144 | $500 | $944 |

Rates are averaged for all Nissan Frontier models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Find Cheaper Nissan Frontier Insurance

Finding cheaper rates on car insurance consists of being a low-risk driver, having above-average credit, not filing small claims, and insuring your home and auto with the same company. Shop around once a year by getting rate quotes from direct companies, and also from your local independent and exclusive agents.

The items below are a condensed summary of the data that was covered above.

- You may be able to save up to $160 per year simply by quoting early and online

- Policyholders who may need more liability coverage will pay about $480 every year to raise from a 30/60 limit to the 250/500 level

- Teen drivers pay higher rates, as much as $436 each month if full coverage is included

- Higher risk drivers with multiple at-fault accidents may pay on average $1,590 more every year to insure their Frontier

Even though the average annual Nissan Frontier insurance cost is $1,394, your policy can be higher or lower depending upon your individual profile. Those factors include your age, home address, driving history, and the model year of your pickup.

Compare Quotes From Top Companies and SaveFree Car Insurance Comparison

Secured with SHA-256 Encryption

How does the size and class of the Nissan Frontier affect liability rates?

The most basic form of coverage that everybody who drives must carry is called liability car insurance, which is broken up into two forms called bodily injury liability and property damage liability.

Your liability rates are impacted by the size and class of the vehicle you drive. In the case of the Nissan Frontier, the Insurance Institute for Highway Safety (IIHS) classifies the model as a small pickup truck.

These types of models are generally considered to be safer than smaller vehicles you see on the road like economy cars or sports cars. For this reason, insurance rates tend to be more affordable since there is less risk of injury to the driver and occupants in the Nissan Frontier.

Although it’s helpful to know how size and class play a factor in what you will end up paying for Nissan Frontier insurance costs, you are likely more concerned with how it impacts your wallet.

What does liability insurance cost for a Nissan Frontier?

Bodily injury liability insurance will kick in after an accident that is your fault. This coverage will help pay for things like medical expenses and lost wages incurred by the opposing driver.

The following general quotes will show a breakdown of how much bodily injury liability costs for the Nissan Frontier from low to high coverage.

- Low ($25,000): $88.45

- Medium ($50,000): $109.11

- High ($100,000): $121.12

Property damage liability insurance will pay for damage you inflicted on the other driver’s property, such as their vehicle.

Let’s take a look at what property damage liability insurance costs for a Nissan Frontier based on the level of coverage you wish to receive.

- Low ($25,000): $105.65

- Medium ($50,000): $106.46

- High ($100,000): $111.18

Property damage rates on the Nissan Frontier remain mostly the same, even with more coverage.

What are the safety features and ratings of the Nissan Frontier?

Equipping a pickup like the Nissan Frontier with innovative safety features is vital to the safety of the driver and the truck’s occupants.

Take a look at the following list of safety features on the Nissan Frontier with information sourced from AutoBlog.com.

- Anti-Lock Brakes – Also known as ABS, these brakes have sensors that detect when the tire(s) have stopped moving when extreme braking occurs. The ABS system will modify pressure allowing the tire(s) to continue rotating safely.

- Front-Impact Airbags – This feature serves to protect the heads of the driver and passengers during a front-end crash.

- Stability Control – This feature automatically senses when the van’s handling limits have been exceeded and reduces engine power and applies select brakes to help prevent the driver from losing control.

- Anti-Whiplash – These head restraints actively react to rear collision forces and cradle the occupants’ head in an effort to reduce the likelihood of a whiplash injury.

- Pretensioners – This feature automatically tightens the seatbelts to place the occupant in the optimal seating position during a collision.

Even though the safety features of the Nissan Frontier are impressive, insurance rates for this pickup are still tied to every model that belongs to the same size and class.

The IIHS reports that out of 1,276,485 registered small pickups, a total of 33 deaths have been reported for this class. Broken down, that is a fatality rate of 26 per one million registered people who drive a model like the Nissan Frontier.

Beyond vehicle type, fatality statistics vary based on the point of impact from which the crash occurred. Take a look at the following figures to see how some types of crashes are more fatal than others.

- Frontal Impact: 2,493 deaths

- Side Impact: 807 deaths

- Rear Impact: 173 deaths

- Other (mostly rollovers): 896 deaths

As you can see from these figures, frontal impact crashes tend to be the most fatal.

What is the MSRP of the Nissan Frontier?

As of the writing of this article, Kelley Blue Book (KBB) reports that the MSRP value of a base-level 2019 Nissan Frontier is $24,255 with a fair market value between $22,005 and $23,734.

If you want to protect your very own Frontier, you will need to explore the option of getting full coverage. Having this on your policy is the only way your truck is covered in the event of a crash.

Two types of coverage you can get to protect your car are collision and comprehensive insurance.

- Collision car insurance is a type of coverage that will pay for any costs associated with repairing or even replacing your vehicle if it gets damaged after colliding with another car or object.

- Comprehensive car insurance protects you from any damage sustained that is outside of your control, such as a bicycle running into your vehicle while it is parked on the street.

The IIHS reports that the Nissan Frontier has a loss ratio of -28 percent for collision coverage, which is better than the average. On the other hand, the comprehensive loss percentage on this model is -2 percent, which is on par with the average for this vehicle class.

How much will it cost to repair my Nissan Frontier?

All cars start depreciating the minute they are driven off the dealership lot. Therefore, paying for repairs is a reality for all vehicle owners, regardless of the model’s long-term durability. The only thing that changes is how much you are going to pay to keep your vehicle in great-driving condition.

In the case of the Nissan Frontier, experts from RepairPal suggest that the annual cost of repairs on this forward-thinking pickup truck is $470 per year.

Beyond the average overall cost of ownership, different parts of the truck cost varying amounts to fix. Take a look at the following repair quotes courtesy of Instant Estimator.

- Front Bumper: $387.80

- Rear Bumper: $397.80

- Hood: $377

- Roof: $389.40

- Front Door: $389.20

- Back Door: $377.80

- Fender: $327.40

- Quarter Panel: $377

By now, we have gone into extensive detail about Nissan Frontier insurance costs but want to ask, “is there anything we might have missed or additional topics you would’ve liked to know more about?” If not, feel encouraged to use our free online tool to start comparing quotes from different insurance providers.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,232 |

| 20 | $3,180 |

| 30 | $1,432 |

| 40 | $1,382 |

| 50 | $1,262 |

| 60 | $1,238 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,716 |

| $250 | $1,562 |

| $500 | $1,382 |

| $1,000 | $1,210 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,382 |

| 50/100 | $1,458 |

| 100/300 | $1,556 |

| 250/500 | $1,809 |

| 100 CSL | $1,497 |

| 300 CSL | $1,712 |

| 500 CSL | $1,868 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $7,438 |

| 20 | $5,052 |

| 30 | $3,032 |

| 40 | $2,976 |

| 50 | $2,840 |

| 60 | $2,814 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $72 |

| Multi-vehicle | $72 |

| Homeowner | $21 |

| 5-yr Accident Free | $97 |

| 5-yr Claim Free | $88 |

| Paid in Full/EFT | $60 |

| Advance Quote | $66 |

| Online Quote | $96 |

| Total Discounts | $572 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area