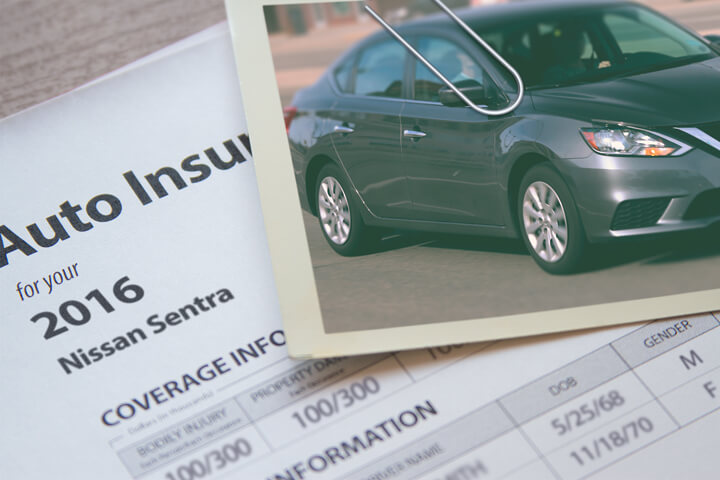

Cheapest 2016 Nissan Sentra Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Having to pay for pricey Nissan Sentra insurance can sap your checking account and make it tough to pay other bills. Comparing cost estimates is recommended to reduce premiums and put more money in your pocket.

You have multiple insurance companies to pick from, and although it’s a good thing to have a selection, too many choices makes it more difficult to compare rates.

It’s a great practice to get comparison quotes on a regular basis because rates are variable and change quite frequently. Even if you think you had the lowest rate for Sentra coverage last year you can probably find a lower rate today. You’ll find quite a bit of inaccurate information about car insurance out there, but in a few minutes you can learn some good information on how to stop overpaying for insurance.

This information will let you in on how car insurance quotes work. If you have car insurance now, you will most likely be able to lower your premiums substantially using these methods. But car owners must comprehend how the larger insurance companies market on the web and apply this information to your search.

The quickest way to compare rates is to realize most insurance companies allow for online access to provide you with a free rate quote. To get started, all you need to do is give the companies some data such as if you require a SR-22, the year, make and model of vehicles, how much coverage you want, and your occupation. Your insurance information is then submitted to insurance carriers in your area and they return rate quotes very quickly.

To compare multiple company rates now, click here and find out if you can get cheaper insurance.

Car insurance policy discounts you can’t miss

Some insurance providers don’t always publicize every policy discount in an easy-to-find place, so the list below details both the well known and the harder-to-find credits available to you.

- Early Renewal Discounts – Some car insurance companies give discounts for signing up before your current expiration date. The savings is around 10%.

- Seat Belt Usage – Drivers who require all occupants to wear their seat belts can save up to 15% on the medical payments or PIP coverage costs.

- Service Members Pay Less – Being on active duty in the military could mean lower car insurance rates.

- 55 and Retired – Seniors may receive lower premium rates for Sentra coverage.

- Discounts for Government Workers – Active or former government employment could provide a small rate reduction for Sentra coverage but check with your company.

- Anti-lock Brake System – Vehicles that have steering control and anti-lock brakes can reduce accidents and therefore earn up to a 10% discount.

- Responsible Drivers – Safe drivers can get discounts for up to 45% lower rates for Sentra coverage than drivers with accident claims.

A little note about advertised discounts, most credits do not apply to the entire cost. A few only apply to the price of certain insurance coverages like medical payments or collision. Even though it may seem like it’s possible to get free car insurance, companies wouldn’t make money that way.

A few of the larger companies and a selection of discounts are detailed below.

- State Farm discounts include student away at school, Steer Clear safe driver discount, multiple autos, Drive Safe & Save, and multiple policy.

- American Family includes discounts for defensive driver, early bird, good driver, mySafetyValet, accident-free, and air bags.

- AAA offers discounts for good student, anti-theft, AAA membership discount, education and occupation, multi-car, and multi-policy.

- GEICO has discounts for federal employee, military active duty, daytime running lights, driver training, and five-year accident-free.

- Mercury Insurance has savings for low natural disaster claims, professional/association, age of vehicle, annual mileage, good driver, and good student.

- Farmers Insurance policyholders can earn discounts including early shopping, pay in full, mature driver, good student, and bundle discounts.

- Progressive offers discounts including continuous coverage, multi-vehicle, online quote discount, homeowner, and good student.

Double check with every insurance company to give you their best rates. Some discounts may not be offered in your area.

Learn how to lower your insurance costs

Lots of things are part of the equation when pricing auto insurance. Some factors are common sense such as traffic violations, although some other factors are not as apparent such as your marital status or your financial responsibility.

The itemized list below are some of the things used by insurance companies to determine your rates.

- Job and insurance prices – Did you know that where you work can have an impact on rates? Careers like lawyers, executives and dentists usually pay higher premium rates in part from job stress and lots of time spent at work. Conversely, careers such as actors, engineers and the unemployed have lower than average premiums for Sentra coverage.

- Tickets and citations cost more than a fine – Only having one moving violation can boost insurance rates by as much as thirty percent. Drivers who don’t get tickets receive lower rates than their less careful counterparts. Drivers who have license-revoking citations such as reckless driving, hit and run or driving under the influence may be required to submit a SR-22 form with their state motor vehicle department in order to keep their license.

- High policy claims frequency drives up insurance rates – If you frequently file small claims, you can look forward to higher rates. Companies provide cheaper rates to insureds who are not frequent claim filers. Your insurance policy is intended for major claims that would cause financial hardship.

- Being married is a bonus – Having a wife or husband may save some money on your policy. Having a spouse usually means you are more mature and responsible and it’s statistically proven that drivers who are married are more cautious.

- Don’t let your policy lapse – Driving without insurance coverage in place can get you a ticket and any future policy may cost more because you let your coverage lapse. Not only will you pay higher rates, failure to provide proof of insurance might get you fines or a revoked license. You may then be required to prove you have insurance by filing a SR-22 with your state DMV.

- Gender as a rate factor – Statistics show that females take fewer risks when driving. However, don’t assume that males are worse at driving than females. Females and males have auto accidents at a similar rate, but the men tend to have more serious accidents. Not only are claims higher, but men get cited for more serious violations like driving under the influence (DUI). Males from age 16 to 21 have the highest risk to insure so they pay the highest premiums.

- Prevent theft and save – Selecting a car model with a theft deterrent system can earn a premium discount. Advanced theft deterrents like GM’s OnStar, tamper alarm systems and vehicle immobilizers help track and prevent car theft.

Insurance agents can help

When buying the best insurance coverage, there isn’t really a “best” method to buy coverage. Everyone’s situation is unique and your policy should reflect that. Here are some questions about coverages that can help discover if your situation would benefit from an agent’s advice.

- Do I need more liability coverage?

- What is PIP insurance?

- Is my teen driver covered when they drive my company car?

- Do I have any recourse if my insurance company denies a claim?

- Does medical payments coverage apply to all occupants?

- Do I benefit by insuring my home with the same company?

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

If you can’t answer these questions, you might consider talking to a licensed insurance agent. If you don’t have a local agent, fill out this quick form or you can go here for a list of companies in your area.

Buyer beware of car insurance advertising tricks

Popular car insurance providers such as Allstate, GEICO and Progressive endlessly run television, radio, and online ads. They all seem to advertise claims that you can save just by switching your coverage. How is it plausible that every one can give you a lower rate? You have to listen carefully.

All companies look for specific characteristics for a prospective insured that makes them money. For example, a profitable risk profile might have to be a married female, has a clean driving record, and drives a lower-performance vehicle. Anybody that meets those criteria gets the lowest prices and have a good chance to save a lot if they switch.

People who are not a match for the “perfect” profile will probably have to pay a higher premium and this results in the prospect going elsewhere. If you listen to the ad wording, they say “drivers who switch” not “everybody who quotes” save that much when switching. That’s why insurance companies can confidently advertise the way they do.

This really illustrates why you really need to compare as many free auto insurance quotes as you can. It’s impossible to know which car insurance company will give you the biggest savings.

Auto insurance policy coverages for a 2016 Nissan Sentra

Learning about specific coverages of your policy can be of help when determining appropriate coverage at the best deductibles and correct limits. Auto insurance terms can be ambiguous and nobody wants to actually read their policy. Listed below are typical coverages available from auto insurance companies.

Comprehensive insurance – This pays for damage caused by mother nature, theft, vandalism and other events. You first have to pay a deductible then your comprehensive coverage will pay.

Comprehensive coverage protects against things like hitting a deer, vandalism and fire damage. The highest amount a auto insurance company will pay at claim time is the market value of your vehicle, so if the vehicle is not worth much it’s not worth carrying full coverage.

Uninsured/Underinsured Motorist (UM/UIM) – Your UM/UIM coverage provides protection when the “other guys” either are underinsured or have no liability coverage at all. It can pay for injuries sustained by your vehicle’s occupants as well as damage to your Nissan Sentra.

Since many drivers only purchase the least amount of liability that is required, it only takes a small accident to exceed their coverage. For this reason, having high UM/UIM coverages should not be overlooked. Frequently the UM/UIM limits do not exceed the liability coverage limits.

Collision – Collision insurance pays for damage to your Sentra caused by collision with another vehicle or an object, but not an animal. You have to pay a deductible and the rest of the damage will be paid by collision coverage.

Collision insurance covers claims such as damaging your car on a curb, colliding with another moving vehicle, rolling your car and sideswiping another vehicle. Paying for collision coverage can be pricey, so you might think about dropping it from vehicles that are 8 years or older. Drivers also have the option to increase the deductible to get cheaper collision coverage.

Med pay and Personal Injury Protection (PIP) – Medical payments and Personal Injury Protection insurance kick in for short-term medical expenses for things like X-ray expenses, dental work and doctor visits. They are often utilized in addition to your health insurance plan or if there is no health insurance coverage. It covers all vehicle occupants and also covers any family member struck as a pedestrian. Personal injury protection coverage is not universally available but can be used in place of medical payments coverage

Auto liability – Liability insurance provides protection from damage that occurs to people or other property by causing an accident. It protects you against other people’s claims, and doesn’t cover damage to your own property or vehicle.

Coverage consists of three different limits, per person bodily injury, per accident bodily injury, and a property damage limit. As an example, you may have policy limits of 25/50/25 which stand for $25,000 bodily injury coverage, a per accident bodily injury limit of $50,000, and a limit of $25,000 paid for damaged property. Some companies may use one limit called combined single limit (CSL) that pays claims from the same limit and claims can be made without the split limit restrictions.

Liability coverage pays for things such as medical services, emergency aid, funeral expenses and loss of income. The amount of liability coverage you purchase is your choice, but you should buy as high a limit as you can afford.

More comparisons equals lower rates

Some companies do not offer rates over the internet and these small, regional companies provide coverage only through local independent agents. Cost effective 2016 Nissan Sentra insurance is definitely available both online in addition to many insurance agents, and you should compare rates from both to have the best chance of lowering rates.

As you go through the steps to switch your coverage, you should never buy poor coverage just to save money. There have been many situations where an insured cut physical damage coverage only to regret at claim time they didn’t have enough coverage. Your strategy should be to buy a smart amount of coverage at an affordable rate, but do not skimp to save money.

Use our FREE quote tool to compare rates now!

To learn more, take a look at these articles:

- Older Drivers FAQ (iihs.org)

- What Car Insurance is Cheapest for a Nissan Sentra in Indianapolis? (IndyAutoGuard.com)

- Child Safety Seats (Insurance Information Institute)

- Uninsured Motorist Statistics (Insurance Information Institute)

- Smart Auto Insurance Tips (Insurance Information Institute)

- Airbag FAQ (iihs.org)

- Red Light Cameras (State Farm)

Frequently Asked Questions

What factors contribute to the cost of insurance for a 2016 Nissan Sentra?

Several factors influence the cost of insurance for a 2016 Nissan Sentra. These include the driver’s age, driving history, location, credit score, and the level of coverage desired. Additionally, the car’s safety features, theft rates, repair costs, and overall reliability can impact insurance premiums.

: Can the trim level of a 2016 Nissan Sentra affect insurance rates?

Yes, the trim level of a 2016 Nissan Sentra can influence insurance rates. Generally, higher trim levels come with additional features that may increase the car’s value and repair costs. As a result, insurance premiums may be slightly higher for higher trim levels compared to base models.

Can the coverage level chosen affect insurance costs for a 2016 Nissan Sentra?

Yes, the coverage level selected for a 2016 Nissan Sentra can impact insurance costs. Choosing a higher coverage level, such as comprehensive and collision coverage, may lead to higher premiums. On the other hand, opting for a basic liability-only coverage may result in lower insurance costs.

Does the credit score of the insured driver affect insurance rates for a 2016 Nissan Sentra?

Yes, the credit score of the insured driver can affect insurance rates for a 2016 Nissan Sentra. Insurance providers often use credit-based insurance scores as one of the factors to determine premiums. Drivers with good credit scores are typically seen as lower risk and may be offered lower insurance rates.

Is it advisable to pay the insurance premium in full for a 2016 Nissan Sentra?

Paying the insurance premium in full for a 2016 Nissan Sentra can have advantages. Some insurance providers offer discounts or reduced fees for paying the premium in a lump sum rather than monthly installments. If you have the financial means to do so, paying in full can save you money in the long run and simplify your budgeting by eliminating monthly payments.

How does my driving history impact the insurance cost for a 2016 Nissan Sentra?

Your driving history plays a significant role in determining the insurance cost for a 2016 Nissan Sentra. If you have a clean driving record with no accidents or traffic violations, you are more likely to qualify for lower insurance premiums.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Honda CR-V Insurance

- Honda Civic Insurance

- Dodge Grand Caravan Insurance

- Ford F-150 Insurance

- Nissan Rogue Insurance

- Chevrolet Silverado Insurance

- Toyota Corolla Insurance

- Toyota Camry Insurance

- Jeep Wrangler Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area