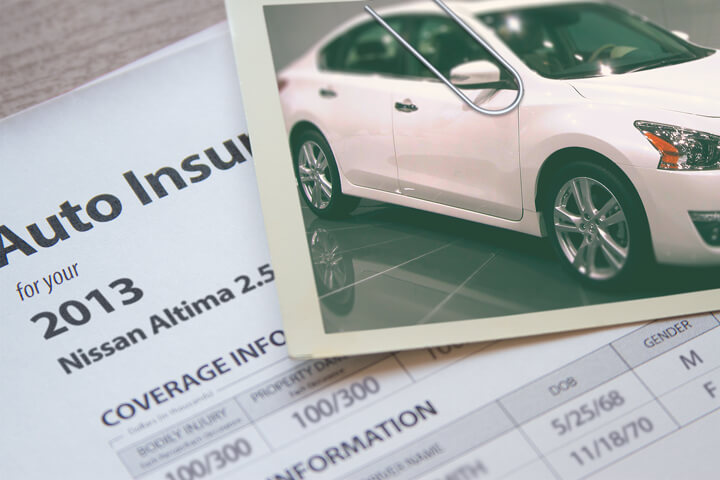

Cheapest 2013 Nissan Altima Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Nobody I know looks forward to paying for auto insurance, especially knowing their premiums are too high. Insurance companies such as State Farm, Farmers Insurance, GEICO and Allstate increase brand awareness with catchy ads and consumers find it hard to ignore the propoganda and take the time to shop coverage around.

Consumers need to take a look at other company’s rates yearly since insurance rates change quite often. If you had the best rates on Altima coverage two years ago you can probably find a lower rate today. Starting right now, ignore everything you know about auto insurance because we’re going to show you the fastest and easiest way to lower your annual insurance bill.

These factors can influence what you pay for Nissan Altima insurance

It’s important that you understand some of the elements that go into determining the price you pay for auto insurance. Knowing what controls the rates you pay allows you to make educated decisions that could result in much lower annual insurance costs.

Listed below are some of the items companies use to determine premiums.

- A lapse in coverage is a bad thing – Having an insurance coverage lapse is a quick way to trigger a rate increase. And not only will insurance be more expensive, failure to provide proof of insurance will get you a license revocation or jail time. You may then be required to file a SR-22 with your state motor vehicle department to get your license reinstated.

- Careful drivers pay lower rates – A bad driving record impacts your car insurance rates tremendously. Good drivers receive lower rates than people who have multiple driving citations. Only having one citation can increase rates forty percent or more. If you have severe violations like DWI, reckless driving or hit and run convictions may find they need to file a SR-22 to the state department of motor vehicles in order to drive a vehicle legally.

- The more you drive the more you pay – The higher the mileage driven in a year’s time the more you’ll pay to insure your vehicle. Most insurance companies price each vehicle’s coverage based on their usage. Vehicles not used for work or commuting qualify for better rates as compared to vehicles used primarily for driving to work. Ask your agent if your auto insurance declarations sheet is showing the correct usage for each vehicle. Incorrect usage on your Altima can result in significantly higher rates.

- Optional equipment can affect rates – Driving a car with a theft deterrent system can save you a little every year. Anti-theft features such as tamper alarm systems, vehicle immobilizer technology and General Motors OnStar all hinder your car from being stolen.

- How your age affects price – Mature drivers tend to be more responsible, file fewer claims and tend to be better behind the wheel. Youthful drivers are known to be more careless in a vehicle and because of this, their auto insurance rates are much higher.

- Occupation reflects on rates – Careers like real estate brokers, architects and dentists tend to have the highest average rates in part from stressful work requirements and lots of time spent at work. Other occupations like scientists, historians and retirees receive lower rates on Altima coverage.

- Sex matters – Statistics demonstrate that men are more aggressive behind the wheel. However, this does not mean women are BETTER drivers than men. Women and men tend to get into accidents in similar percentages, but men have costlier accidents. Men also get cited for more serious violations such as reckless driving. Young males are several times more likely to be in an accident and therefore have the most expensive auto insurance rates.

Comprehensive Car Insurance Comparison

There are several ways to compare Nissan Altima car insurance quotes, but some are less time-consuming than others. You can spend countless hours driving to agents in your area, or you could save time and use the internet to accomplish the same thing much quicker.

All the larger companies belong to a marketplace where prospective buyers only type in their quote data once, and every company can give them a price based on the submitted data. This prevents consumers from doing quotation requests to each company.

To fill out one form to compare multiple rates now click here (opens in new window).

One minor caveat to using this type of form is buyers cannot specifically choose which carriers you want to price. If you prefer to choose specific providers to compare, we put together a list of low cost car insurance companies in your area. View list of insurance companies.

It’s up to you how you get prices quotes, just make darn sure you compare identical coverage limits and deductibles on every quote. If each company quotes higher or lower deductibles you will not be able to determine the best price for your Nissan Altima.

Cut your auto insurance rates with discounts

Auto insurance companies don’t necessarily list all available discounts in an easy-to-find place, so here is a list some of the best known and the harder-to-find auto insurance savings. If they aren’t giving you every credit possible, you’re paying more than you need to.

- Passive Restraint Discount – Vehicles equipped with air bags or motorized seat belts can get savings up to 30%.

- Life Insurance – Select insurance companies reward you with a discount if you purchase auto and life insurance together.

- Memberships – Affiliation with certain professional organizations could trigger savings when buying auto insurance on Altima coverage.

- Student Driver Training – Have your child take driver’s ed class in high school.

- Federal Government Employee – Active or retired federal employment may qualify you for a discount on Altima coverage depending on your company.

- Military Discounts – Being on active duty in the military can result in better rates.

- Anti-theft System – Cars that have factory anti-theft systems can help prevent theft and qualify for as much as a 10% discount.

- Early Switch Discount – Select companies give a discount for switching policies prior to your current policy expiration. It’s a savings of about 10%.

- Good Students Pay Less – A discount for being a good student can be rewarded with saving of up to 25%. The good student discount can last up until you turn 25.

- Student in College – Youth drivers living away from home attending college and do not have a car can receive lower rates.

It’s important to understand that most discount credits are not given to the overall cost of the policy. The majority will only reduce individual premiums such as liability and collision coverage. So even though they make it sound like all the discounts add up to a free policy, it doesn’t quite work that way.

For a list of insurance companies with the best auto insurance discounts, click here.

You are unique and your insurance coverage should be too

When buying coverage, there really is no perfect coverage plan. Everyone’s needs are different so this has to be addressed. For instance, these questions might point out if your insurance needs will benefit from professional help.

- Will my vehicle be repaired with OEM or aftermarket parts?

- Is a blown tire covered by insurance?

- Do I benefit by insuring my home with the same company?

- What is an SR-22 filing?

- Is upholstery damage covered by car insurance?

- Should I waive the damage coverage when renting a car?

- How can I find cheaper teen driver insurance?

- Am I covered when driving someone else’s vehicle?

- Is my state a no-fault state?

- Does my policy cover my teen driver if they drive my company car?

If you’re not sure about those questions but you think they might apply to your situation, then you may want to think about talking to an insurance agent. To find lower rates from a local agent, fill out this quick form or go to this page to view a list of companies. It only takes a few minutes and you can get the answers you need.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Auto insurance coverage information

Knowing the specifics of a insurance policy can be of help when determining which coverages you need for your vehicles. The coverage terms in a policy can be difficult to understand and even agents have difficulty translating policy wording. Shown next are typical coverages available from insurance companies.

Coverage for medical payments – Medical payments and Personal Injury Protection insurance provide coverage for bills such as dental work, ambulance fees and chiropractic care. The coverages can be used to fill the gap from your health insurance plan or if you are not covered by health insurance. It covers not only the driver but also the vehicle occupants in addition to any family member struck as a pedestrian. PIP is only offered in select states but can be used in place of medical payments coverage

Comprehensive coverages – Comprehensive insurance will pay to fix damage OTHER than collision with another vehicle or object. You first have to pay a deductible and then insurance will cover the rest of the damage.

Comprehensive insurance covers claims like damage from getting keyed, damage from flooding and falling objects. The highest amount you can receive from a comprehensive claim is the actual cash value, so if the vehicle’s value is low consider dropping full coverage.

Collision coverage – Collision coverage covers damage to your Altima caused by collision with an object or car. You have to pay a deductible then your collision coverage will kick in.

Collision coverage pays for claims such as driving through your garage door, sustaining damage from a pot hole, colliding with a tree, damaging your car on a curb and hitting a parking meter. Collision coverage makes up a good portion of your premium, so consider removing coverage from lower value vehicles. Another option is to raise the deductible to save money on collision insurance.

Uninsured and underinsured coverage – This gives you protection when the “other guys” are uninsured or don’t have enough coverage. This coverage pays for medical payments for you and your occupants and damage to your Nissan Altima.

Because many people only purchase the least amount of liability that is required, their liability coverage can quickly be exhausted. So UM/UIM coverage is very important.

Liability auto insurance – This provides protection from damages or injuries you inflict on a person or their property in an accident. It protects YOU from claims by other people. Liability doesn’t cover your injuries or vehicle damage.

It consists of three limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. You commonly see liability limits of 100/300/100 that means you have a limit of $100,000 per injured person, a limit of $300,000 in injury protection per accident, and a total limit of $100,000 for damage to vehicles and property.

Liability coverage pays for things such as repair bills for other people’s vehicles, funeral expenses, attorney fees, emergency aid and medical expenses. How much liability coverage do you need? That is your choice, but consider buying as large an amount as possible.

Spend less. Save more.

You just read a lot of techniques to save on 2013 Nissan Altima insurance. The most important thing to understand is the more rate quotes you have, the better your comparison will be. Drivers may discover the most savings is with a smaller regional carrier. Some small companies often have lower prices on specific markets than the large multi-state companies such as State Farm and Allstate.

The cheapest insurance can be sourced on the web as well as from independent agents, so you should compare both to get a complete price analysis. A few companies don’t offer online quoting and most of the time these smaller companies sell through independent agents.

Use our FREE quote tool to compare rates now!

To read more, link through to the following helpful articles:

- Things to Know Before you Cancel Insurance (Allstate)

- Bodily Injury Coverage (Liberty Mutual)

- Understanding your Policy (NAIC.org)

- How to Avoid Staged Accidents (State Farm)

- Vehicle Size and Weight FAQ (iihs.org)

- Understanding Rental Car Insurance (Insurance Information Institute)

Frequently Asked Questions

What factors affect the insurance rates for a 2013 Nissan Altima?

Several factors can influence the insurance rates for a 2013 Nissan Altima. Below are the six common factors:

- Location:

- Driver’s age and experience:

- Driving record:

- Insurance coverage and deductible:

- Vehicle usage:

- Safety features:

Are there any specific insurance providers known for offering affordable rates for a 2013 Nissan Altima?

Insurance rates can vary significantly between providers, and what may be affordable for one driver may not be the same for another. It’s essential to compare quotes from multiple insurance providers to find the best rates for your 2013 Nissan Altima. Some well-known insurance companies that are worth considering for their competitive rates include GEICO, Progressive, State Farm, Allstate, and Farmers Insurance.

Can the age of my 2013 Nissan Altima affect insurance rates?

Yes, the age of your 2013 Nissan Altima can influence insurance rates. Generally, older vehicles may have lower insurance rates compared to newer models. This is because the value of the car decreases over time, and repairs or replacements may be less expensive. However, other factors such as the vehicle’s safety features, theft rates, and repair costs can still impact insurance rates for older vehicles.

Can I lower my insurance rates for a 2013 Nissan Altima by taking a defensive driving course?

Yes, taking a defensive driving course can potentially lower your insurance rates for a 2013 Nissan Altima. Many insurance companies offer discounts to drivers who have completed an approved defensive driving course. These courses provide valuable knowledge and skills that can help you become a safer driver, reducing the risk of accidents.

Can I transfer my existing insurance policy to a 2013 Nissan Altima?

If you already have an insurance policy in place, you may be able to transfer it to your 2013 Nissan Altima. However, it’s crucial to inform your insurance provider about the vehicle change as soon as possible. Depending on the specifics of your policy, coverage limits, and requirements, your insurance rates may be adjusted accordingly.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Honda CR-V Insurance

- Chevrolet Silverado Insurance

- Honda Accord Insurance

- Dodge Ram Insurance

- Toyota Rav4 Insurance

- Ford F-150 Insurance

- Jeep Grand Cherokee Insurance

- Toyota Tacoma Insurance

- Nissan Rogue Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area