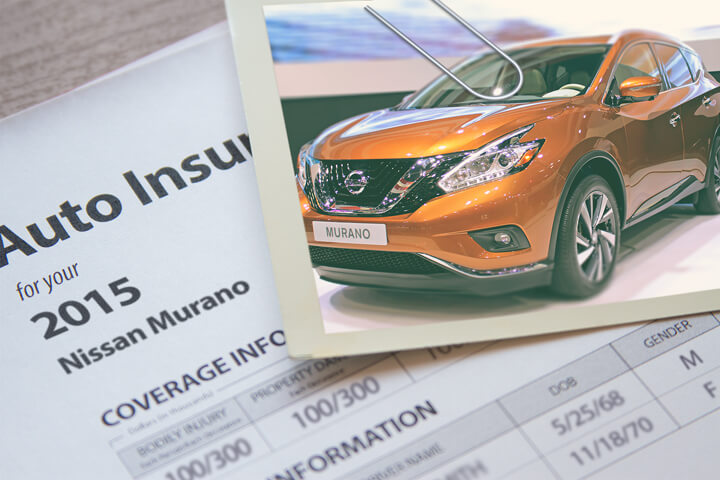

Cheapest 2015 Nissan Murano Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Searching for better auto insurance rates for your Nissan Murano? Finding the most affordable auto insurance online may be intimidating for beginners to comparing rates online. With so many choices of insurance companies available, how can you have a chance to compare the different rates to find the best available price?

You should take the time to check auto insurance prices quite often since insurance rates trend upward over time. Just because you found the best price on Murano coverage last year a different company probably has better rates today. Forget all the misinformation about auto insurance because you’re about to find out the tricks you need to know to save money, get proper deductibles and limits, all at the lowest rate.

How to reduce Nissan Murano insurance rates

The cost of insuring your cars can be expensive, but you may find discounts that can drop the cost substantially. A few discounts will automatically apply at the time of quoting, but some must be asked about before being credited.

- Driver Safety – Taking part in a course teaching defensive driving skills could save 5% or more if you qualify.

- Payment Discounts – By paying your policy upfront instead of monthly or quarterly installments you can actually save on your bill.

- Save with a New Car – Putting insurance coverage on a new car can be considerably cheaper since new cars are generally safer.

- Passive Restraints and Air Bags – Vehicles with factory air bags may earn rate discounts of 20% or more.

- Discount for Life Insurance – Select insurance companies reward you with lower rates if you buy a life insurance policy as well.

- Anti-lock Brakes – Vehicles equipped with ABS or steering control are safer to drive and earn discounts up to 10%.

- Discount for Good Grades – This discount can get you a discount of up to 25%. The discount lasts until age 25.

- Early Switch Discount – Some companies give discounts for switching to them prior to your current policy expiring. It’s a savings of about 10%.

- More Vehicles More Savings – Buying coverage for multiple cars or trucks on the same insurance coverage policy qualifies for this discount.

As a disclaimer on discounts, many deductions do not apply to all coverage premiums. Some only reduce the cost of specific coverages such as liability and collision coverage. Even though it may seem like it’s possible to get free car insurance, it doesn’t quite work that way. But any discount will cut your overall premium however.

Companies that possibly offer these benefits include:

- Progressive

- MetLife

- Mercury Insurance

- Nationwide

- GEICO

- AAA

Check with all companies you are considering what discounts are available to you. Some discounts might not be offered in every state.

The easiest way to compare car insurance company rates is to know the trick most of the bigger providers allow for online access to give you rate quotes. All consumers are required to do is provide the companies a bit of rating information like if you’re married, an estimate of your credit level, how much coverage you want, and what your job is. The data is then submitted to many highly-rated insurers and you will receive price estimates very quickly.

To find lower rates now, click here and enter your zip code.

Tailor your coverage to you

When it comes to choosing coverage for your vehicles, there is no “best” method to buy coverage. Every situation is different.

These are some specific questions may help highlight if you will benefit from professional help.

- Can I afford low physical damage deductibles?

- Is my vehicle covered by my employer’s policy when using it for work?

- Should I waive the damage coverage when renting a car?

- Does coverage extend to a rental car in a foreign country?

- When do I need to add a new car to my policy?

- How can I get high-risk coverage after a DUI?

- Will my rates increase for filing one claim?

- Does my policy pay for OEM or aftermarket parts?

- Should I drop comprehensive coverage on older vehicles?

- Should I have a commercial auto policy?

If you can’t answer these questions, you may need to chat with a licensed insurance agent. To find an agent in your area, fill out this quick form.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Insurance policy specifics

Learning about specific coverages of your insurance policy helps when choosing appropriate coverage for your vehicles. Policy terminology can be difficult to understand and even agents have difficulty translating policy wording.

Auto collision coverage

This pays for damage to your Murano caused by collision with another car or object. You first must pay a deductible and then insurance will cover the remainder.

Collision can pay for things such as sideswiping another vehicle, colliding with another moving vehicle, hitting a parking meter, crashing into a ditch and crashing into a building. This coverage can be expensive, so you might think about dropping it from vehicles that are older. It’s also possible to choose a higher deductible to get cheaper collision coverage.

Comprehensive insurance

Comprehensive insurance pays for damage that is not covered by collision coverage. You first have to pay a deductible and then insurance will cover the rest of the damage.

Comprehensive insurance covers claims like hitting a bird, vandalism and a broken windshield. The maximum payout you’ll receive from a claim is the ACV or actual cash value, so if the vehicle’s value is low consider dropping full coverage.

Liability car insurance

This provides protection from damage that occurs to other’s property or people that is your fault. It protects YOU from legal claims by others, and does not provide coverage for damage sustained by your vehicle in an accident.

Coverage consists of three different limits, per person bodily injury, per accident bodily injury, and a property damage limit. You commonly see liability limits of 100/300/100 which stand for a $100,000 limit per person for injuries, a limit of $300,000 in injury protection per accident, and a total limit of $100,000 for damage to vehicles and property. Some companies may use a combined single limit or CSL which provides one coverage limit without having the split limit caps.

Liability can pay for things like legal defense fees, emergency aid and court costs. How much liability coverage do you need? That is up to you, but consider buying higher limits if possible.

Coverage for medical expenses

Personal Injury Protection (PIP) and medical payments coverage provide coverage for short-term medical expenses such as ambulance fees, nursing services, rehabilitation expenses and pain medications. They are often used in conjunction with a health insurance policy or if you are not covered by health insurance. It covers you and your occupants as well as being hit by a car walking across the street. PIP is not available in all states and gives slightly broader coverage than med pay

Coverage for uninsured or underinsured drivers

Uninsured or Underinsured Motorist coverage protects you and your vehicle when the “other guys” do not carry enough liability coverage. This coverage pays for medical payments for you and your occupants as well as damage to your Nissan Murano.

Since many drivers have only the minimum liability required by law, their liability coverage can quickly be exhausted. So UM/UIM coverage is important protection for you and your family. Usually your uninsured/underinsured motorist coverages are set the same as your liability limits.

A little work can save a LOT of money

You just learned a lot of tips how to compare 2015 Nissan Murano insurance prices online. The key concept to understand is the more times you quote, the better your chances of lowering your rates. Consumers may even find the best price on car insurance is with a lesser-known regional company.

Cheap insurance is definitely available online and with local insurance agents, so you should compare both to have the best selection. There are still a few companies who do not offer you the ability to get quotes online and usually these smaller companies provide coverage only through local independent agents.

When trying to cut insurance costs, don’t be tempted to buy poor coverage just to save money. There are many occasions where someone dropped liability limits or collision coverage only to regret at claim time that the savings was not a smart move. Your focus should be to buy the best coverage you can find for the lowest price, not the least amount of coverage.

Use our FREE quote tool to compare rates now!

Helpful information

- Red Light Cameras (State Farm)

- Uninsured Motorist Statistics (Insurance Information Institute)

- Collision Coverage (Liberty Mutual)

- Preventing Carjacking and Theft (Insurance Information Institute)

Frequently Asked Questions

How can I find the cheapest auto insurance rates for my 2015 Nissan Murano?

To find the most affordable auto insurance rates, it is recommended to compare quotes from different companies. You can use online tools provided by insurance providers to get rate quotes by providing some rating information such as marital status, credit level estimate, desired coverage, and occupation. This will help you receive price estimates quickly and easily.

Are there any discounts available for auto insurance rates?

Yes, many insurance companies offer discounts that can help reduce the cost of your auto insurance. While some discounts are automatically applied at the time of quoting, others need to be specifically asked about before being credited. Discounts may vary by company and state, so it’s best to check with each company to see what discounts they offer.

How can I tailor my coverage to my specific needs?

Choosing coverage for your vehicles depends on your individual circumstances. There is no one-size-fits-all approach to buying coverage. To determine the coverage that suits you best, consider factors such as your financial situation, driving habits, and risk tolerance. If you’re unsure about the coverage you need, it may be helpful to speak with a licensed insurance agent who can provide guidance based on your requirements.

What are some important auto insurance coverages to consider?

When it comes to auto insurance, there are several important coverages to consider:

- Collision Coverage: This pays for damage to your Nissan Murano caused by a collision with another vehicle or object. You will first need to pay a deductible, and then the insurance company will cover the remaining costs.

- Comprehensive Coverage: This pays for damage to your vehicle that is not caused by a collision, such as vandalism, theft, or natural disasters. Like collision coverage, you will need to pay a deductible before the insurance company covers the remaining costs.

- Liability Car Insurance: This provides protection if you cause damage to someone else’s property or injure others in an accident. It does not cover damage to your own vehicle. Liability coverage includes different limits for bodily injury per person, bodily injury per accident, and property damage. It’s important to consider buying higher limits if possible.

- Medical Expenses Coverage: Personal Injury Protection (PIP) and medical payments coverage provide coverage for short-term medical expenses resulting from an accident. They can cover ambulance fees, nursing services, rehabilitation expenses, and pain medications.

- Uninsured/Underinsured Motorist Coverage: This protects you and your vehicle if you’re involved in an accident with someone who doesn’t have enough liability coverage. It covers medical payments and damage to your vehicle.

How can I save money on my auto insurance?

There are several ways to save money on auto insurance:

- Compare Quotes: Obtain quotes from multiple insurance companies to find the best rates and coverage options.

- Seek Discounts: Ask insurance companies about available discounts, such as safe driver discounts, multi-policy discounts, or discounts for installing safety features in your vehicle.

- Choose Higher Deductibles: Opting for higher deductibles can lower your premium, but make sure you can afford to pay the deductible if you need to make a claim.

- Maintain a Good Driving Record: Avoid accidents and traffic violations to keep your insurance rates lower.

- Bundle Policies: Consider bundling your auto insurance with other policies, such as home or renters insurance, to receive a discount.

Remember, while it’s important to find affordable insurance, it’s equally important to ensure you have adequate coverage for your needs.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Sienna Insurance

- Chevrolet Silverado Insurance

- Dodge Grand Caravan Insurance

- Honda Accord Insurance

- Hyundai Tucson Insurance

- Toyota Rav4 Insurance

- Toyota Corolla Insurance

- Chevrolet Traverse Insurance

- Jeep Grand Cherokee Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area