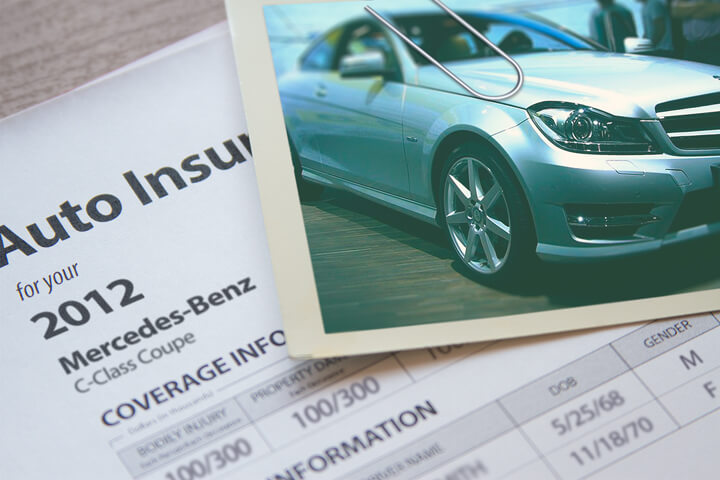

Cheapest 2012 Mercedes-Benz C-Class Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Want the cheapest car insurance rates for your Mercedes-Benz C-Class? Finding lower rates for car insurance can seem to be nearly impossible for people who are new to comparison shopping online. Consumers have so many companies to choose from that it can easily become more work than you anticipated to locate the lowest price.

It’s a great practice to do rate comparisons periodically because rates go up and down regularly. If you had the lowest price for C-Class insurance last year you will most likely find a better rate today. Starting now, forget anything you know (or think you know) about car insurance because you’re going to learn how to use online quotes to properly buy coverages and cut your premium.

If you are paying for car insurance now, you will most likely be able to cut costs considerably using this strategy. The purpose of this post is to help you learn how car insurance quotes work and some tips to save money. But drivers can benefit by having an understanding of the way companies sell insurance online because it can help you find the best coverage.

Discounts can save BIG

The price of auto insurance can be rather high, buy you may qualify for discounts that can drop the cost substantially. Certain discounts will be triggered automatically when you quote, but a few need to be specifically requested before they will apply.

- Payment Discounts – By paying your policy upfront rather than paying monthly you could save up to 5%.

- Passive Restraint Discount – Vehicles with factory air bags may earn rate discounts of more than 20%.

- Paperwork-free – Certain companies will give a small break just for signing your application over the internet.

- No Accidents – Drivers with accident-free driving histories can save substantially as compared to bad drivers.

- Theft Prevention System – Vehicles with anti-theft systems are stolen less frequently and will save you 10% or more.

Consumers should know that some credits don’t apply to all coverage premiums. A few only apply to specific coverage prices like collision or personal injury protection. So when the math indicates you could get a free insurance policy, insurance companies aren’t that generous. But any discount will bring down your overall premium however.

Car insurance companies that may have some of the above discounts include:

It’s a good idea to ask each company how you can save money. Savings might not be offered in every state.

Auto Insurance Comparisons

When shopping for auto insurance there are multiple ways to compare rate quotes from auto insurance companies in your area. The quickest method to compare 2012 Mercedes-Benz C-Class insurance prices consists of shopping online. This can be accomplished in a couple of different ways.

The single most time-saving way to get quotes would be an industry-wide quote request form click to view form in new window. This easy form prevents you from having to do separate forms for each company. Taking the time to complete one form will return price quotes from multiple companies. This is perfect if you don’t have a lot of time.

A less efficient way to get quotes online requires a visit to the website of each company to complete their respective quote request forms. For instance, let’s assume you want rates from State Farm, 21st Century and Farmers. To get rate quotes you would need to go to every website to enter your coverage information, which is why the first method is more popular. For a list of links to companies insuring cars in your area, click here.

The hardest way to compare rates is to drive around to different agent offices. Buying insurance online makes this process obsolete unless you have a need for the personal advice that only a license agent can provide. Drivers can price shop online and get advice from an agent in your area. We’ll cover that shortly.

It’s up to you how you get prices quotes, just make darn sure you compare identical information on every quote. If you use differing limits you can’t possibly make a fair comparison for your Mercedes-Benz C-Class. Quoting even small variations in insurance coverages can result in a big premium difference. Keep in mind that more quotes helps you find the best rates.

Factors that can influence Mercedes-Benz C-Class insurance rates

An important part of buying insurance is that you know the different types of things that help determine the rates you pay for car insurance. Knowing what controls the rates you pay helps enable you to make changes that can help you get much lower annual insurance costs.

The following are a few of the “ingredients” that factor into your rates.

- Proper usage rating affects rates – The higher the mileage driven in a year the higher your rate. Most companies rate vehicles based on their usage. Cars not used for work or commuting get more affordable rates than vehicles that are driven to work every day. Ask your agent if your car insurance declarations sheet shows the correct usage for each vehicle. If your policy improperly rates your C-Class can cost quite a bit.

- Liability coverage is peace of mind – The liability section of your policy will protect you if a court rules you are at fault for causing damage or personal injury in an accident. Liability insurance provides legal defense which can cost thousands of dollars. Carrying liability coverage is mandatory and cheap compared to insuring for physical damage coverage, so drivers should carry high limits.

- Rates may be higher depending on your occupation – Jobs such as judges, business owners and dentists have the highest average rates in part from high stress and long work hours. Other jobs such as actors, historians and retirees get better rates for C-Class insurance.

- Teen drivers pay high rates – More mature drivers tend to be more responsible, statistically cause fewer accidents and receive fewer citations. Youthful drivers tend to be more careless when driving therefore car insurance rates are much higher.

Will just any policy work for me?

When it comes to buying adequate coverage, there is no perfect coverage plan. Every situation is different.

Here are some questions about coverages that could help you determine whether or not you could use an agent’s help.

- Is there coverage for injuries to my pets?

- What are the best liability limits?

- How high should deductibles be on a 2012 Mercedes-Benz C-Class?

- Why am I required to buy liability insurance?

- Is my camper covered by my car insurance policy?

- Should I waive the damage coverage when renting a car?

If you don’t know the answers to these questions, you might consider talking to a licensed agent. To find lower rates from a local agent, take a second and complete this form.

Insurance coverages explained

Learning about specific coverages of insurance can be of help when determining the best coverages and the correct deductibles and limits. Insurance terms can be impossible to understand and reading a policy is terribly boring.

Coverage for uninsured or underinsured drivers

Uninsured or Underinsured Motorist coverage protects you and your vehicle’s occupants when the “other guys” are uninsured or don’t have enough coverage. Covered claims include medical payments for you and your occupants and damage to your 2012 Mercedes-Benz C-Class.

Since a lot of drivers only carry the minimum required liability limits, their liability coverage can quickly be exhausted. So UM/UIM coverage is a good idea. Usually the UM/UIM limits are similar to your liability insurance amounts.

Liability auto insurance

This can cover damage or injury you incur to people or other property. This coverage protects you from claims by other people. Liability doesn’t cover your injuries or vehicle damage.

Liability coverage has three limits: bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. Your policy might show liability limits of 100/300/100 that translate to a limit of $100,000 per injured person, a per accident bodily injury limit of $300,000, and a total limit of $100,000 for damage to vehicles and property. Occasionally you may see a combined limit that pays claims from the same limit rather than limiting it on a per person basis.

Liability can pay for claims like court costs, structural damage, loss of income, emergency aid and medical services. How much liability should you purchase? That is your choice, but you should buy as large an amount as possible.

Coverage for collisions

This coverage covers damage to your C-Class resulting from a collision with an object or car. You have to pay a deductible then your collision coverage will kick in.

Collision can pay for claims like driving through your garage door, crashing into a ditch, rolling your car, damaging your car on a curb and hitting a mailbox. Paying for collision coverage can be pricey, so consider removing coverage from older vehicles. It’s also possible to raise the deductible to save money on collision insurance.

Coverage for medical expenses

Personal Injury Protection (PIP) and medical payments coverage pay for expenses like X-ray expenses, pain medications and rehabilitation expenses. They are often used to fill the gap from your health insurance program or if there is no health insurance coverage. They cover not only the driver but also the vehicle occupants and also covers being hit by a car walking across the street. Personal Injury Protection is not an option in every state and gives slightly broader coverage than med pay

Comprehensive insurance

This coverage will pay to fix damage from a wide range of events other than collision. You first must pay your deductible then the remaining damage will be covered by your comprehensive coverage.

Comprehensive coverage protects against things like damage from flooding, vandalism, hitting a deer and theft. The highest amount you’ll receive from a claim is the actual cash value, so if it’s not worth much more than your deductible it’s probably time to drop comprehensive insurance.

Be Smart and Buy Smart

Consumers change insurance companies for a number of reasons such as policy non-renewal, unfair underwriting practices, delays in paying claims or even being labeled a high risk driver. Whatever your reason, switching insurance companies is actually quite simple.

When shopping online for insurance, it’s very important that you do not reduce coverage to reduce premium. In too many instances, an accident victim reduced comprehensive coverage or liability limits only to regret at claim time that the small savings ended up costing them much more. Your aim should be to find the BEST coverage at the best price while not skimping on critical coverages.

Low-cost 2012 Mercedes-Benz C-Class insurance is possible from both online companies in addition to many insurance agents, so you should compare both in order to have the best chance of saving money. A few companies do not provide online quoting and most of the time these regional insurance providers sell through independent agents.

Additional information

- Red Light Cameras (State Farm)

- Anti-Lock Brake FAQ (iihs.org)

- Airbag FAQ (iihs.org)

- Collision Coverage (Liberty Mutual)

Frequently Asked Questions

How can I find the cheapest car insurance rates for my Mercedes-Benz C-Class?

To find the cheapest car insurance rates for your Mercedes-Benz C-Class, it is recommended to compare quotes from multiple insurance companies. You can use online quote tools or visit the websites of different insurance providers to request quotes. By comparing rates and coverage options, you can identify the most affordable option for your specific needs.

What are some discounts that can help lower the cost of auto insurance?

Auto insurance companies often offer various discounts that can help reduce the cost of your premium. Some common discounts include safe driver discounts, multi-policy discounts (when you bundle multiple insurance policies with the same provider), good student discounts, and discounts for certain safety features in your vehicle. It’s advisable to inquire with each insurance company about the available discounts to see if you qualify for any of them.

Are there any factors that can influence the insurance rates for a 2012 Mercedes-Benz C-Class?

Yes, several factors can influence the insurance rates for a 2012 Mercedes-Benz C-Class. These factors may include the age and model of the vehicle, your location, your driving history, the coverage options you choose, and even your credit score. Insurance companies assess these factors to determine the level of risk associated with insuring your vehicle, which can impact your premium.

Is it necessary to have uninsured or underinsured motorist coverage?

Uninsured or underinsured motorist coverage is not mandatory in all states, but it can be beneficial. This coverage protects you and your vehicle occupants in case you are involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages. It can help pay for medical expenses and vehicle repairs that may otherwise be the responsibility of the at-fault driver.

Should I work with an insurance agent to find the right coverage for me?

The decision to work with an insurance agent depends on your personal preference and needs. An agent can provide personalized advice and guidance based on your specific circumstances, helping you find the coverage that suits you best. However, you can also research and compare insurance options independently using online resources and quote tools. Ultimately, the goal is to find the right coverage at the best price while ensuring you have adequate protection.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Chevrolet Silverado Insurance

- Toyota Sienna Insurance

- Toyota Camry Insurance

- Dodge Grand Caravan Insurance

- Toyota Rav4 Insurance

- Dodge Ram Insurance

- Honda Civic Insurance

- Toyota Corolla Insurance

- Jeep Wrangler Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area