Hyundai Accent Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Apr 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Need car insurance for your Hyundai Accent? It can be hard to find the best rates for a vehicle without spending hours comparison shopping. Luckily, we are here to help you.

Our guide breaks down rates for the Hyundai Accent into easy to understand sections. We will go over how your area affects rates, what coverages will cost, how safety ratings impact rates, and much more. Let’s get started.

Enter your ZIP code in our free tool to start comparing Hyundai Accent rates today.

The average insurance rates for a Hyundai Accent are $1,334 a year including full coverage. Comprehensive costs on average $236, collision costs $524, and liability insurance is estimated at $416. Liability-only coverage costs approximately $474 a year, with high-risk coverage costing around $2,918. 16-year-old drivers cost the most to insure at $5,118 a year or more.

Average premium for full coverage: $1,334

Policy rates by type of insurance:

Rates are based on $500 comprehensive and collision deductibles, 30/60 liability limits, and includes uninsured/under-insured motorist coverage. Prices are averaged for all 50 U.S. states and for all Accent models.

Price Range Variability

Using a middle-aged driver as an example, Hyundai Accent insurance rates go from as low as $474 for your basic liability-only policy to the much higher price of $2,918 for a driver required to buy high-risk insurance.

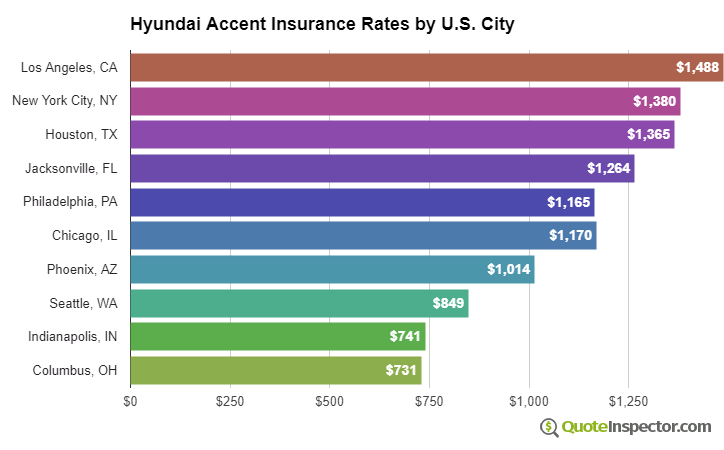

Urban vs. Rural Price Range

Living in a larger city has a significant impact on car insurance rates. Rural areas are shown to have a lower frequency of comprehensive and collision claims than congested cities.

The example below illustrates how where you live affects car insurance rates.

The examples above highlight why everyone should get quotes based on a specific location and risk profile, rather than relying on rate averages.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

More Rate Information

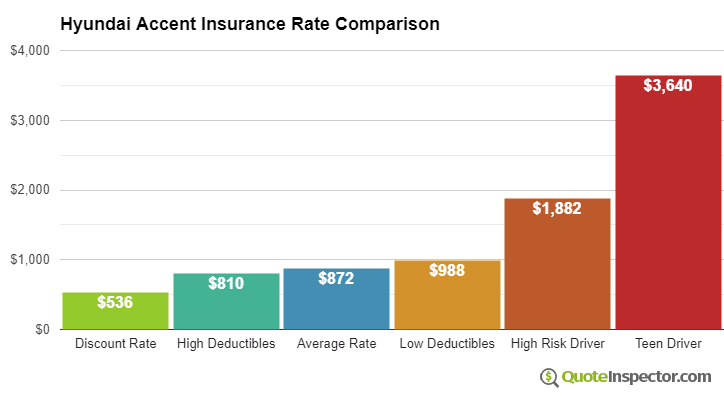

The chart below breaks down estimated Hyundai Accent insurance rates for different risk profiles and scenarios.

- The best full coverage rate is $762

- Choosing higher $1,000 deductibles can save around $172 every year

- The average rate for a good driver age 40 with $500 deductibles is $1,334

- Buying pricier low deductibles for comp and collision coverage will increase the cost to $1,672

- High-risk insureds with multiple tickets or accidents could pay upwards of $2,918 or more

- Policy cost for full coverage for a teen driver for full coverage may cost $5,118 each year

Insurance rates for a Hyundai Accent also range considerably based on your risk profile, the model of your Accent, and policy deductibles and limits.

A more mature driver with no violations or accidents and high deductibles could pay as little as $1,200 annually on average, or $100 per month, for full coverage. Rates are highest for teenagers, where even good drivers should be prepared to pay upwards of $5,100 a year. View Rates by Age

Your home state plays a big part in determining prices for Hyundai Accent insurance rates. A good driver about age 40 could pay as low as $1,020 a year in states like Missouri, New Hampshire, and Vermont, or at least $1,900 on average in Michigan, New York, and Louisiana.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,208 | -$126 | -9.4% |

| Alaska | $1,024 | -$310 | -23.2% |

| Arizona | $1,108 | -$226 | -16.9% |

| Arkansas | $1,334 | -$0 | 0.0% |

| California | $1,518 | $184 | 13.8% |

| Colorado | $1,276 | -$58 | -4.3% |

| Connecticut | $1,372 | $38 | 2.8% |

| Delaware | $1,508 | $174 | 13.0% |

| Florida | $1,668 | $334 | 25.0% |

| Georgia | $1,232 | -$102 | -7.6% |

| Hawaii | $958 | -$376 | -28.2% |

| Idaho | $902 | -$432 | -32.4% |

| Illinois | $994 | -$340 | -25.5% |

| Indiana | $1,004 | -$330 | -24.7% |

| Iowa | $902 | -$432 | -32.4% |

| Kansas | $1,270 | -$64 | -4.8% |

| Kentucky | $1,820 | $486 | 36.4% |

| Louisiana | $1,976 | $642 | 48.1% |

| Maine | $822 | -$512 | -38.4% |

| Maryland | $1,100 | -$234 | -17.5% |

| Massachusetts | $1,066 | -$268 | -20.1% |

| Michigan | $2,318 | $984 | 73.8% |

| Minnesota | $1,116 | -$218 | -16.3% |

| Mississippi | $1,598 | $264 | 19.8% |

| Missouri | $1,184 | -$150 | -11.2% |

| Montana | $1,434 | $100 | 7.5% |

| Nebraska | $1,052 | -$282 | -21.1% |

| Nevada | $1,598 | $264 | 19.8% |

| New Hampshire | $962 | -$372 | -27.9% |

| New Jersey | $1,490 | $156 | 11.7% |

| New Mexico | $1,180 | -$154 | -11.5% |

| New York | $1,406 | $72 | 5.4% |

| North Carolina | $770 | -$564 | -42.3% |

| North Dakota | $1,090 | -$244 | -18.3% |

| Ohio | $922 | -$412 | -30.9% |

| Oklahoma | $1,370 | $36 | 2.7% |

| Oregon | $1,222 | -$112 | -8.4% |

| Pennsylvania | $1,272 | -$62 | -4.6% |

| Rhode Island | $1,778 | $444 | 33.3% |

| South Carolina | $1,208 | -$126 | -9.4% |

| South Dakota | $1,126 | -$208 | -15.6% |

| Tennessee | $1,168 | -$166 | -12.4% |

| Texas | $1,608 | $274 | 20.5% |

| Utah | $988 | -$346 | -25.9% |

| Vermont | $914 | -$420 | -31.5% |

| Virginia | $800 | -$534 | -40.0% |

| Washington | $1,032 | -$302 | -22.6% |

| West Virginia | $1,222 | -$112 | -8.4% |

| Wisconsin | $924 | -$410 | -30.7% |

| Wyoming | $1,188 | -$146 | -10.9% |

Opting for high physical damage deductibles can save as much as $510 each year, whereas buying more liability protection will cost you more. Changing from a 50/100 limit to a 250/500 limit will raise rates by up to $318 more each year. View Rates by Deductible or Liability Limit

If you have a few points on your driving record or tend to cause accidents, you are likely paying at a minimum $1,600 to $2,200 additional every year, depending on your age. Hyundai Accent insurance for high-risk drivers ranges anywhere from 43% to 133% more than the average rate. View High Risk Driver Rates

Because rates have so much variability, the best way to figure out exactly what you will pay is to regularly compare rates from as many companies as possible. Each auto insurer utilizes a different rate formula, and rates will be varied from one company to the next.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Hyundai Accent Blue 2-Dr Hatchback | $1,098 | $92 |

| Hyundai Accent GLS 4-Dr Sedan | $1,426 | $119 |

| Hyundai Accent GS 2-Dr Hatchback | $1,208 | $101 |

| Hyundai Accent SE 2-Dr Hatchback | $1,372 | $114 |

Rates assume 2023 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Hyundai Accent | $244 | $536 | $398 | $1,336 |

| 2023 Hyundai Accent | $236 | $524 | $416 | $1,334 |

| 2022 Hyundai Accent | $228 | $502 | $430 | $1,318 |

| 2021 Hyundai Accent | $216 | $484 | $442 | $1,300 |

| 2020 Hyundai Accent | $206 | $450 | $452 | $1,266 |

| 2019 Hyundai Accent | $198 | $424 | $456 | $1,236 |

| 2018 Hyundai Accent | $190 | $380 | $460 | $1,188 |

| 2017 Hyundai Accent | $178 | $350 | $460 | $1,146 |

| 2016 Hyundai Accent | $172 | $328 | $464 | $1,122 |

| 2015 Hyundai Accent | $168 | $306 | $474 | $1,106 |

| 2014 Hyundai Accent | $156 | $284 | $474 | $1,072 |

| 2013 Hyundai Accent | $150 | $258 | $478 | $1,044 |

| 2012 Hyundai Accent | $140 | $236 | $474 | $1,008 |

| 2011 Hyundai Accent | $132 | $214 | $474 | $978 |

| 2010 Hyundai Accent | $128 | $192 | $468 | $946 |

| 2009 Hyundai Accent | $126 | $188 | $460 | $932 |

| 2008 Hyundai Accent | $124 | $178 | $452 | $912 |

| 2007 Hyundai Accent | $114 | $170 | $446 | $888 |

| 2006 Hyundai Accent | $110 | $162 | $442 | $872 |

Rates are averaged for all Hyundai Accent models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Find the Best Cheap Hyundai Accent Insurance

Finding cheaper rates on Hyundai Accent insurance takes avoiding accidents and violations, having a good credit history, paying for small claims out-of-pocket, and insuring your home and auto with the same company. Take the time to comparison shop at every policy renewal by getting quotes from direct car insurance companies like GEICO, Progressive, and Esurance, and also from local exclusive and independent agents.

The list below is a quick review of the data touched on in the above illustrations.

- Drivers who require higher liability limits will pay around $460 per year to raise limits from a 30/60 limit to 250/500 limits

- You may be able to save as much as $160 per year simply by quoting online well ahead of the renewal date

- Increasing comprehensive and collision deductibles can save around $500 each year

- Teenagers pay higher rates, with premiums being up to $427 each month including comprehensive and collision insurance

By increasing your deductible and shopping for quotes, you can save an average of $660 a year.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does the size and class of the Hyundai Accent affect liability rates?

Before we talk about size and class, let’s establish what liability insurance covers. This coverage is required in most states, as it protects you if you cause an accident. It is composed of two parts: bodily injury liability and property damage liability.

Bodily injury liability will pay for the other driver’s medical costs if you caused the accident, while property damage liability will pay for the driver’s vehicle repairs. The more liability coverage you have, the less you will have to pay out of pocket after an accident.

So how does this relate to the size and class of a vehicle? Think of what would happen if there was a collision between a monster truck and a small sports car. The monster truck’s larger size and sturdier frame would likely inflict more damage on the sports car than the other way around.

Because of this, cars that are known to inflict significant damage on smaller vehicles will have higher liability rates. Insurers know that if there is an accident with these vehicles, they will have to pay more on liability claims. In addition, cars that are prone to crashing (such as sports cars) will also have higher liability rates, as more liability claims are made on sports cars.

The Hyundai Accent is not a large car, so it likely won’t be the car that totals another vehicle in an accident. It is classified as a mini four-door sedan, which means it is on the lighter side. However, it could still have high liability rates if it is prone to crashing.

To see how many claims are made on the Hyundai Accent, we want to cover the Insurance Institute for Highway Safety’s (IIHS) 2016 to 2018 data on insurance losses by make and model. While the IIHS doesn’t have data on bodily injury losses for the Hyundai Accent, the loss for property damage is 13 percent.

This loss is average for the Hyundai Accent’s size and weight group. While the loss number could be better (negative is always best), an average loss number is never bad. It means that you won’t have a high rate for your liability insurance on your Hyundai Accent.

What does liability insurance cost for the Hyundai Accent?

While we’ve deduced that your rate won’t be astronomically high based on liability losses, we want to make sure this is true by getting a sample quote from Geico. Our sample quote is based on a 40-year-old male driver. He has a bachelor’s degree, owns his vehicle, has a clean record, and travels an average of 13,000 miles a year.

Below, you can see the average bodily injury liability rates for a 2021 Hundia Accent four-door sedan.

- Low ($15,000/$30,000): $43.75

- Medium ($100,000/$200,000): $89.68

- High ($500,000/$500,000): $144.36

The upgrade from low to high coverage is $100, which is a little high. Still, it only comes out to $16 a month, which isn’t too bad. Next, take a look at property damage rates.

- Low ($5,000): $437.88

- Medium ($20,000): $467.38

- High ($100,000): $488.92

Property damage liability insurance costs more than bodily injury liability, but its limits are lower than bodily injury liability. This makes sense when you consider the high price of hospital bills (especially for serious injuries) compared to the usual price of most vehicles (under $30,000).

The price to upgrade to high coverage is also only $8 a month for property damage insurance. This means you can upgrade both your liability coverages for $24 a month. We do recommend having at least medium coverage, as liability insurance protects you from financial ruin and lawsuits after an accident.

What are the safety features and ratings of the Hyundai Accent?

It seems like every year, new vehicle models boast more and more safety features. This is good for both your safety and your wallet. Insurers offer discounts for vehicles that have crash prevention features, crash safety features, and anti-theft technology. If your car can help you avoid crashes and protect you from serious injury, this means insurers will have to pay out fewer claims.

According to AutoBlog.com, the 2020 Hyundai Accent has the following standard safety features:

- Crash prevention: anti-lock brakes and stability control.

- Crash protection: front-impact airbags, side-impact airbags, overhead airbags, seatbelt pretensioners, and anti-whiplash headrests.

- Anti-theft: vehicle break-in detection alarm.

The 2020 Hyundai Accent doesn’t have an ignition disable device, which only allows the car to start if the original manufacturer key is used. This could make the Hyundai Accent a little more vulnerable to theft. However, the vehicle still has plenty of great features, such as multiple airbags and anti-whiplash headrests.

In addition to safety features, insurers will also lower your rates if your vehicle has great crash safety ratings. The IIHS did perform a crashworthiness test on the 2020 Hyundai Accent four-door sedan and gave it the following ratings:

- Small overlap front (driver-side): Good

- Small overlap front (passenger-side): Acceptable

- Moderate overlap front: Good

- Side: Good

- Roof strength: Good

- Head restraints and seats: Good

With the exception of the small overlap front crash test on the passenger-side, the 2020 Hyundai scored well (good is the highest rating). Watch the video below for an example of how the IIHS tested the 2020 Hyundai Accent.

The excellent results of the crash test mean that you may have lower insurance rates. However, insurers may also look at general crash fatalities for the three size groupings: cars, pickups, and SUVs. Cars do have higher fatality rates, as the IIHS’s 2018 data on driver deaths per million vehicles showed 48 fatalities for cars, 34 fatalities for pickups, and 23 fatalities for SUVs.

For all occupant deaths per million vehicles, there were 69 fatalities for cars, 42 fatalities for pickups, and 32 fatalities for SUVs. If you take a look at the list below, you can see cars’ fatalities by crash impact point.

- Frontal Impact: 7,433

- Side Impact: 3,568

- Rear Impact: 834

- Other (mostly rollovers): 1,303

The IIHS’s data shows that out of the total car fatalities (13,138), frontal and side impacts were the most fatal. The total car fatalities are also much higher than the totals for SUVs (5,035) and pickups (4,369).

The good news is that insurers won’t be overly concerned about these numbers. Though owning a car over an SUV or pickup may raise your rates a bit, insurers care more about the safety features of your vehicle and how well it will perform in a crash. Since the 2020 Hyundai Accent had a great crash rating, your rates shouldn’t be too expensive.

What is the MSRP of the Hyundai Accent?

The manufacturer suggested retail price (MSRP) is the manufacturer’s estimate of the vehicle’s value. This price is what sellers will base their invoice price on (also known as the sticker price). However, the sticker price is not what you want to pay. Instead, you should look for the fair market range to find out the prices others are paying for your vehicle.

Watch the video below for a further explanation about these prices.

Even though the MSRP isn’t the price you pay, insurers will still look at the MSRP to determine rates because the MSRP gives insurers an idea of how much vehicle parts will cost. The MSRP will, therefore, affect your collision and comprehensive rates, as these two coverages pay for repairs to your vehicle.

Did you know? Lenders often require drivers with leases to carry these coverages in what is called force-placed insurance, so lenders don’t have a loss if you total your vehicle. The definitions of these coverages below helps explain why these coverages are so important.

- What is collision insurance and what does it cover? It covers repairs after collisions with other vehicles or objects (such as fence posts).

- What is comprehensive coverage on a car insurance policy? It covers repairs after animal collisions, weather damage, vandalism, and vehicle replacement after a theft.

Basically, the higher the MSRP is, the more you will have to pay for these two coverages. Now that you understand the connection between rates and MSRP, take a look at Kelley Blue Book’s (KBB) average prices for a 2020 Hyundai Accent.

- MSRP: $16,250

- Fair Market Range: $14,699 to $15,976

- Fair Purchase Price: $15,338

The MSRP is about $1,000 more than the fair purchase price. This is why you should always shop around and compare car prices before committing to a seller and buying a car at face value.

Another factor that will affect your rates is the collision and comprehensive losses of a vehicle. If the losses are higher than average and the MSRP is higher than average, your rates could be very high. If you take a look at the IIHS’s losses below, you can see that while the comprehensive loss is average for the Hyundai Accent, the collision loss is poor.

- Collision Loss: 35 percent (substantially worse than average)

- Comprehensive Loss: -14 percent (average)

Because the collision loss is rather high, you may notice that you pay more for collision coverage than usual. However, your comprehensive rates should be normal for your vehicle size and class.

How much will it cost to repair my Hyundai Accent?

Have you ever been shocked by the bill for your car repairs? Perhaps a part was hard to get, or a defect in your car made repairs take twice as long. Insurers want to be aware of how much it will cost to repair your car, so they can adjust their rates accordingly.

The good news is that according to RepairPal’s reliability rating, the Hyundai Accent has low ownership costs. The average annual cost for repairs is $444, which includes regular maintenance such as oil changes.

We also collected repair estimates from InstantEstimator.com’s tool, so you can see what the average repair costs for level two damage would be for a Hyundai Accent.

- Front bumper: $413

- Rear bumper: $423

- Hood: $375

- Roof: $423

- Front door: $391

- Back door: $379

- Fender: $327

- Quarter panel: $351

These estimates are based on paint and body labor, as well as the cost of painting supplies, color tint, hazardous waste disposal, and the final color/sand/buff. While the estimates don’t include shipping costs, these estimates are a good approximation of what repairs will cost.

Since insurers will use these estimates when calculating collision and comprehensive rates, it’s a good thing that the Hyundai Accent’s repair costs are on the low side. Lower repair costs mean that insurers can lower rates, as your insurer won’t face a huge financial loss if you get into an accident.

We hope our guide to Hyundai Accent’s rates helped you better understand the process and prices. If you want to make sure you are getting the cheapest rates possible, make sure to shop around at insurers. Enter your ZIP code in our free online tool to start comparison shopping for rates for your Hyundai Accent today.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,118 |

| 20 | $3,130 |

| 30 | $1,388 |

| 40 | $1,334 |

| 50 | $1,222 |

| 60 | $1,200 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,672 |

| $250 | $1,514 |

| $500 | $1,334 |

| $1,000 | $1,162 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,334 |

| 50/100 | $1,443 |

| 100/300 | $1,531 |

| 250/500 | $1,761 |

| 100 CSL | $1,478 |

| 300 CSL | $1,673 |

| 500 CSL | $1,815 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $7,296 |

| 20 | $4,990 |

| 30 | $2,974 |

| 40 | $2,918 |

| 50 | $2,788 |

| 60 | $2,764 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $71 |

| Multi-vehicle | $72 |

| Homeowner | $20 |

| 5-yr Accident Free | $100 |

| 5-yr Claim Free | $87 |

| Paid in Full/EFT | $61 |

| Advance Quote | $67 |

| Online Quote | $94 |

| Total Discounts | $572 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area