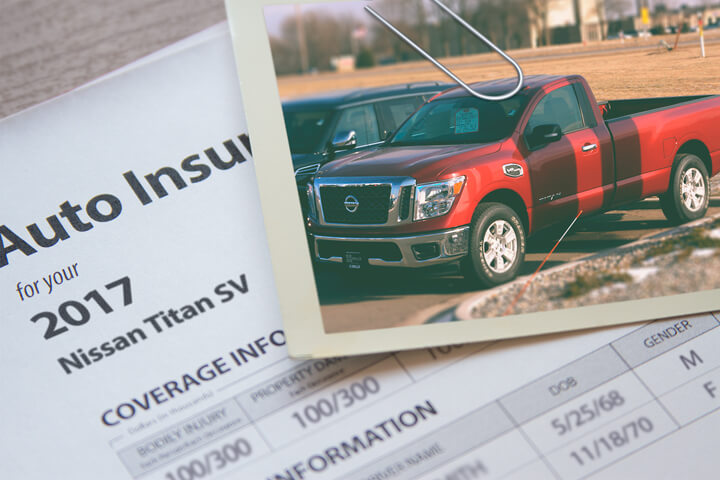

Cheapest 2017 Nissan Titan Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Feel like you have high-priced insurance? Say no more because there are many consumers feeling the pinch from expensive insurance.

You have so many auto insurance companies to purchase coverage from, and even though it’s nice to have a choice, more options can take longer to compare rates and find the lowest cost insurance.

Buy insurance coverage online

There are a variety of methods to compare insurance coverage quotes, but there is one way that is less labor-intensive and much quicker. You can waste hours discussing policy coverages with local insurance agents in your area, or you could save time and use online quotes to maximize your effort.

Many popular insurance companies belong to a marketplace where insurance shoppers submit one quote, and each participating company returns a rated price based on that data. This system prevents you from having to do form submissions for every insurance coverage company.

To use this form to compare rates click here to start a free quote.

The one downside to using this type of system is you are unable to specify which carriers to get quotes from.

You can use whichever method you prefer to find lower rates, just make sure you use exactly the same coverage limits and deductibles for every quote you compare. If you compare different limits and deductibles on each one it will be nearly impossible to determine which rate is truly the best. Just slight variations in insurance coverages or limits can make a big difference in price. And when comparing insurance coverage rates, know that quoting more increases the change that you will find lower pricing.

Discount auto insurance quotes

Auto insurance is easily one of your largest bills, but discounts can save money and there are some available that you may not even be aware of. Certain discounts will be triggered automatically when you get a quote, but once in a while a discount must be specially asked for prior to getting the savings.

- Theft Deterent System – Cars and trucks equipped with anti-theft or alarm systems are stolen with less frequency and earn discounts up to 10% off your auto insurance quote.

- Save over 55 – Mature drivers can get lower premium rates for Titan insurance.

- Low Miles Discount – Low annual miles may allow you to get better premium rates on cars that stay parked.

- Save with a New Car – Buying a new car instead of a used car can get you a discount since new vehicles are generally safer.

- Full Payment Discount – By paying your policy upfront rather than paying monthly you can avoid the installment charge.

- E-sign – Certain companies will provide an incentive for completing your application on their website.

While discounts sound great, it’s important to understand that most credits do not apply the whole policy. A few only apply to the cost of specific coverages such as liability, collision or medical payments. Despite the fact that it seems like you would end up receiving a 100% discount, company stockholders wouldn’t be very happy.

The best auto insurance companies and a partial list of their discounts include:

- GEICO may offer discounts for driver training, defensive driver, anti-lock brakes, emergency military deployment, and membership and employees.

- Travelers may have discounts that include student away at school, driver training, new car, hybrid/electric vehicle, home ownership, IntelliDrive, and payment discounts.

- Nationwide offers discounts for defensive driving, easy pay, business or organization, multi-policy, and accident-free.

- Farmers Insurance has savings for youthful driver, mature driver, bundle discounts, business and professional, and good student.

- Esurance may include discounts for safety device, emergency road assistance, renters, multi-car, Switch & Save, claim free, and paid-in-full.

- State Farm discounts include Drive Safe & Save, student away at school, multiple autos, accident-free, multiple policy, and safe vehicle.

- Progressive offers discounts including continuous coverage, multi-vehicle, homeowner, multi-policy, and good student.

- Mercury Insurance offers premium reductions for multi-policy, annual mileage, age of vehicle, anti-theft, low natural disaster claims, and accident-free.

Before you buy a policy, ask every prospective company which credits you are entitled to. Some of the earlier mentioned discounts might not be available to policyholders in your area.

Tailor your auto insurance coverage to you

When choosing proper insurance coverage for your personal vehicles, there is no cookie cutter policy. Everyone’s needs are different so this has to be addressed. For example, these questions can aid in determining if you would benefit from professional advice.

- Do I need more liability coverage?

- Is a new car covered when I drive it off the dealer lot?

- What is PIP insurance?

- Do I need replacement cost coverage on my 2017 Nissan Titan?

- Is my custom paint covered by insurance?

- Should I carry comprehensive and collision coverage?

- Is other people’s property covered if stolen from my vehicle?

- Should I put collision coverage on all my vehicles?

- What is the minimum liability in my state?

- When can I cancel my policy?

If it’s difficult to answer those questions but a few of them apply, then you may want to think about talking to a licensed insurance agent.

Insurance advertising gotchas

Insurance providers like 21st Century, Allstate and State Farm regularly use television, radio, and online ads. They all have a common claim that drivers will save a bundle if you move your policy. Is it even possible that every company can cost less than your current company? Here is the trick they use.

Insurance companies require specific criteria for the type of driver that will add to their bottom line. For instance, a preferred risk should be over the age of 50, owns their home, and chooses high deductibles. A customer that matches those criteria receives the best premium rates and most likely will save if they switch.

Consumers who don’t qualify for this ideal profile must pay a more expensive rate and this can result in the customer not purchasing. Company advertisements say “customers who switch” not “all people who quote” save that much money. That is how companies can make the claims of big savings. Different companies use different criteria so you really should compare free auto insurance quotes often. It is just not possible to predict which insurance company will have the lowest rate quotes.

The coverage is in the details

Learning about specific coverages of car insurance aids in choosing the right coverages and the correct deductibles and limits. Policy terminology can be difficult to understand and even agents have difficulty translating policy wording. Shown next are typical coverages available from car insurance companies.

Collision coverage protection

Collision coverage pays to fix your vehicle from damage resulting from a collision with another car or object. You first must pay a deductible and the rest of the damage will be paid by collision coverage.

Collision coverage pays for things like damaging your car on a curb, sideswiping another vehicle, rolling your car and scraping a guard rail. Collision is rather expensive coverage, so consider dropping it from vehicles that are 8 years or older. You can also choose a higher deductible to get cheaper collision coverage.

Liability coverages

This coverage can cover damage that occurs to other people or property that is your fault. It protects YOU against other people’s claims. Liability doesn’t cover damage sustained by your vehicle in an accident.

Split limit liability has three limits of coverage: bodily injury per person, bodily injury per accident and property damage. Your policy might show limits of 50/100/50 that means you have $50,000 bodily injury coverage, a per accident bodily injury limit of $100,000, and a limit of $50,000 paid for damaged property.

Liability can pay for things such as medical expenses, repair costs for stationary objects, medical services and pain and suffering. How much liability should you purchase? That is up to you, but you should buy as large an amount as possible.

Medical expense coverage

Coverage for medical payments and/or PIP reimburse you for immediate expenses for pain medications, doctor visits, dental work, nursing services and prosthetic devices. They are often utilized in addition to your health insurance policy or if you are not covered by health insurance. Coverage applies to not only the driver but also the vehicle occupants and will also cover if you are hit as a while walking down the street. PIP coverage is not available in all states and may carry a deductible

Uninsured or underinsured coverage

This provides protection when the “other guys” either are underinsured or have no liability coverage at all. It can pay for hospital bills for your injuries as well as your vehicle’s damage.

Since a lot of drivers carry very low liability coverage limits, their limits can quickly be used up. That’s why carrying high Uninsured/Underinsured Motorist coverage should not be overlooked.

Comprehensive protection

This pays to fix your vehicle from damage that is not covered by collision coverage. A deductible will apply then your comprehensive coverage will pay.

Comprehensive can pay for things like damage from getting keyed, hail damage and falling objects. The highest amount your car insurance company will pay is the cash value of the vehicle, so if your deductible is as high as the vehicle’s value consider dropping full coverage.

A little work can save a LOT of money

As you prepare to switch companies, it’s very important that you do not buy lower coverage limits just to save a few bucks. There are many occasions where an insured dropped uninsured motorist or liability limits only to discover later that it was a big mistake. The proper strategy is to buy enough coverage at a price you can afford, but don’t skip important coverages to save money.

We just presented many ways to shop for 2017 Nissan Titan insurance online. The key thing to remember is the more price quotes you have, the better your comparison will be. Drivers may discover the lowest priced insurance coverage comes from an unexpected company. Regional companies may have significantly lower car insurance rates on certain market segments than their larger competitors like Progressive and GEICO.

Some insurance coverage companies do not provide online price quotes small, regional companies only sell coverage through independent agencies. Lower-priced 2017 Nissan Titan insurance is possible online in addition to many insurance agents, and you need to price shop both to have the best rate selection.

Much more information about insurance coverage is available below:

- Bodily Injury Coverage (Liberty Mutual)

- What does Personal Injury Protection (PIP) Cover? (Allstate)

- Things to Know Before you Cancel Insurance (Allstate)

- Auto Insurance 101 (About.com)

- Distracted Driving Extends Beyond Texting (State Farm)

- Neck Injury FAQ (iihs.org)

Frequently Asked Questions

What factors determine the cost of insurance for a 2017 Nissan Titan?

Several factors can influence the cost of insurance for a 2017 Nissan Titan, including your location, driving record, age, gender, marital status, credit score, coverage options, deductibles, and the insurance company’s rating system.

Are there any specific safety features on the 2017 Nissan Titan that could lower insurance costs?

Yes, the 2017 Nissan Titan comes with various safety features that could potentially lower insurance costs. These features may include advanced airbags, anti-lock brakes, stability control, traction control, a rearview camera, blind-spot monitoring, and collision warning systems. It’s advisable to check with insurance providers to see if they offer any discounts for these safety features.

How can I find the cheapest insurance for my 2017 Nissan Titan?

To find the cheapest insurance for your 2017 Nissan Titan, it’s recommended to compare quotes from multiple insurance providers. You can do this by contacting different insurance companies directly or using online comparison websites. Be sure to provide accurate and consistent information to get the most accurate quotes.

Are there any specific insurance companies known for offering affordable rates for a 2017 Nissan Titan?

Insurance rates can vary between companies, and the affordability of insurance for a 2017 Nissan Titan can depend on several factors. It’s advisable to research and compare rates from various insurance companies to find the best option for your specific circumstances. Some insurance providers may offer discounts or incentives for certain demographics or driver profiles, so it’s worth exploring different options.

Can I lower my insurance costs for a 2017 Nissan Titan by increasing my deductibles?

Increasing your deductibles can generally lead to lower insurance premiums. However, it’s important to consider your financial situation and ability to pay the deductible in the event of a claim. Higher deductibles mean you’ll have to pay more out-of-pocket if you file a claim. Make sure to evaluate the potential savings against the potential financial burden before adjusting your deductibles.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Honda CR-V Insurance

- Toyota Corolla Insurance

- Toyota Rav4 Insurance

- Toyota Camry Insurance

- Hyundai Tucson Insurance

- Toyota Tacoma Insurance

- Honda Civic Insurance

- Ford F-150 Insurance

- Dodge Ram Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area