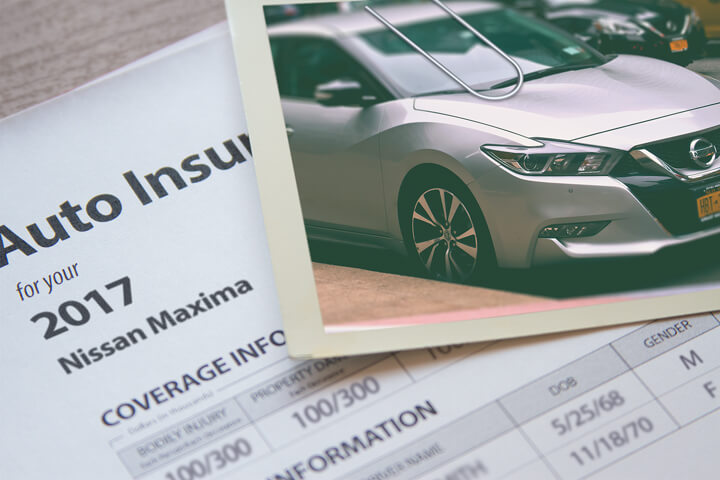

Cheapest 2017 Nissan Maxima Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Want cheaper insurance coverage rates for your Nissan Maxima? Nobody likes buying insurance coverage, in particular when their premiums are through the roof.

Because there are so many choices, it’s nearly impossible to choose the most cost effective insurance coverage company.

It’s important to compare prices before your next renewal due to the fact that insurance prices are variable and change quite frequently. If you had the best deal for Maxima insurance a year ago a different company probably has better rates today. Block out anything you think you know about insurance coverage because you’re about to find out the best methods to find better coverage at a better price.

Low cost insurance prices

Effectively comparing insurance prices can take hours if you aren’t aware of the most efficient way to do it. You can waste hours talking about coverages with insurance agencies in your area, or you can stay home and use online quotes to get prices fast.

All the larger companies belong to a marketplace that enables customers to enter their coverage request one time, and at least one company can provide price quotes based on that data. This prevents consumers from doing quotation requests to each individual insurance company.

To get comparison pricing now click here to open in new window.

One minor caveat to doing it this way is you don’t know exactly the insurers to receive prices from. So if you want to choose individual companies to receive pricing from, we have assembled a list of the cheapest insurance companies in your area. Click here for list of insurance companies.

The method you choose is up to you, but make sure you use the same coverages with every price quote. If you are comparing different data then you won’t be able to determine the lowest rate for your Nissan Maxima. Quoting even small variatio

ns in coverage limits can result in a big premium difference. And when price shopping your coverage, comparing a large number of companies helps improve the odds of finding the best price.

What is the best car insurance coverage?

When choosing adequate coverage for your vehicles, there really is not a one size fits all plan. Everyone’s situation is unique so your insurance should reflect that These are some specific questions might point out if your situation will benefit from professional help.

- Does my policy pay for OEM or aftermarket parts?

- Who is covered when they drive my 2017 Nissan Maxima?

- Am I covered when driving a rental car?

- Can I pay claims out-of-pocket if I buy high deductibles?

- How much underlying liability do I need for an umbrella policy?

- Am I covered when driving on a suspended license?

- Does my 2017 Nissan Maxima qualify for pleasure use?

- What if I don’t agree with a claim settlement offer?

If you’re not sure about those questions but a few of them apply, you might consider talking to a licensed insurance agent. If you want to speak to an agent in your area, fill out this quick form or you can go here for a list of companies in your area.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Educate yourself about auto insurance coverages

Knowing the specifics of auto insurance aids in choosing the best coverages for your vehicles. The coverage terms in a policy can be impossible to understand and coverage can change by endorsement. Listed below are the usual coverages available from auto insurance companies.

UM/UIM (Uninsured/Underinsured Motorist) coverage – This provides protection when the “other guys” are uninsured or don’t have enough coverage. Covered losses include injuries to you and your family and damage to your Nissan Maxima.

Because many people carry very low liability coverage limits, it doesn’t take a major accident to exceed their coverage limits. That’s why carrying high Uninsured/Underinsured Motorist coverage should not be overlooked. Frequently these limits are set the same as your liability limits.

Comprehensive auto coverage – Comprehensive insurance coverage pays to fix your vehicle from damage OTHER than collision with another vehicle or object. You first have to pay a deductible and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive insurance covers claims like hitting a deer, fire damage, hitting a bird and damage from a tornado or hurricane. The maximum amount you’ll receive from a claim is the market value of your vehicle, so if the vehicle’s value is low consider removing comprehensive coverage.

Coverage for liability – This will cover damage that occurs to other people or property by causing an accident. Split limit liability has three limits of coverage: bodily injury per person, bodily injury per accident and property damage. As an example, you may have liability limits of 100/300/100 which stand for a limit of $100,000 per injured person, a per accident bodily injury limit of $300,000, and property damage coverage for $100,000. Another option is one limit called combined single limit (CSL) which provides one coverage limit rather than limiting it on a per person basis.

Liability can pay for claims like funeral expenses, attorney fees, medical expenses, legal defense fees and medical services. How much liability should you purchase? That is a decision to put some thought into, but buy as much as you can afford.

Collision coverage – This coverage pays for damage to your Maxima resulting from colliding with an object or car. You have to pay a deductible and then insurance will cover the remainder.

Collision insurance covers things such as colliding with another moving vehicle, damaging your car on a curb, crashing into a ditch and sustaining damage from a pot hole. Collision is rather expensive coverage, so consider removing coverage from vehicles that are 8 years or older. You can also raise the deductible in order to get cheaper collision rates.

Medical payments and PIP coverage – Coverage for medical payments and/or PIP pay for bills for nursing services, surgery and chiropractic care. They are used in conjunction with a health insurance policy or if you do not have health coverage. They cover you and your occupants as well as being hit by a car walking across the street. Personal injury protection coverage is not an option in every state and gives slightly broader coverage than med pay.

Use our FREE quote tool to compare rates now!

Frequently Asked Questions

How can I find cheaper insurance coverage rates for my Nissan Maxima?

To find cheaper insurance coverage rates for your Nissan Maxima, it’s important to compare prices from different insurance companies. You can use online quote tools to get prices quickly and easily. Additionally, consider staying up to date with insurance prices as they can change frequently. Shopping around before your next renewal can help you find better coverage at a better price.

What is the best car insurance coverage for my Nissan Maxima?

The best car insurance coverage for your Nissan Maxima depends on your specific needs and situation. There is no one-size-fits-all plan. To determine the best coverage, consider factors such as your budget, driving habits, and level of risk tolerance. It may be helpful to speak with a licensed insurance agent who can provide personalized advice based on your circumstances.

How can I effectively compare insurance prices for my Nissan Maxima?

Comparing insurance prices can be time-consuming if you’re not aware of the most efficient methods. One way to save time is by using online quote tools that allow you to enter your coverage request once and receive multiple price quotes from different companies. Another option is to choose individual companies to receive pricing from and request quotes directly. Regardless of the method you choose, make sure you use the same coverages for accurate comparisons.

What coverages are available from auto insurance companies?

Auto insurance companies offer various coverages for your Nissan Maxima. Some common coverages include:

- Liability coverage: Covers damage to other people or property caused by an accident where you are at fault.

- Collision coverage: Pays for damage to your Maxima resulting from colliding with another object or vehicle.

- Comprehensive coverage: Covers damage to your vehicle from incidents other than collisions, such as theft, fire, or natural disasters.

- Uninsured/Underinsured motorist coverage: Provides protection if you’re involved in an accident with a driver who doesn’t have insurance or lacks sufficient coverage.

- Medical payments and PIP coverage: Help pay for medical expenses for you and your passengers in the event of an accident. It’s important to understand the specifics of each coverage to choose the ones that best suit your needs.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Dodge Ram Insurance

- Chevrolet Silverado Insurance

- Honda Civic Insurance

- Jeep Wrangler Insurance

- Toyota Camry Insurance

- Toyota Sienna Insurance

- Toyota Rav4 Insurance

- Toyota Corolla Insurance

- Chevrolet Impala Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area