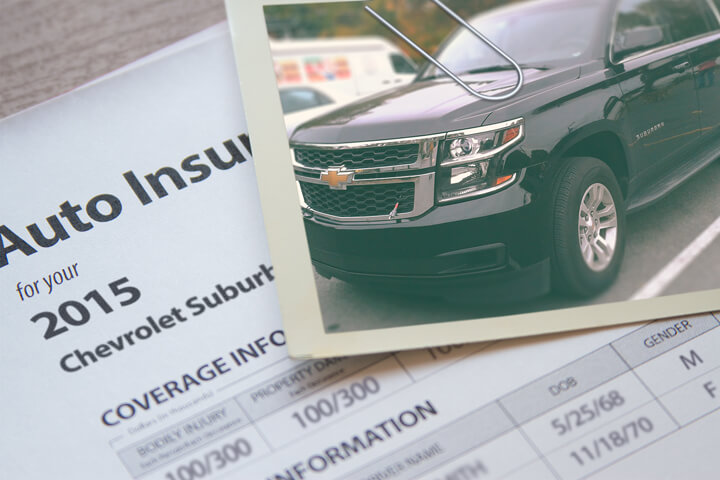

Cheapest 2015 Chevrolet Suburban Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Consumers have a choice when looking for affordable Chevy Suburban insurance. You can either waste hours contacting agents trying to get quotes or use the internet to get rate quotes. There is a better way to compare insurance coverage rates so you’re going to learn the quickest way to get price quotes for a Chevy and find the cheapest rates from local insurance agents and online providers.

Save money by taking advantage of these discounts

Companies don’t always advertise every available discount very well, so we break down both the well known and the more hidden ways to save on car insurance. If you don’t get every credit possible, you’re just leaving money on the table.

- Student in College – Children who attend school more than 100 miles from home and do not have a car can receive lower rates.

- Federal Employees – Active or retired federal employment may qualify you for a discount on Suburban coverage depending on your company.

- Discount for Life Insurance – Select insurance companies reward you with a break if you buy life insurance from them.

- Organization Discounts – Being a member of a professional or civic organization could trigger savings when buying car insurance on Suburban coverage.

- No Claims – Drivers with accident-free driving histories can earn big discounts when compared with bad drivers.

- Anti-lock Brake System – Vehicles with anti-lock braking systems can avoid accidents and therefore earn up to a 10% discount.

- Pay Upfront and Save – If you pay your bill all at once instead of monthly or quarterly installments you could save 5% or more.

- Auto/Home Discount – When you combine your home and auto insurance with one company you could get a discount of at least 10% off all policies.

- Homeowners Savings – Being a homeowner can help you save on car insurance because owning a home is proof that your finances are in order.

It’s important to understand that most discount credits are not given to the entire cost. Some only apply to specific coverage prices like medical payments or collision. So when the math indicates all the discounts add up to a free policy, companies don’t profit that way.

For a list of providers offering car insurance discounts, follow this link.

How to Get Insurance Coverage

Getting a cheaper price on 2015 Chevy Suburban insurance is a fairly straight forward process. Just spend a few minutes on the computer getting comparison quotes online with multiple companies. This can be accomplished in a couple of different ways.

- The first (and easiest) way consumers can analyze rates is an all-inclusive rate comparison like this one (opens in new window). This easy form saves time by eliminating separate forms for every insurance coverage company. A single form will return quotes direct from many companies. This is by far the quickest method.

- A more time consuming way to shop for insurance coverage online is to take the time to go to the website for each individual company to request a price quote. For example, let’s say you want comparison quotes from GEICO, State Farm and Progressive. You would have to spend time on each company’s site to input your insurance information, which is why the first method is quicker.For a list of links to insurance companies in your area, click here.

- The least efficient way to compare rates is driving to insurance agents’ offices. Shopping for insurance coverage online can eliminate the need for a local agent unless you prefer the professional advice of a licensed agent. You can, however, compare online quotes but buy from a local insurance agent. We’ll cover that shortly.

However you get your quotes, make darn sure you compare exactly the same deductibles and coverage limits with each company. If the quotes have mixed coverages then you won’t be able to make an equal comparison.

When should I use an insurance agent?

When it comes to choosing adequate coverage, there isn’t really a cookie cutter policy. Everyone’s needs are different.

For instance, these questions could help you determine if your insurance needs may require specific advice.

- Is my custom paint covered by insurance?

- Do I have coverage when making deliveries for my home business?

- What if I don’t agree with a claim settlement offer?

- Can I afford low physical damage deductibles?

- Why am I required to buy high-risk coverage?

- What can I do if my company denied a claim?

- Does medical payments coverage apply to all occupants?

- Which is better, split liability limits or combined limits?

- Should I drop comprehensive coverage on older vehicles?

If you don’t know the answers to these questions then you might want to talk to an insurance agent. To find lower rates from a local agent, simply complete this short form. It’s fast, free and can help protect your family.

Educate yourself about auto insurance coverages

Knowing the specifics of auto insurance can be of help when determining appropriate coverage for your vehicles. The terms used in a policy can be ambiguous and even agents have difficulty translating policy wording.

Medical expense coverage – Coverage for medical payments and/or PIP reimburse you for bills such as chiropractic care, pain medications and X-ray expenses. They can be used in conjunction with a health insurance policy or if you lack health insurance entirely. It covers you and your occupants and will also cover getting struck while a pedestrian. Personal injury protection coverage is only offered in select states and may carry a deductible

Comprehensive protection – This pays to fix your vehicle from damage caused by mother nature, theft, vandalism and other events. You first must pay your deductible and then insurance will cover the rest of the damage.

Comprehensive coverage protects against claims such as theft, damage from flooding, hail damage, a tree branch falling on your vehicle and falling objects. The highest amount your auto insurance company will pay is the cash value of the vehicle, so if the vehicle is not worth much consider dropping full coverage.

Collision coverage – This coverage will pay to fix damage to your Suburban resulting from a collision with another vehicle or an object, but not an animal. A deductible applies then the remaining damage will be paid by your insurance company.

Collision coverage pays for things such as driving through your garage door, crashing into a building and sideswiping another vehicle. This coverage can be expensive, so analyze the benefit of dropping coverage from lower value vehicles. Another option is to increase the deductible in order to get cheaper collision rates.

Uninsured or underinsured coverage – This coverage provides protection when the “other guys” either are underinsured or have no liability coverage at all. It can pay for hospital bills for your injuries as well as your vehicle’s damage.

Since a lot of drivers carry very low liability coverage limits, it only takes a small accident to exceed their coverage. This is the reason having UM/UIM coverage is very important.

Auto liability insurance – This coverage provides protection from damage that occurs to a person or their property that is your fault. It protects YOU against claims from other people, and does not provide coverage for your injuries or vehicle damage.

Coverage consists of three different limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. As an example, you may have values of 100/300/100 that translate to a $100,000 limit per person for injuries, a limit of $300,000 in injury protection per accident, and $100,000 of coverage for damaged property.

Liability can pay for things like bail bonds, medical expenses and legal defense fees. How much liability coverage do you need? That is your choice, but it’s cheap coverage so purchase higher limits if possible.

A penny earned…

As you go through the steps to switch your coverage, it’s a bad idea to skimp on critical coverages to save a buck or two. In many instances, drivers have reduced liability limits or collision coverage to discover at claim time that it was a big mistake. The aim is to purchase a proper amount of coverage at an affordable rate, not the least amount of coverage.

Budget-conscious 2015 Chevy Suburban insurance is available from both online companies as well as from independent agents, so compare prices from both to have the best selection. There are still a few companies who don’t offer the ability to get a quote online and usually these small insurance companies provide coverage only through local independent agents.

Insureds who switch companies do it for a number of reasons such as an unsatisfactory settlement offer, poor customer service, unfair underwriting practices or questionable increases in premium. Regardless of your reason for switching companies, choosing a new company is not as difficult as it may seem.

To read more, feel free to visit the articles below:

- What is a Telematics Device? (Allstate)

- How Much Auto Coverage do I Need? (Insurance Information Institute)

- Understanding Car Crashes Video (iihs.org)

- Liability Insurance Coverage (Nationwide)

- A Tree Fell on Your Car: Now What? (Allstate)

- Protecting Teens from Drunk Driving (Insurance Information Institute)

Frequently Asked Questions

How can I find the cheapest insurance for a 2015 Chevrolet Suburban?

To find the cheapest insurance for your 2015 Chevrolet Suburban, consider the following steps:

- Compare quotes from multiple insurance providers: Obtain quotes from different insurers to compare prices and coverage options.

- Opt for higher deductibles: Increasing your deductible amount can lower your insurance premium.

- Maintain a clean driving record: Having a good driving history without accidents or traffic violations can help lower your insurance costs.

- Inquire about discounts: Ask insurance providers about available discounts, such as multi-policy, safe driver, or loyalty discounts.

- Explore usage-based insurance: Some insurers offer usage-based insurance programs that monitor your driving habits. If you are a safe driver, this can potentially result in lower premiums.

- Consider your coverage needs: Assess your insurance requirements and consider if you can adjust coverage levels to reduce costs. However, ensure you have adequate coverage to protect yourself and your vehicle.

Are there any specific factors that affect insurance rates for a 2015 Chevrolet Suburban?

Several factors can influence insurance rates for a 2015 Chevrolet Suburban, including:

- Vehicle make and model: The Chevrolet Suburban is an SUV, and insurance rates for SUVs can be higher due to factors like repair costs and theft rates.

- Age and condition of the vehicle: Older vehicles typically have lower values, which may result in lower insurance premiums.

- Safety features: The presence of safety features like anti-lock brakes, airbags, and security systems can potentially reduce insurance costs.

- Driver’s age and driving history: Younger drivers with less experience generally have higher insurance rates. Additionally, drivers with a history of accidents or traffic violations may face increased premiums.

- Location: Insurance rates can vary based on the area where the vehicle is primarily driven or parked. Urban areas may have higher rates due to increased risks.

- Insurance coverage and deductibles: Higher coverage limits and lower deductibles generally lead to higher premiums.

Can I get a discount on insurance for my 2015 Chevrolet Suburban?

Yes, it’s possible to obtain discounts on insurance for your 2015 Chevrolet Suburban. Insurance providers often offer various discounts that can help lower your premium. Some common discounts include:

- Multi-policy discount: If you insure multiple vehicles or bundle your auto insurance with other policies like home insurance, you may be eligible for a discount.

- Safe driver discount: Having a clean driving record with no accidents or traffic violations can qualify you for a discount.

- Good student discount: If you or a family member on your policy is a full-time student with good grades, you may be eligible for a discount.

- Anti-theft device discount: Installing security features such as an alarm system or vehicle tracking device may lead to a discount on your insurance.

- Low mileage discount: If you drive your Chevrolet Suburban less frequently than average, you may qualify for a low mileage discount. It’s essential to inquire about available discounts with your insurance provider and ensure you meet the criteria for each discount.

How does the deductible affect insurance costs for a 2015 Chevrolet Suburban?

The deductible amount you choose can impact your insurance costs for a 2015 Chevrolet Suburban. The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in after a claim. Generally, a higher deductible results in a lower insurance premium because you’re assuming more risk. However, it’s important to choose a deductible amount that you can comfortably afford in case of an accident or damage to your vehicle. Assess your financial situation and weigh the potential savings against your ability to pay the deductible if needed.

Can I adjust my coverage levels to reduce insurance costs for my 2015 Chevrolet Suburban?

Yes, adjusting your coverage levels can potentially reduce insurance costs for your 2015 Chevrolet Suburban. However, it’s crucial to strike a balance between cost savings and ensuring you have adequate coverage. Here are some options to consider:

- Liability coverage: This coverage pays for damages you cause to others in an accident. While the minimum coverage required by law varies, it’s generally recommended to have enough liability coverage to protect your assets.

- Comprehensive and collision coverage: These coverages protect your own vehicle against damage from various perils. If you have an older vehicle or one with a lower market value, you might consider reducing or eliminating these coverages to save on premiums.

- Uninsured/underinsured motorist coverage: This coverage protects you if you’re involved in an accident with a driver who has insufficient insurance. While it’s important coverage, you can review the limits to find a balance between protection and cost. Before making changes to your coverage levels, consult with your insurance provider to understand the potential impacts and ensure you have the necessary protection.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Rav4 Insurance

- GMC Sierra Insurance

- Honda Civic Insurance

- Dodge Ram Insurance

- Ford F-150 Insurance

- Toyota Corolla Insurance

- Ford Edge Insurance

- Honda CR-V Insurance

- Toyota Camry Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area