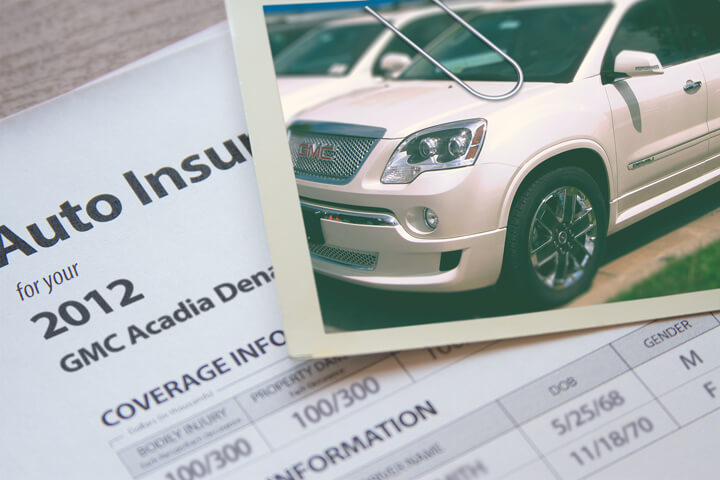

Cheapest 2012 GMC Acadia Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Scraping up a payment for overpriced GMC Acadia insurance can drain your bank account, especially in this economy. Shopping your coverage around is a great way to cut your insurance bill. Since consumers have many different company options, it can be challenging to locate the cheapest provider.

Consumers need to do rate comparisons periodically since insurance rates change quite often. Just because you had the lowest rates for Acadia coverage last year you can probably find a better price now. There is too much inaccurate information about insurance coverage online but we’re going to give you some solid techniques on how to stop overpaying for insurance.

Auto Insurance Comparison Rates

All the larger auto insurance companies give prices for coverage online. Getting online quotes is quite easy as you simply type in your coverage preferences as detailed in the form. After you submit the form their rating system sends out for information on your driving record and credit history and quotes a price based on many factors. Online quotes simplifies rate comparisons, but the time required to go to each company’s website and repetitively complete many quote forms gets old quite quickly. But it’s absolutely necessary to perform this step if you are searching for the lowest possible prices on auto insurance.

Rate comparisons made easy

The quickest way to find better auto insurance pricing is to use a quote form that obtains quotes from several different companies. The form is fast, requires less work, and makes online price comparison much more enjoyable and efficient. Immediately after submitting the form, it is rated with multiple companies and you can pick any or none of the price quotes you receive. If the quotes result in lower rates, you can click and sign and purchase the new policy. This process only takes a few minutes and could lower your rates considerably.

To find out how much you’re overpaying now, simply click here to open in new window and enter your information. If you have a policy now, it’s recommended you complete the form with the insurance coverages as shown on your current policy. This helps ensure you’re receiving comparison quotes for the exact same coverage.

Are you falling for claims of savings?

Consumers constantly see and hear ads for cheaper car insurance by companies like State Farm, GEICO and Progressive. They all seem to say the same thing about savings if you move to them.

How do they all claim to save you money? It’s all in the numbers.

All the different companies can use profiling for the type of driver that is profitable for them. An example of a profitable customer could possibly be between the ages of 40 and 55, has no driving citations, and drives less than 10,000 miles a year. Any driver who fits that profile will get very good rates and therefore will pay quite a bit less when switching companies.

Potential customers who don’t meet the requirements must pay higher rates and ends up with business not being written. Company advertisements say “customers who switch” not “people who quote” save that kind of money. This is how insurance companies can make those claims. This illustrates why it’s extremely important to compare as many rates as you can. Because you never know the company that will have the lowest GMC Acadia insurance rates.

You probably qualify for some discounts

Car insurance companies don’t necessarily list every available discount very well, so we break down both the well known and also the lesser-known savings tricks you should be using. If you don’t get every credit possible, you’re paying more than you need to.

- Life Insurance – Some companies give a break if you buy life insurance from them.

- Passive Restraint Discount – Vehicles with factory air bags or automatic seat belts can qualify for discounts of up to 25% or more.

- Multiple Cars – Insuring all your vehicles with the same company qualifies for this discount.

- Good Student – This discount can earn a discount of 20% or more. This discount can apply until age 25.

- Theft Prevention System – Vehicles with anti-theft systems are stolen less frequently and will save you 10% or more.

- Driver Safety – Successfully completing a defensive driving course can save you 5% or more if your company offers it.

- Senior Citizens – If you qualify as a senior citizen, you may be able to get reduced rates for Acadia coverage.

As a disclaimer on discounts, some credits don’t apply to your bottom line cost. Some only apply to the price of certain insurance coverages like comprehensive or collision. Even though it may seem like you could get a free insurance policy, insurance companies aren’t that generous.

There’s no such thing as the perfect policy

When buying the right insurance coverage for your vehicles, there really is no one size fits all plan. Every situation is different and your policy should reflect that. These are some specific questions may help highlight whether your personal situation could use an agent’s help.

- Should I file a claim if it’s only slightly more than my deductible?

- Am I covered when pulling a rental trailer?

- Is my 2012 GMC Acadia covered for smoke damage?

- Am I covered when driving in Canada or Mexico?

- Does my personal policy cover me when driving out-of-state?

- Do I have any recourse if my insurance company denies a claim?

- If my 2012 GMC Acadia is totaled, can I afford another vehicle?

- Is a blown tire covered by insurance?

If you’re not sure about those questions but a few of them apply then you might want to talk to a licensed agent. To find lower rates from a local agent, simply complete this short form. It’s fast, free and may give you better protection.

Parts of your insurance policy

Having a good grasp of your insurance policy helps when choosing the right coverages for your vehicles. Policy terminology can be ambiguous and even agents have difficulty translating policy wording. Shown next are typical coverage types offered by insurance companies.

Auto liability

Liability insurance protects you from damage or injury you incur to other people or property in an accident. This coverage protects you from legal claims by others. It does not cover your injuries or vehicle damage.

It consists of three limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. As an example, you may have limits of 25/50/25 that means you have $25,000 bodily injury coverage, $50,000 for the entire accident, and property damage coverage for $25,000.

Liability coverage protects against claims like pain and suffering, repair bills for other people’s vehicles and bail bonds. How much liability should you purchase? That is your choice, but it’s cheap coverage so purchase as much as you can afford.

Comprehensive coverage (or Other than Collision)

Comprehensive insurance will pay to fix damage OTHER than collision with another vehicle or object. You first must pay your deductible and then insurance will cover the rest of the damage.

Comprehensive coverage protects against claims such as damage from getting keyed, rock chips in glass, damage from a tornado or hurricane, falling objects and a tree branch falling on your vehicle. The maximum amount you can receive from a comprehensive claim is the market value of your vehicle, so if the vehicle is not worth much consider dropping full coverage.

Insurance for medical payments

Med pay and PIP coverage kick in for bills for ambulance fees, dental work and rehabilitation expenses. They are used to fill the gap from your health insurance policy or if there is no health insurance coverage. Coverage applies to all vehicle occupants and will also cover if you are hit as a while walking down the street. PIP coverage is only offered in select states but it provides additional coverages not offered by medical payments coverage

Uninsured Motorist or Underinsured Motorist insurance

This protects you and your vehicle’s occupants from other drivers when they are uninsured or don’t have enough coverage. It can pay for injuries sustained by your vehicle’s occupants and damage to your 2012 GMC Acadia.

Since a lot of drivers only carry the minimum required liability limits, it doesn’t take a major accident to exceed their coverage limits. For this reason, having high UM/UIM coverages is important protection for you and your family.

Auto collision coverage

Collision insurance pays for damage to your Acadia resulting from a collision with another car or object. A deductible applies then your collision coverage will kick in.

Collision insurance covers claims such as sideswiping another vehicle, scraping a guard rail and rolling your car. Collision coverage makes up a good portion of your premium, so consider removing coverage from lower value vehicles. You can also increase the deductible to save money on collision insurance.

Stretch your dollar

Throughout this article, we presented a lot of techniques to save on 2012 GMC Acadia insurance. The key thing to remember is the more price quotes you have, the better your comparison will be. You may even find the lowest priced insurance coverage comes from some of the smallest insurance companies. They often have lower prices on specific markets as compared to the big name companies such as Allstate or State Farm.

When trying to cut insurance costs, you should never buy less coverage just to save a little money. There have been many situations where an insured cut liability limits or collision coverage and discovered at claim time that their decision to reduce coverage ended up costing them more. Your focus should be to purchase plenty of coverage at a price you can afford, not the least amount of coverage.

To read more, feel free to visit these articles:

- What is Full Coverage? (Allstate)

- Who Has Cheap Riverside Auto Insurance Rates for a GMC Acadia? (QuoteRiverside.com)

- What is Covered by GAP Insurance? (Allstate)

- Booster Seat Ratings (iihs.org)

- What is a Telematics Device? (Allstate)

Frequently Asked Questions

How can I find the cheapest insurance for my 2012 GMC Acadia?

To find the cheapest insurance for your 2012 GMC Acadia, consider the following steps:

- Shop around: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Opt for higher deductibles: Choosing a higher deductible can lower your insurance premium, but make sure you can afford to pay the deductible if you need to make a claim.

- Maintain a clean driving record: Having a history of safe driving can help you secure lower insurance rates.

- Explore available discounts: Inquire about any discounts you may be eligible for, such as multi-policy, multi-vehicle, or good driver discounts.

- Consider usage-based insurance: Some insurance companies offer programs where your rates are based on your driving habits, potentially resulting in lower premiums if you have good driving behavior.

What factors influence the cost of insurance for a 2012 GMC Acadia?

Several factors can affect the cost of insurance for a 2012 GMC Acadia, including:

- Age and driving experience: Younger and inexperienced drivers typically pay higher insurance premiums.

- Location: Insurance rates can vary based on your location due to factors like crime rates and accident frequency in the area.

- Vehicle usage: The intended use of your car, such as personal or business, can impact insurance rates.

- Coverage and deductible: The type and level of coverage you choose, as well as your deductible amount, can affect your insurance premium.

- Driving record: A history of accidents or traffic violations can result in higher insurance rates.

- Credit history: Some insurance providers consider credit history when determining premiums.

- Safety features: The presence of safety features in your 2012 GMC Acadia, such as anti-lock brakes, airbags, or an anti-theft system, can potentially lower your insurance costs.

Are there any specific insurance providers known for offering affordable rates for a 2012 GMC Acadia?

While specific insurance rates can vary based on individual circumstances, it’s generally a good idea to consider obtaining quotes from various insurance providers. Some well-known insurance companies often offer competitive rates for auto insurance, including:

- Progressive

- GEICO

- State Farm

- Allstate

- Nationwide

- USAA (for military personnel and their families)

Are there any insurance discounts available specifically for a 2012 GMC Acadia?

Insurance discounts can vary depending on the insurance provider, but some common discounts that may apply to a 2012 GMC Acadia (or any vehicle) include:

- Multi-policy discount: If you insure your GMC Acadia and other policies, such as home or renters insurance, with the same provider, you may qualify for a discount.

- Multi-vehicle discount: If you insure multiple vehicles on the same policy, you may be eligible for a discount.

- Good driver discount: Maintaining a clean driving record with no accidents or traffic violations can often lead to discounted rates.

- Safety features discount: If your 2012 GMC Acadia is equipped with safety features like anti-lock brakes, airbags, or an anti-theft system, you may qualify for a discount.

- Low mileage discount: If you don’t drive your GMC Acadia extensively, you may be eligible for a discount.

- Good student discount: If you have a student driver with good grades, you may qualify for discounted rates.

- Pay-in-full discount: Some insurers offer discounts if you pay your premium in full rather than in installments.

Are there any additional tips to lower the cost of insurance for my 2012 GMC Acadia?

Here are some additional tips to potentially reduce the cost of insurance for your 2012 GMC Acadia:

- Take a defensive driving course: Successfully completing a defensive driving course can sometimes qualify you for discounted rates.

- Maintain a good credit score: Some insurance companies consider credit history when determining premiums, so maintaining a good credit score may help lower your rates.

- Remove unnecessary coverage: Review your insurance policy to ensure you’re not paying for coverage you don’t need, but be cautious to maintain adequate protection.

- Avoid filing small claims: Consider handling minor damages out of pocket instead of filing a claim, as multiple claims can lead to higher premiums.

- Regularly review your policy: As your circumstances change, such as moving or adding safety features, update your insurance provider to see if it affects your rates.

- Bundle insurance policies: If you have multiple insurance needs, bundling them with one provider may result in discounted rates.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Hyundai Tucson Insurance

- Honda Accord Insurance

- Honda Civic Insurance

- Honda CR-V Insurance

- Dodge Ram Insurance

- Toyota Corolla Insurance

- Toyota Camry Insurance

- Chevrolet Equinox Insurance

- Ford Explorer Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area