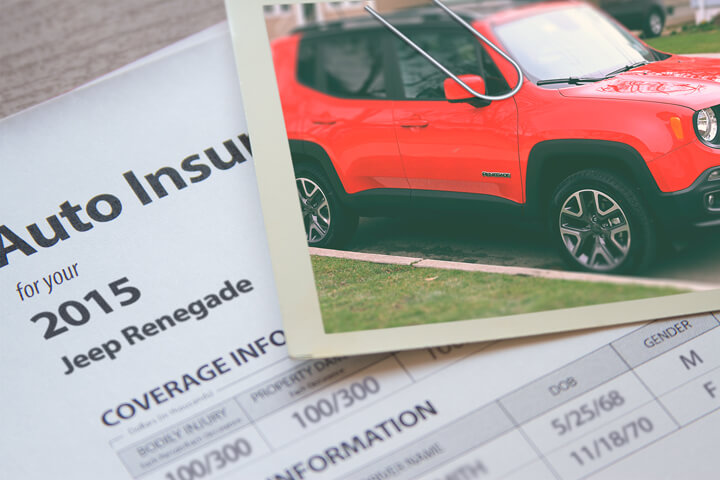

Jeep Renegade Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Finding cheaper auto insurance through online rate quotes can be fast and easy and at the same time you might just save a little. The most important part is to get rates from all companies so you can compare all your choices.

If you are a novice to online auto insurance shopping, it's easy to be confused by the hoards of companies vying for your business. Finding cheaper coverage prices can be surprisingly simple. The only requirement is to take the time to get quotes provided by online insurance companies. It is quite easy and can be accomplished by visiting this page.

Auto insurance rates on a Jeep Renegade can fluctuate considerably depending on several factors. Taken into consideration are:

- Higher performance Renegade vehicles cost more

- Accidents raise premiums

- Home/auto policy bundles save money

- Pleasure use vs. commuting use

- Young drivers cost more

- Being married can lower rates

- Special coverage such as replacement cost

- Claims drive up premiums

- No coverage lapses saves money

- Whether you rent or own your home

A final factor which can affect Jeep Renegade insurance rates is the model year. Models that are a few years old have a reduced actual cash value in comparison to older models so the cost to replace them may result in lower rates. Conversely, more recent Renegade vehicles may have a trim level with safety features such as autonomous braking, an advanced theft deterrent system, a telematics system, and adaptive headlights which may provide discounts that lower premiums.

Auto liability

damages or injuries you inflict on things such as emergency aid, pain and suffering, and medical services. .

Collision coverage

an object or car. . , . .

Comprehensive coverages

that is not covered by collision coverage. . you can receive from a comprehensive claim , .

Uninsured or underinsured coverage

This . , . .

Medical payments and PIP coverage

expenses doctor visits, EMT expenses, and X-ray expenses. . .

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Dodge Ram Insurance

- Honda Odyssey Insurance

- Toyota Camry Insurance

- Honda Accord Insurance

- Toyota Corolla Insurance

- Ford Edge Insurance

- Ford F-150 Insurance

- Subaru Outback Insurance

- Toyota Rav4 Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area