Audi A5 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

When the time comes to figure out how much Audi A5 insurance costs, you might be left with more questions than answers. In order to streamline your search for a quality provider and help you determine if you should have full coverage or liability alone, we have prepared this in-depth guide.

This article will inform you about average insurance rates for the Audi A5, how the size and class of the vehicle play a factor, what liability insurance costs for the Audi A5, its safety features, MSRP value, and repair estimates.

By the time you have finished reading through this piece, you will be better equipped to find the right insurance provider for a good rate. In fact, you can start comparing quotes right now by taking advantage of our free online quote tool.

U.S. average auto insurance rates for an Audi A5 are $1,028 annually for full coverage insurance. Comprehensive costs around $194 each year, collision costs $296, and liability is $402. A policy with just liability insurance costs around $446 a year, with coverage for high-risk drivers costing around $2,218. Teenage drivers pay the highest rates at $3,988 a year or more.

Average premium for full coverage: $1,028

Price estimates for individual coverage:

Estimates include $500 deductible amounts, 30/60 bodily injury liability limits, and includes uninsured motorist and medical coverage. Estimates are averaged for all 50 states and A5 models.

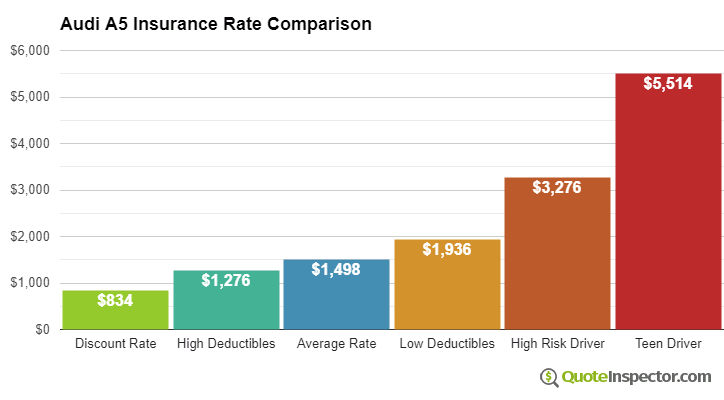

Price Range from Low to High

For the normal driver, Audi A5 insurance prices go from as cheap as $446 for the bare minimum liability coverage to a high rate of $2,218 for a driver who requires high-risk insurance.

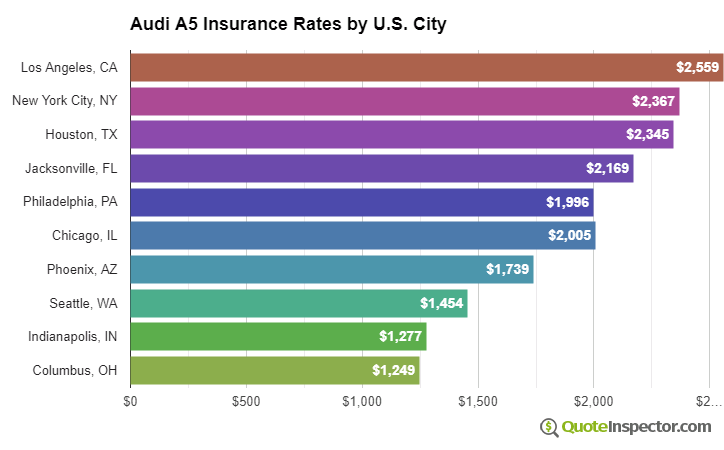

Geographic Price Range

Choosing to live in a large city can have significant affects on car insurance rates. Areas with sparse population have fewer physical damage claims than densely populated cities.

The graphic below illustrates how geographic area affects auto insurance rates.

The ranges above illustrate why all drivers should compare rates quotes for a specific zip code and their own personal driving habits, instead of using average rates.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Additional Rate Information

The chart below illustrates estimated Audi A5 insurance rates for additional coverage choices and driver risks.

- The best discount rate is $607

- Raising to $1,000 deductibles will save about $110 each year

- The estimated rate for the average middle-age driver using $500 deductibles is $1,028

- Using low deductibles will cost $1,244

- At-risk drivers who are prone to accidents and violations could pay at least $2,218 or more

- The price with full coverage for a teen driver can be $3,988

Insurance prices for an Audi A5 are also quite variable based on the trim level and model year, your risk profile, and deductibles and policy limits.

More mature drivers with a clean driving record and high physical damage deductibles may pay as little as $1,000 every 12 months on average for full coverage. Prices are much higher for teenage drivers, where even without any violations or accidents they can expect to pay as much as $3,900 a year. View Rates by Age

If you have some driving violations or you caused a few accidents, you are probably paying at least $1,200 to $1,700 extra each year, depending on your age. Insurance for high-risk drivers is expensive and can cost as much as 43% to 130% more than a normal policy. View High Risk Driver Rates

Using high physical damage deductibles can reduce prices by up to $330 every year, whereas increasing liability limits will increase prices. Switching from a 50/100 bodily injury limit to a 250/500 limit will increase prices by as much as $362 more per year. View Rates by Deductible or Liability Limit

The state you live in also has a big influence on Audi A5 insurance prices. A middle-age driver might find prices as low as $670 a year in states like Vermont, Wisconsin, and North Carolina, or be forced to pay as much as $1,390 on average in Michigan, New York, and Florida.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $928 | -$100 | -9.7% |

| Alaska | $788 | -$240 | -23.3% |

| Arizona | $852 | -$176 | -17.1% |

| Arkansas | $1,028 | -$0 | 0.0% |

| California | $1,170 | $142 | 13.8% |

| Colorado | $980 | -$48 | -4.7% |

| Connecticut | $1,054 | $26 | 2.5% |

| Delaware | $1,160 | $132 | 12.8% |

| Florida | $1,282 | $254 | 24.7% |

| Georgia | $950 | -$78 | -7.6% |

| Hawaii | $736 | -$292 | -28.4% |

| Idaho | $696 | -$332 | -32.3% |

| Illinois | $766 | -$262 | -25.5% |

| Indiana | $776 | -$252 | -24.5% |

| Iowa | $692 | -$336 | -32.7% |

| Kansas | $976 | -$52 | -5.1% |

| Kentucky | $1,400 | $372 | 36.2% |

| Louisiana | $1,522 | $494 | 48.1% |

| Maine | $634 | -$394 | -38.3% |

| Maryland | $848 | -$180 | -17.5% |

| Massachusetts | $820 | -$208 | -20.2% |

| Michigan | $1,784 | $756 | 73.5% |

| Minnesota | $860 | -$168 | -16.3% |

| Mississippi | $1,232 | $204 | 19.8% |

| Missouri | $912 | -$116 | -11.3% |

| Montana | $1,102 | $74 | 7.2% |

| Nebraska | $808 | -$220 | -21.4% |

| Nevada | $1,232 | $204 | 19.8% |

| New Hampshire | $742 | -$286 | -27.8% |

| New Jersey | $1,150 | $122 | 11.9% |

| New Mexico | $908 | -$120 | -11.7% |

| New York | $1,082 | $54 | 5.3% |

| North Carolina | $592 | -$436 | -42.4% |

| North Dakota | $842 | -$186 | -18.1% |

| Ohio | $708 | -$320 | -31.1% |

| Oklahoma | $1,052 | $24 | 2.3% |

| Oregon | $942 | -$86 | -8.4% |

| Pennsylvania | $978 | -$50 | -4.9% |

| Rhode Island | $1,370 | $342 | 33.3% |

| South Carolina | $932 | -$96 | -9.3% |

| South Dakota | $868 | -$160 | -15.6% |

| Tennessee | $900 | -$128 | -12.5% |

| Texas | $1,240 | $212 | 20.6% |

| Utah | $762 | -$266 | -25.9% |

| Vermont | $700 | -$328 | -31.9% |

| Virginia | $616 | -$412 | -40.1% |

| Washington | $792 | -$236 | -23.0% |

| West Virginia | $942 | -$86 | -8.4% |

| Wisconsin | $710 | -$318 | -30.9% |

| Wyoming | $914 | -$114 | -11.1% |

Since prices can be so different, the only way to figure out your exact price is to do a rate comparison and see which company has the best price. Every auto insurance company uses a different method to calculate prices, so the prices may be quite different between companies.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Audi A5 2.0T Quattro Premium 2-Dr Coupe | $980 | $82 |

| Audi A5 2.0T Quattro Premium Plus 2-Dr Coupe | $996 | $83 |

| Audi A5 2.0T Premium 2-Dr Convertible | $1,110 | $93 |

| Audi A5 2.0T Premium Plus 2-Dr Convertible | $1,110 | $93 |

| Audi A5 2.0T Quattro Prestige 2-Dr Coupe | $1,016 | $85 |

| Audi A5 3.2 Quattro Premium Plus 2-Dr Coupe | $1,016 | $85 |

| Audi A5 3.2 Quattro Prestige 2-Dr Coupe | $1,016 | $85 |

| Audi A5 2.0T Quattro Prestige S-Line 2-Dr Coupe | $1,046 | $87 |

| Audi A5 2.0T Prestige 2-Dr Convertible | $1,148 | $96 |

| Audi A5 2.0T Prestige S-Line 2-Dr Convertible | $1,148 | $96 |

| Audi A5 3.2 Quattro Prestige S-Line 2-Dr Coupe | $1,066 | $89 |

Rates assume 2011 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Audi A5 | $356 | $744 | $338 | $1,574 |

| 2023 Audi A5 | $344 | $726 | $354 | $1,560 |

| 2022 Audi A5 | $332 | $696 | $364 | $1,528 |

| 2021 Audi A5 | $314 | $672 | $376 | $1,498 |

| 2020 Audi A5 | $302 | $624 | $384 | $1,446 |

| 2019 Audi A5 | $290 | $588 | $388 | $1,402 |

| 2018 Audi A5 | $278 | $526 | $390 | $1,330 |

| 2017 Audi A5 | $260 | $484 | $390 | $1,270 |

| 2016 Audi A5 | $250 | $454 | $394 | $1,234 |

| 2015 Audi A5 | $244 | $424 | $402 | $1,206 |

| 2014 Audi A5 | $226 | $394 | $402 | $1,158 |

| 2013 Audi A5 | $220 | $358 | $406 | $1,120 |

| 2012 Audi A5 | $206 | $326 | $402 | $1,070 |

| 2011 Audi A5 | $194 | $296 | $402 | $1,028 |

| 2010 Audi A5 | $188 | $266 | $398 | $988 |

Rates are averaged for all Audi A5 models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Buy Low Cost Audi A5 Insurance

Getting lower rates on car insurance consists of having a good driving record, having a good credit history, not filing small claims, and insuring your home and auto with the same company. Invest the time to compare rates at every other renewal by quoting rates from direct insurance companies like GEICO, Progressive, and Esurance, and also from several local insurance agents.

The next list is a review of the concepts that were presented in the illustrations above.

- Higher risk drivers who have several accidents or serious violations pay on average $1,190 more every year to buy Audi A5 insurance

- Drivers age 20 and younger pay higher prices, as much as $332 a month including comprehensive and collision insurance

- It is possible to save up to $120 per year simply by quoting online in advance

- Increasing physical damage deductibles could save up to $325 each year

- It is possible to save up to $120 per year simply by quoting online in advance

Now that we have gone into detail about what average Audi A5 insurance rates look like based on age, location, and driving history, you might be curious about other contributing factors that determine rates.

[360_quote_team]

How does the size and class of the Audi A5 affect liability rates?

The Insurance Institute for Highway Safety (IIHS) classifies the Audi A5 as a midsize luxury car. This is important to know because the size of the vehicle you drive ultimately determines how much money you will pay for the most basic form of coverage, which is called auto liability insurance.

Insurance providers will take the size and class of the Audi A5 into consideration when providing you with a quote. They do this because some vehicles are generally safer than others due to their structural design and curb weight.

As a midsize luxury car, the Audi A5 is comparable to models like the Acura TLX or Lincoln MKZ. Liability rates for the Audi A5 are affected by the loss percentages for each model in the class.

The IIHS reports that the Audi A5 has a property damage loss percentage of -49 percent, which is considered highly favorable among the vehicle class. As of the writing of this article, loss ratio data for bodily injury liability was not available.

What does liability insurance cost for an Audi A5?

Now that we know how liability rates are calculated, you are likely curious to know what the actual rates might be based on the level of coverage you want to have.

The following general quotes will show a breakdown of how much bodily injury liability costs for the Audi A5 as an itemized cost on your insurance policy.

- Low ($25,000): $101.43

- Medium ($50,000): $121.53

- High ($100,000): $132.48

While bodily injury liability will pay for the opposing driver’s medical expenses, you will still need to have coverage for any damage you are responsible for causing to their car. That’s where property damage liability insurance comes into play.

Take a look at the following general property damage liability quotes for the Audi A5 based on low to high coverage.

- Low ($25,000): $107.27

- Medium ($50,000): $104.95

- High ($100,000): $107.65

It’s interesting to note that both forms of liability insurance for the Audi A5 fluctuate at a minimal level. Therefore, if you are on the fence between low or high coverage, it won’t impact your wallet too much if you decide to play it safe.

What are the safety features and ratings of the Audi A5?

Luxury automakers like Audi have earned a reputation for including a lot of safety features in their vehicles. Having these equipped in the car you drive often leads to better safety ratings and a more favorable insurance rate.

Take a look at the following list of safety features for the 2020 Audi A5 sourced from AutoBlog.com.

- Anti-Lock Brakes – Also known as ABS, these brakes have sensors that detect when the tire(s) have stopped moving when extreme braking occurs. The ABS system will modify pressure allowing the tire(s) to continue rotating safely.

- Stability Control – This feature automatically senses when the van’s handling limits have been exceeded and reduces engine power and applies select brakes to help prevent the driver from losing control.

- Front-Impact Airbags – This feature serves to protect the heads of the driver and passengers during a front-end crash.

- Side-Impact Airbags – This feature protects the torso area of the driver and passengers during a side-impact collision.

- Knee Airbags – When deployed, these airbags protect the lower extremities of the driver and passengers inside the Audi A5.

- Anti-Whiplash – These head restraints actively react to rear collision forces and cradle the occupants’ head in an effort to reduce the likelihood of a whiplash injury.

- Pretensioners – This feature automatically tightens the seatbelts to place the occupant in the optimal seating position during a collision.

- Anti-Theft Security – This technology anticipates and detects unwanted vehicle intrusion. The vehicle is equipped with an ignition-disable device that will prevent the engine from starting if the correct original manufacturer key is not used.

These safety features go a long way in the event of a collision. However, it’s important to know the fatality statistics for other vehicles like the Audi A5 so you have a full understanding of how this vehicle class compares to the national average.

The IIHS reports that out of 9,736,590 registered midsize cars, a total of 396 road fatalities have been reported for this vehicle class. Broken down, that is a fatality rate of 41 per one million registered people who drive a model like the Audi A5.

Additionally, the impact point of a crash also plays a factor in how fatal an accident can truly be. The following statistics show how many deaths occurred based on where the crash originated.

- Frontal Impact: 7,433 deaths

- Side Impact: 3,568 deaths

- Rear Impact: 834 deaths

- Other (mostly rollovers): 1,303 deaths

Driving is unpredictable in nature, but having knowledge about what can go wrong will only serve to benefit you in the long run. Beyond educating yourself, having the right auto insurance policy is the next step to take to enjoy peace of mind every time you get behind the wheel of your Audi A5.

What is the MSRP of the Audi A5?

The current value of the vehicle you drive is directly tied to the amount of money you can expect to pay for insurance.

As of the writing of this article, Kelley Blue Book (KBB) reports that the MSRP value of a 2019 Audi A5 Premium is $45,195 with a fair market value between $36,997 and $41,498.

If you decide to buy instead of lease a new Audi A5, one thing you might want to consider is getting full coverage. A lot of drivers do this because liability insurance will not pay for any damages sustained to your vehicle.

Two types of coverage you can get to protect your car are collision and comprehensive insurance.

- Collision car insurance is a type of coverage that will pay for any costs associated with repairing or even replacing your vehicle if it gets damaged after colliding with another car or object.

- Comprehensive car insurance protects you from any damage sustained that is outside of your control, such as a bicycle running into your vehicle while it is parked on the street.

When it comes to loss percentages, the Audi A5 has a collision loss percentage of 58 percent and a comprehensive loss percentage of 41 percent. This is considered above average for the vehicle class.

How much will it cost to repair my Audi A5?

One thing that all car-owners have in common is vehicle maintenance. Even though luxury vehicles like the Audi A5 are built to last, you still have to pay for general upkeep and repairs.

Experts from RepairPal estimate that the annual cost of repairs for the Audi A5 is $798 per year. This includes everything from oil changes and tire rotations to major work that is needed following an accident.

Speaking of which, if you ever found yourself in a situation where you have to pay to repair a certain part of the vehicle, the following estimates come courtesy of Instant Estimator:

- Front Bumper: $412.60

- Rear Bumper: $422.60

- Hood: $377.00

- Roof: $426.60

- Front Door: $389.20

- Back Door: $377.80

- Fender: $327.40

- Quarter Panel: $352.20

To this point, we have gone into great detail about Audi A5 insurance and with a little luck, we’ve answered the question, “How much is insurance for an Audi A5?”

However, we still recognize that we might have missed something so we are curious to know, is there anything else you’d like to see us expand upon?

If not, enter your five-digit ZIP code in our online tool to start comparing quotes for free from the industry’s top insurance providers.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $3,988 |

| 20 | $2,354 |

| 30 | $1,056 |

| 40 | $1,028 |

| 50 | $942 |

| 60 | $924 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,244 |

| $250 | $1,144 |

| $500 | $1,028 |

| $1,000 | $918 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,028 |

| 50/100 | $1,146 |

| 100/300 | $1,247 |

| 250/500 | $1,508 |

| 100 CSL | $1,187 |

| 300 CSL | $1,408 |

| 500 CSL | $1,569 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $5,656 |

| 20 | $3,752 |

| 30 | $2,250 |

| 40 | $2,218 |

| 50 | $2,116 |

| 60 | $2,096 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $54 |

| Multi-vehicle | $55 |

| Homeowner | $17 |

| 5-yr Accident Free | $68 |

| 5-yr Claim Free | $66 |

| Paid in Full/EFT | $42 |

| Advance Quote | $48 |

| Online Quote | $71 |

| Total Discounts | $421 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area