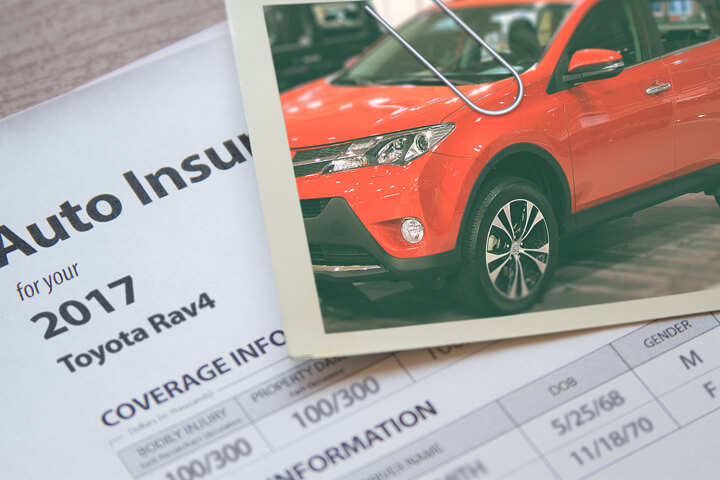

Cheapest 2017 Toyota RAV4 Insurance Rates in 2026

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Looking for the cheapest insurance coverage rates for your Toyota RAV4? Are you sick and tired of paying out the nose to make your insurance coverage payment? Your situation is no different than many other consumers.

With so many different company options, it’s nearly impossible to pick the best insurance company.

The best way to compare car insurance company rates is to realize all the major auto insurance companies have advanced systems to compare their rates. The only thing you need to do is give the companies some data like if you went to college, the make and model of your vehicles, if the vehicle is leased, and level of coverage desired. The rating information is instantly provided to many of the top insurers and they provide comparison quotes within a short period of time.

To start a quote now, click here and find out if you can get cheaper insurance.

Tailor your insurance coverage to you

When it comes to choosing coverage for your vehicles, there is no one size fits all plan. Everyone’s situation is a little different so your insurance should reflect that These are some specific questions may help highlight if you may require specific advice.

- Should I put collision coverage on all my vehicles?

- Is my ex-spouse still covered by my policy?

- Does coverage extend to Mexico or Canada?

- Am I covered when using my vehicle for business?

- Am I insured when driving a different vehicle?

- Where can I get insurance after a DUI in my state?

- Am I covered by my employer’s commercial auto policy when driving my personal car for business?

- Am I covered if I hit a deer?

If it’s difficult to answer those questions then you might want to talk to an agent. To find an agent in your area, complete this form or click here for a list of insurance companies in your area.

Insurance specifics

Understanding the coverages of insurance helps when choosing the best coverages and proper limits and deductibles. The coverage terms in a policy can be impossible to understand and even agents have difficulty translating policy wording. Shown next are typical coverages found on the average insurance policy.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Liability

Liability coverage can cover damage or injury you incur to people or other property in an accident. This coverage protects you against other people’s claims. Liability doesn’t cover your injuries or vehicle damage.

Split limit liability has three limits of coverage: per person bodily injury, per accident bodily injury, and a property damage limit. You might see limits of 100/300/100 that means you have $100,000 bodily injury coverage, a limit of $300,000 in injury protection per accident, and property damage coverage for $100,000.

Liability insurance covers things such as medical expenses, loss of income, structural damage and emergency aid. How much coverage you buy is up to you, but it’s cheap coverage so purchase as high a limit as you can afford.

Uninsured/Underinsured Motorist coverage

This protects you and your vehicle from other motorists when they either are underinsured or have no liability coverage at all. It can pay for medical payments for you and your occupants as well as damage to your Toyota RAV4.

Since a lot of drivers carry very low liability coverage limits, their limits can quickly be used up. So UM/UIM coverage is a good idea.

Collision coverage

This coverage pays to fix your vehicle from damage caused by collision with another car or object. A deductible applies and then insurance will cover the remainder.

Collision insurance covers claims like backing into a parked car, crashing into a building, sustaining damage from a pot hole and sideswiping another vehicle. Paying for collision coverage can be pricey, so consider removing coverage from vehicles that are older. Another option is to bump up the deductible in order to get cheaper collision rates.

Medical payments coverage and PIP

Medical payments and Personal Injury Protection insurance kick in for expenses such as pain medications, chiropractic care, dental work and funeral costs. They can be utilized in addition to your health insurance plan or if you lack health insurance entirely. It covers you and your occupants in addition to if you are hit as a while walking down the street. Personal Injury Protection is only offered in select states but can be used in place of medical payments coverage

Comprehensive coverage

This coverage covers damage that is not covered by collision coverage. You first have to pay a deductible then the remaining damage will be covered by your comprehensive coverage.

Comprehensive insurance covers claims like hitting a bird, falling objects, fire damage, a tree branch falling on your vehicle and damage from a tornado or hurricane. The highest amount you’ll receive from a claim is the ACV or actual cash value, so if the vehicle’s value is low it’s probably time to drop comprehensive insurance.

Use our FREE quote tool to compare rates now!

Frequently Asked Questions

How can I find the cheapest insurance for my 2017 Toyota RAV4?

Finding the cheapest insurance for your 2017 Toyota RAV4 involves several factors. Here are a few tips to help you find affordable coverage:

- Shop around: Obtain quotes from multiple insurance providers to compare prices and coverage options.

- Maintain a good driving record: Insurance companies often offer lower rates to drivers with a clean driving history.

- Opt for a higher deductible: Choosing a higher deductible can lower your insurance premium, but make sure you can afford to pay the deductible in case of a claim.

- Consider bundling: Some insurance companies offer discounts if you bundle your auto insurance with other policies, such as homeowners or renters insurance.

- Look for discounts: Inquire about any available discounts, such as safe driver discounts, multi-car discounts, or discounts for safety features in your RAV4.

- Review your coverage needs: Assess your coverage needs and consider adjusting your policy accordingly. Eliminating unnecessary coverage can help reduce costs.

Are there specific insurance providers known for offering affordable rates for a 2017 Toyota RAV4?

Insurance rates can vary between providers, so it’s always a good idea to compare quotes from multiple companies. However, some insurance providers are known for offering competitive rates. A few well-known insurers include GEICO, Progressive, State Farm, Allstate, and Nationwide. Remember, rates can vary based on individual factors such as location, driving history, and coverage needs, so it’s important to obtain personalized quotes to find the best rate for your specific situation.

Does the color of my 2017 Toyota RAV4 affect insurance rates?

Generally, the color of your vehicle does not directly impact insurance rates. Insurance companies primarily consider factors such as the make, model, age, engine size, safety features, and repair costs of the vehicle when determining premiums. However, it’s essential to provide accurate information about your RAV4’s trim level, safety features, and any modifications, as these can influence insurance costs.

Can I get a discount on insurance for my 2017 Toyota RAV4 if I have anti-theft devices installed?

Yes, installing anti-theft devices in your 2017 Toyota RAV4 can often lead to discounts on your insurance premium. Anti-theft devices, such as alarms, tracking systems, and immobilizers, can reduce the risk of theft or vandalism, making your vehicle less of a liability for the insurance company. Be sure to inform your insurance provider about any anti-theft devices installed in your RAV4 to potentially qualify for discounts.

Are there any specific safety features in the 2017 Toyota RAV4 that could help lower insurance rates?

Yes, certain safety features in the 2017 Toyota RAV4 may help lower insurance rates. The RAV4 comes equipped with standard safety features, such as airbags, stability control, traction control, and anti-lock brakes. Additionally, if your RAV4 has advanced safety features like lane departure warning, forward collision warning, automatic emergency braking, or adaptive cruise control, you may be eligible for further discounts on your insurance premium. Consult with your insurance provider to determine which safety features may qualify you for discounts.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Nissan Rogue Insurance

- Subaru Forester Insurance

- Honda CR-V Insurance

- Ford Explorer Insurance

- Honda Accord Insurance

- Chevrolet Silverado Insurance

- Ford F-150 Insurance

- Toyota Camry Insurance

- Volkswagen Jetta Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area