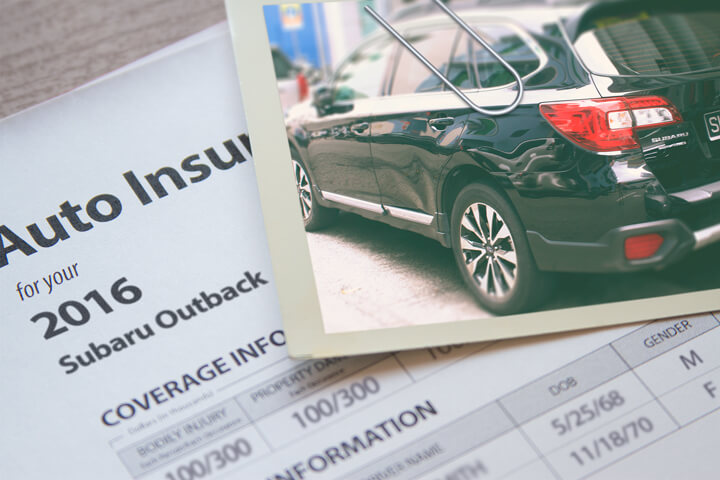

Cheapest 2016 Subaru Outback Insurance Rates in 2026

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Expensive insurance can bleed your personal savings and make it impossible to make ends meet.

Consumers have many car insurance companies to buy insurance from, and though it is a good thing to be able to choose, having more insurers makes it harder to find a good deal.

Take advantage of these money-saving discounts

Properly insuring your vehicles can get expensive, but there could be significant discounts that many people don’t even know exist. Some trigger automatically when you purchase, but some need to be inquired about before you will receive the discount.

- Multiple Cars – Buying a policy with primary and secondary vehicles on one policy could earn a price break for each car.

- Mature Driver Discount – Drivers over the age of 55 may receive better insurance rates for Outback coverage.

- Driver Training Discounts – Taking time to complete a course that instructs on driving safety could save 5% or more depending on where you live.

- No Accidents – Drivers who don’t have accidents get the best insurance rates in comparison to drivers who are more careless.

- Homeowners Pay Less – Owning your own home or condo can get you a discount due to the fact that maintaining a home demonstrates responsibility.

- Theft Deterent System – Cars and trucks equipped with tracking devices and advanced anti-theft systems have a lower chance of being stolen and therefore earn up to a 10% discount.

While discounts sound great, it’s important to understand that some of the credits will not apply to all coverage premiums. Most only apply to the cost of specific coverages such as collision or personal injury protection. Even though it may seem like you would end up receiving a 100% discount, insurance companies wouldn’t stay in business.

A list of companies and some of the premium reductions they offer are:

- Farm Bureau has savings for multi-vehicle, good student, multi-policy, safe driver, and 55 and retired.

- MetLife may have discounts that include good driver, good student, accident-free, defensive driver, multi-policy, and claim-free.

- Progressive may include discounts for online signing, multi-vehicle, good student, continuous coverage, online quote discount, and multi-policy.

- AAA policyholders can earn discounts including anti-theft, education and occupation, multi-car, good driver, multi-policy, and AAA membership discount.

- American Family offers premium reductions for TimeAway discount, bundled insurance, mySafetyValet, multi-vehicle, good driver, and Steer into Savings.

- GEICO offers discounts including multi-vehicle, multi-policy, five-year accident-free, air bags, defensive driver, anti-lock brakes, and seat belt use.

- State Farm may offer discounts for driver’s education, multiple policy, anti-theft, defensive driving training, multiple autos, accident-free, and Drive Safe & Save.

It’s a good idea to ask each company the best way to save money. Some of the discounts discussed earlier might not be offered in every state. To choose insurance companies with significant discounts, click here to view.

Do I need special coverages?

When choosing the right insurance coverage, there is no perfect coverage plan. Your needs are not the same as everyone else’s so your insurance needs to address that. Here are some questions about coverages that might help in determining if your situation might need an agent’s assistance.

- Am I covered if I hit a deer?

- Do I need PIP (personal injury protection) coverage in my state?

- How many claims can I have before being canceled?

- Am I covered if I crash into my own garage door?

- When do I need to add a new car to my policy?

- When should I drop full coverage on my 2016 Subaru Outback?

If you don’t know the answers to these questions, you might consider talking to a licensed agent. If you want to speak to an agent in your area, simply complete this short form or you can also visit this page to select a carrier

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tricks in insurance coverage advertising

Big name companies like State Farm and Allstate regularly use ads on TV and radio. They all seem to make an identical promise of big savings after switching your policy. Is it even possible that every company can make the same claim? Here is how they do it.

Different companies quote their best rates for the type of customer that earns them a profit. For instance, a desirable insured may be between 30 and 50, has a clean driving record, and chooses high deductibles. A driver who meets those qualifications gets the lowest car insurance rates and most likely will save when they switch companies.

Potential insureds who cannot meet this stringent profile will be quoted higher prices with the end result being the customer buying from someone else. The ads say “customers that switch” not “all people who quote” save that much money. That’s the way insurance companies can advertise the way they do. Different companies use different criteria so you should do a price quote comparison at every renewal. Because you cannot predict which company will give you the biggest savings.

Car insurance coverages 101

Understanding the coverages of your car insurance policy can help you determine appropriate coverage and the correct deductibles and limits. The coverage terms in a policy can be difficult to understand and nobody wants to actually read their policy. Below you’ll find typical coverages found on the average car insurance policy.

Uninsured/Underinsured Motorist (UM/UIM)

This coverage protects you and your vehicle from other drivers when they either have no liability insurance or not enough. Covered losses include injuries to you and your family and also any damage incurred to your Subaru Outback.

Since a lot of drivers only carry the minimum required liability limits, their liability coverage can quickly be exhausted. For this reason, having high UM/UIM coverages is a good idea.

Comprehensive insurance

Comprehensive insurance coverage covers damage that is not covered by collision coverage. You need to pay your deductible first then the remaining damage will be covered by your comprehensive coverage.

Comprehensive coverage pays for claims such as rock chips in glass, hitting a bird, fire damage and hail damage. The most you’ll receive from a claim is the ACV or actual cash value, so if your deductible is as high as the vehicle’s value consider removing comprehensive coverage.

Coverage for liability

Liability insurance provides protection from injuries or damage you cause to other’s property or people. It protects you against claims from other people. It does not cover damage sustained by your vehicle in an accident.

Split limit liability has three limits of coverage: bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. As an example, you may have values of 100/300/100 which stand for a $100,000 limit per person for injuries, a total of $300,000 of bodily injury coverage per accident, and property damage coverage for $100,000.

Liability coverage pays for claims like bail bonds, loss of income and emergency aid. How much liability should you purchase? That is your choice, but buy as large an amount as possible.

Med pay and Personal Injury Protection (PIP)

Med pay and PIP coverage pay for expenses for X-ray expenses, funeral costs and nursing services. They are used to cover expenses not covered by your health insurance policy or if you are not covered by health insurance. They cover all vehicle occupants in addition to being hit by a car walking across the street. PIP coverage is not available in all states but can be used in place of medical payments coverage

Coverage for collisions

This will pay to fix damage to your Outback resulting from a collision with another vehicle or an object, but not an animal. You first must pay a deductible and then insurance will cover the remainder.

Collision coverage pays for claims such as crashing into a ditch, scraping a guard rail and backing into a parked car. Paying for collision coverage can be pricey, so you might think about dropping it from vehicles that are 8 years or older. Drivers also have the option to increase the deductible to save money on collision insurance.

Saving money makes a lot of cents

Some companies do not provide online quoting and these regional carriers sell through independent agents. Cheaper auto insurance can be bought from both online companies and also from your neighborhood agents, so compare prices from both in order to have the best chance of saving money.

You just read a lot of information how to compare 2016 Subaru Outback insurance premium rates online. The most important thing to understand is the more rate quotes you have, the higher the chance of saving money. You may even discover the lowest priced auto insurance comes from the least-expected company. These companies may have significantly lower prices on certain market segments as compared to the big name companies such as Progressive or GEICO.

Use our FREE quote tool to compare rates now!

Additional information can be read on the following sites:

- Credit Impacts Car Insurance Rates (State Farm)

- Things to Know Before you Cancel Insurance (Allstate)

- Information for Teen Drivers (GEICO)

- Keeping Children Safe in Crashes Video (iihs.org)

- How Does Hitting a Deer Impact Insurance Rates? (Allstate)

- Older Driver Statistics (Insurance Information Institute)

Frequently Asked Questions

How can I find cheap auto insurance rates for my 2016 Subaru Outback in 2023?

To find cheap auto insurance rates for your 2016 Subaru Outback in 2023, enter your ZIP code below to view companies that offer affordable rates.

Do all insurance companies offer discounts?

While many insurance companies offer discounts, it’s important to note that not all discounts apply to all coverage premiums. Some discounts apply to specific coverages such as collision or personal injury protection. It’s best to inquire with each company about the discounts they offer to find the best way to save money.

Do I need special coverages for my auto insurance?

The right insurance coverage plan depends on your individual needs. There is no perfect coverage plan that applies to everyone. If you’re unsure about your insurance needs, consider speaking to a licensed agent who can assist you in determining the appropriate coverage for your situation.

How do insurance companies advertise big savings on car insurance?

Insurance companies often advertise big savings by quoting their best rates for a specific type of customer profile that meets their criteria. The advertised savings are based on customers who switch from their current policies to the company’s coverage. Different companies use different criteria to determine rates, so it’s recommended to do a price quote comparison at every renewal to find the best savings.

What are the typical coverages found on a car insurance policy?

Typical coverages found on a car insurance policy include:

- Uninsured/Underinsured Motorist (UM/UIM) coverage: Protects you and your vehicle when the other driver has no liability insurance or insufficient coverage.

- Comprehensive coverage: Covers damage not caused by collisions, such as fire damage, hail damage, or hitting a bird.

- Liability coverage: Provides protection against injuries or damage you cause to others, but does not cover damage to your vehicle.

- Med pay and Personal Injury Protection (PIP) coverage: Cover medical expenses for you and your passengers, regardless of who is at fault.

- Collision coverage: Pays for damage to your vehicle resulting from a collision with another vehicle or object. Remember to review your specific policy for details on coverage limits and exclusions.

How can I save money on auto insurance?

To save money on auto insurance, consider the following:

- Compare quotes from multiple companies to find the best rates.

- Inquire about available discounts and ask each company about the best ways to save money.

- Consider raising your deductibles, but ensure you can afford to pay the higher deductible if needed.

- Evaluate whether you need certain coverages based on the age and value of your vehicle.

- Explore both online companies and local agents to find the most affordable options.

Remember, the more rate quotes you have, the higher the chance of saving money.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Kia Optima Insurance

- Ford F-150 Insurance

- Toyota Corolla Insurance

- Hyundai Sonata Insurance

- Nissan Rogue Insurance

- Honda Accord Insurance

- Toyota Camry Insurance

- Honda Civic Insurance

- Chevrolet Silverado Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area