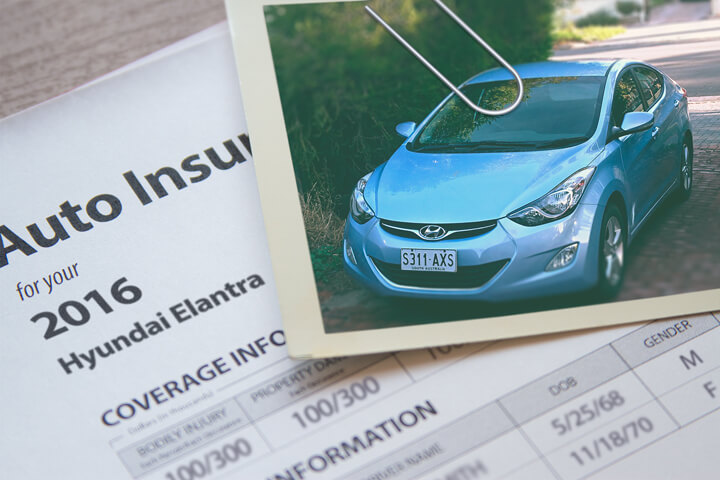

Cheapest 2016 Hyundai Elantra Insurance Rates in 2026

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Searching for lower car insurance rates for your Hyundai Elantra? Are you overwhelmed by the dozens of car insurance companies? You’re not alone. There are so many options available that it can be a lot of work to find the lowest price.

Comprehensive Auto Insurance Comparison Quotes

There are several ways to compare rate quotes from auto insurance companies in your area. The quickest method to find the lowest 2016 Hyundai Elantra rates involves getting comparison quotes online. This can be accomplished in just a few minutes using one of these methods.

- Probably the best way to find low rates is a comparison rater form like this one (opens in new window). This form eliminates the need for separate forms for each company. Just one form will get you price quotes instantly. Just one form and you’re done.

- A more difficult way to shop for auto insurance online requires you to visit the website for each individual company to request a price quote.

Whichever way you use, ensure you are comparing exactly the same deductibles and coverage limits for every quote you compare. If you compare higher or lower deductibles it will be very difficult to make a fair comparison for your Hyundai Elantra. Quoting even small variations in coverages can mean a large discrepancy in price. And when price shopping your coverage, comparing more company’s prices provides better odds of finding a better price.

How do I know if I need professional advice?

When buying coverage for your vehicles, there is no one size fits all plan. Coverage needs to be tailored to your specific needs.

These are some specific questions could help you determine if you might need an agent’s assistance.

- Which is better, split liability limits or combined limits?

- Do I need higher collision deductibles?

- Will I be non-renewed for getting a DUI or other conviction?

- Can I rent a car in Mexico?

- Am I covered when driving in Canada or Mexico?

- Do I need added coverage for expensive stereo equipment?

- Do I need an umbrella policy?

- Does insurance cover damages from a DUI accident?

- Where can I find high-risk insurance?

- When would I need additional glass coverage?

If you don’t know the answers to these questions, you might consider talking to a licensed insurance agent. To find lower rates from a local agent, fill out this quick form.

Learn about insurance coverages for a 2016 Hyundai Elantra

Learning about specific coverages of your insurance policy can be of help when determining the best coverages and the correct deductibles and limits. The terms used in a policy can be impossible to understand and even agents have difficulty translating policy wording.

Auto liability – This provides protection from damage that occurs to other people or property by causing an accident. It protects YOU against claims from other people, and doesn’t cover your own vehicle damage or injuries.

Split limit liability has three limits of coverage: bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. Your policy might show liability limits of 50/100/50 that means you have $50,000 in coverage for each person’s injuries, a limit of $100,000 in injury protection per accident, and a total limit of $50,000 for damage to vehicles and property. Some companies may use a combined single limit or CSL which provides one coverage limit with no separate limits for injury or property damage.

Liability coverage pays for things like structural damage, attorney fees and court costs. How much liability coverage do you need? That is a personal decision, but you should buy as high a limit as you can afford.

Medical expense insurance – Medical payments and Personal Injury Protection insurance reimburse you for short-term medical expenses such as chiropractic care, pain medications and prosthetic devices. The coverages can be used to fill the gap from your health insurance policy or if you are not covered by health insurance. It covers all vehicle occupants and also covers any family member struck as a pedestrian. Personal injury protection coverage is not available in all states but can be used in place of medical payments coverage

Collision coverages – This coverage pays to fix your vehicle from damage caused by collision with a stationary object or other vehicle. You will need to pay your deductible then your collision coverage will kick in.

Collision can pay for claims like crashing into a building, damaging your car on a curb, rolling your car and colliding with another moving vehicle. Paying for collision coverage can be pricey, so consider removing coverage from vehicles that are older. It’s also possible to bump up the deductible to save money on collision insurance.

Protection from uninsured/underinsured drivers – This protects you and your vehicle’s occupants from other drivers when they either have no liability insurance or not enough. Covered losses include injuries sustained by your vehicle’s occupants and also any damage incurred to your Hyundai Elantra.

Since many drivers only carry the minimum required liability limits, it only takes a small accident to exceed their coverage. For this reason, having high UM/UIM coverages is very important. Frequently the UM/UIM limits do not exceed the liability coverage limits.

Comprehensive (Other than Collision) – This covers damage caused by mother nature, theft, vandalism and other events. A deductible will apply and then insurance will cover the rest of the damage.

Comprehensive coverage protects against things such as damage from a tornado or hurricane, fire damage, theft, vandalism and damage from flooding. The most you’ll receive from a claim is the actual cash value, so if your deductible is as high as the vehicle’s value consider dropping full coverage.

Frequently Asked Questions

What should I do if I don’t understand the terms in my insurance policy?

If you’re having difficulty understanding the terms and conditions of your insurance policy, don’t hesitate to reach out to your insurance agent. They can explain the policy wording and provide clarification on any confusing terms.

How do I determine the right coverage limits for my Hyundai Elantra?

The appropriate coverage limits for your Hyundai Elantra depend on your individual needs and budget. Consider factors such as the value of your car, your assets, and your comfort level with assuming financial risk. An insurance agent can help you assess and select suitable coverage limits.

What factors determine the cost of insurance for my Hyundai Elantra?

The cost of insurance for your Hyundai Elantra is influenced by various factors, including your location, driving history, age, credit score, coverage options, and deductibles. To get an accurate quote, provide these details when comparing insurance rates.

Where can I find lower rates from a local agent?

To find lower rates from a local agent, you can fill out a quick form or search online for insurance agents in your area. Additionally, you can ask for recommendations from friends, family, or colleagues.

Will I be non-renewed for getting a DUI or other conviction?

Getting a DUI or other conviction can lead to non-renewal or an increase in insurance premiums. Each insurance company has its own policies regarding such incidents. Contact your insurance provider to understand their specific guidelines.

Do I need an umbrella policy?

Whether you need an umbrella policy depends on your personal circumstances and the level of liability coverage you desire. An umbrella policy provides additional liability protection beyond the limits of your existing policies. Consider consulting with an insurance agent to determine if an umbrella policy is necessary for you.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Camry Insurance

- Toyota Corolla Insurance

- Chevrolet Silverado Insurance

- Honda CR-V Insurance

- Ford F-150 Insurance

- Honda Accord Insurance

- Toyota Prius Insurance

- Toyota Rav4 Insurance

- Honda Civic Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area