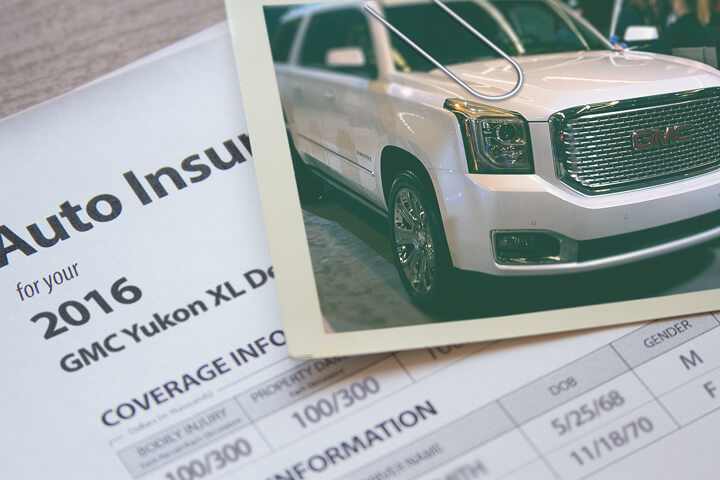

Cheapest 2016 GMC Yukon Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Paying for overpriced GMC Yukon insurance can empty your family’s budget and put the squeeze on your family’s finances. Comparing price quotes is a fast and free way to lower your monthly bill.

Vehicle owners have many insurers to choose from, and although it’s nice to have a choice, it makes it harder to compare rates and cut insurance costs.

You need to shop coverage around every six months since insurance prices are constantly changing. Even if you think you had the lowest rate for Yukon insurance last year you can probably find a better premium rate now. You can find a lot of misleading information regarding insurance coverage out there, but in a few minutes you can learn some excellent ideas to lower your insurance coverage premiums.

Shopping for the cheapest car insurance is easy if you know what you’re doing. If you have a current car insurance policy or are looking for a new policy, you will benefit by learning to find better prices while maintaining coverages. Drivers only need an understanding of how to compare price quotes on the web.

Verify you’re applying every discount

Some companies don’t necessarily list every available discount in a way that’s easy to find, so the following list contains some of the best known as well as the least known discounts that you can inquire about if you buy auto insurance online.

- Student in College – Kids who live away from home at college and don’t have a car could qualify for this discount.

- Life Insurance – Some insurance carriers give a break if you buy some life insurance too.

- Defensive Driver Discount – Taking time to complete a defensive driving course could earn you a small percentage discount and make you a better driver.

- Buy New and Save – Insuring a new car can get you a discount since new model year vehicles are generally safer.

- Military Deployment Discount – Being deployed in the military could mean lower premium rates.

- Claim-Free Discount – Drivers who stay claim-free pay much less in comparison to frequent claim filers.

- Low Mileage Discounts – Driving less could be rewarded with substantially lower rates.

- Paperwork-free – Some of the larger companies will give you a small discount simply for signing digitally online.

- Federal Employees – Active or retired federal employment may reduce rates when you quote auto insurance for Yukon insurance but check with your company.

Drivers should understand that some of the credits will not apply to the overall cost of the policy. Some only apply to the price of certain insurance coverages like liability, collision or medical payments. So when it seems like adding up those discounts means a free policy, you’re out of luck.

If you would like to view providers that offer the discounts shown above, follow this link.

Where can I get cheap car insurance?

Getting a cheaper price on 2016 GMC Yukon insurance is actually easier than you may think. Drivers just need to spend a little time comparing price quotes to find out which insurance company has low cost auto insurance quotes. This can be done using a couple different methods.

- The simplest way to find the lowest comparison rates would be an industry-wide quote request form click to view form in new window. This quick form eliminates the need for separate quote forms for every car insurance company. Taking the time to complete one form will return price quotes direct from many companies.

- A harder way to compare prices is spending the time to visit the website of each company and fill out a new quote form. For instance, we’ll assume you need rates from Progressive, GEICO and Liberty Mutual. You would have to visit each site and enter your information, which can get old fast. For a list of links to companies insuring cars in your area, click here.

Whichever way you choose to compare rates, do your best to enter the same coverages for every company. If your comparisons have unequal deductibles or liability limits you will not be able to determine which rate is truly the best.

When should I discuss my situation with an agent?

When it comes to choosing coverage for your vehicles, there is no perfect coverage plan. Everyone’s situation is unique so your insurance needs to address that. These are some specific questions might point out if your situation might need an agent’s assistance.

- Does medical payments coverage apply to all occupants?

- Does my liability insurance cover pulling a trailer or camper?

- Am I covered when driving on a suspended license?

- At what point should I drop full coverage?

- If my 2016 GMC Yukon is totaled, can I afford another vehicle?

- Do I have any recourse if my insurance company denies a claim?

- Is there coverage for injuries to my pets?

- What are the financial responsibility laws in my state?

If you don’t know the answers to these questions, then you may want to think about talking to a licensed agent. If you don’t have a local agent, fill out this quick form or you can also visit this page to select a carrier It’s fast, free and may give you better protection.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Insurance coverage considerations

Learning about specific coverages of your policy aids in choosing which coverages you need for your vehicles. Insurance terms can be ambiguous and even agents have difficulty translating policy wording. Shown next are the usual coverages available from insurance companies.

Auto collision coverage

This will pay to fix damage to your Yukon resulting from a collision with another car or object. You will need to pay your deductible then the remaining damage will be paid by your insurance company.

Collision can pay for things like hitting a mailbox, backing into a parked car, crashing into a ditch, driving through your garage door and hitting a parking meter. Collision is rather expensive coverage, so analyze the benefit of dropping coverage from vehicles that are 8 years or older. It’s also possible to choose a higher deductible in order to get cheaper collision rates.

Medical payments coverage and PIP

Med pay and PIP coverage provide coverage for short-term medical expenses like EMT expenses, funeral costs, rehabilitation expenses, ambulance fees and chiropractic care. They are used in conjunction with a health insurance policy or if you are not covered by health insurance. Medical payments and PIP cover both the driver and occupants and will also cover if you are hit as a while walking down the street. PIP coverage is only offered in select states and may carry a deductible

Comprehensive coverage

Comprehensive insurance covers damage from a wide range of events other than collision. You need to pay your deductible first and then insurance will cover the rest of the damage.

Comprehensive coverage pays for things like a broken windshield, hitting a bird, hail damage, vandalism and theft. The most a insurance company will pay at claim time is the actual cash value, so if it’s not worth much more than your deductible it’s probably time to drop comprehensive insurance.

Uninsured/Underinsured Motorist coverage

Uninsured or Underinsured Motorist coverage provides protection from other motorists when they either have no liability insurance or not enough. Covered losses include injuries to you and your family and also any damage incurred to your GMC Yukon.

Due to the fact that many drivers only purchase the least amount of liability that is required, their limits can quickly be used up. This is the reason having UM/UIM coverage is a good idea. Frequently these limits are set the same as your liability limits.

Liability coverages

Liability coverage provides protection from damages or injuries you inflict on a person or their property. It protects you against other people’s claims. It does not cover your own vehicle damage or injuries.

Coverage consists of three different limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You might see policy limits of 25/50/25 which means $25,000 bodily injury coverage, a total of $50,000 of bodily injury coverage per accident, and a total limit of $25,000 for damage to vehicles and property. Some companies may use one limit called combined single limit (CSL) that pays claims from the same limit rather than limiting it on a per person basis.

Liability can pay for things such as structural damage, repair bills for other people’s vehicles, court costs, bail bonds and medical services. How much liability coverage do you need? That is a personal decision, but buy higher limits if possible.

Don’t break the bank

Cheaper 2016 GMC Yukon insurance can be sourced on the web as well as from insurance agents, and you need to price shop both so you have a total pricing picture. Some car insurance companies do not offer online quoting and most of the time these smaller companies prefer to sell through independent agents.

When trying to cut insurance costs, it’s not a good idea to buy poor coverage just to save money. There are many occasions where an insured dropped liability coverage limits only to regret at claim time that the small savings ended up costing them much more. The goal is to purchase plenty of coverage at an affordable rate and still be able to protect your assets.

Use our FREE quote tool to compare rates now!

More tips and info about car insurance is available in these articles:

- How to Avoid Common Accidents (State Farm)

- Child Safety Seats (Insurance Information Institute)

- Uninsured Motorists: Threats on the Road (Insurance Information Institute)

- When is the Right Time to Switch Car Insurance Companies? (Allstate)

- Older Drivers FAQ (iihs.org)

- Should I Buy a New or Used Car? (Allstate)

Frequently Asked Questions

What are some tips for finding cheap car insurance?

Finding cheap car insurance is possible if you follow these tips:

- Compare quotes from multiple insurance companies. Use online tools that provide free quotes and compare them to find the best rates.

- Make sure you’re taking advantage of all available discounts. Some companies may not list all discounts upfront, so ask about any discounts you might qualify for, such as safe driver discounts, multi-policy discounts, or good student discounts.

- Maintain a good driving record. Avoid accidents and traffic violations, as they can increase your insurance premiums.

- Consider raising your deductibles. Increasing your deductible can lower your monthly premium, but be sure you can afford to pay the higher deductible if you need to make a claim.

Where can I find cheap car insurance for my 2016 GMC Yukon in 2023?

To find cheap car insurance for your 2016 GMC Yukon in 2023, you have a few options:

- Utilize online comparison tools: Enter your ZIP code on a website that offers free auto insurance quotes. This will allow you to compare rates from multiple insurance companies and find the cheapest option.

- Contact insurance agents: Reach out to insurance agents or brokers who can provide you with quotes from different companies. They can help you find the best rates based on your specific needs.

- Research insurance companies: Look for insurance companies that specialize in providing coverage for GMC vehicles or offer competitive rates for SUVs. Compare their rates and customer reviews to make an informed decision.

When should I discuss my car insurance situation with an agent?

It’s a good idea to discuss your car insurance situation with an agent in the following scenarios:

- If you have unique or complex insurance needs: If your situation requires specialized coverage or if you have specific questions about your policy, an agent can provide personalized guidance.

- If you’re unsure about your coverage options: An agent can help you understand the different coverage types available and recommend the appropriate coverage based on your needs and budget.

- If you want to explore potential discounts: An agent can help you identify all the discounts you might be eligible for and ensure you’re getting the best possible rates.

What are the main coverage options for car insurance?

Car insurance typically offers the following coverage options:

- Liability coverage: This covers damages and injuries you cause to others in an accident.

- Collision coverage: It pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of who is at fault.

- Comprehensive coverage: This covers damages to your vehicle caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

- Medical payments coverage and personal injury protection (PIP): These cover medical expenses for you and your passengers in the event of an accident, regardless of who is at fault.

- Uninsured/underinsured motorist coverage: It protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage.

How can I save money on car insurance without compromising coverage?

Here are some ways to save money on car insurance while maintaining adequate coverage:

- Bundle your policies: If you have multiple insurance policies, such as auto and home insurance, consider bundling them with the same insurance company. Many companies offer discounts for bundled policies.

- Increase your deductibles: Raising your deductibles can lower your premiums, but be sure you can afford to pay the higher deductible if you need to file a claim.

- Maintain a good driving record: Avoid accidents and traffic violations to keep your insurance rates low. Safe driving can often qualify you for discounts.

- Inquire about discounts: Ask your insurance provider about available discounts, such as safe driver discounts, good student discounts, or discounts for installing safety features in your vehicle.

- Review your coverage regularly: Periodically reassess your coverage needs to ensure you’re not overpaying for unnecessary coverage. Adjust your coverage limits based on your vehicle’s value and your financial situation.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Corolla Insurance

- Toyota Sienna Insurance

- Hyundai Sonata Insurance

- Nissan Rogue Insurance

- Jeep Grand Cherokee Insurance

- Subaru Forester Insurance

- Toyota Camry Insurance

- Chevrolet Silverado Insurance

- Honda CR-V Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area