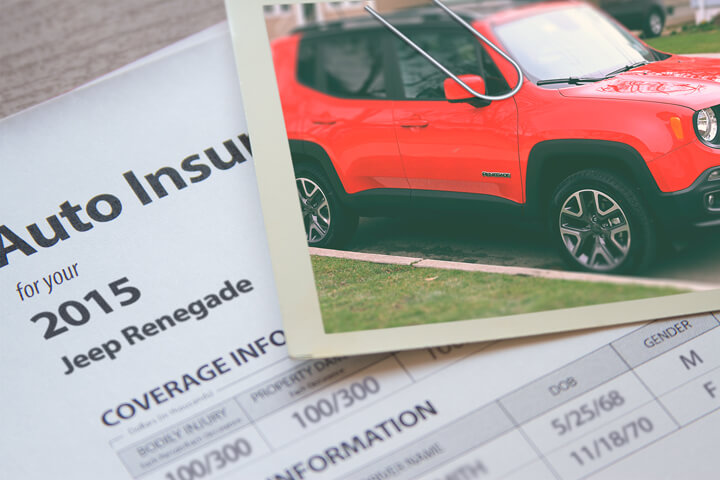

Cheapest 2015 Jeep Renegade Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Tired of paying out the nose to pay your car insurance bill each month? You are no different than most other car owners.

Numerous car insurance companies battle for your business, so it’s not easy to compare every company to discover the definitive lowest cost out there.

Smart consumers take time to shop coverage around before your policy renews because rates are usually higher with each renewal. Even if you think you had the lowest price for Renegade insurance two years ago you can probably find a lower rate today. Forget anything you know (or think you know) about insurance coverage because you’re about to learn the best methods to find great coverage at a great price.

Discounts on Jeep Renegade insurance

Insuring your vehicles can cost a lot, but discounts can save money and there are some available that you may not even be aware of. Certain discounts will be applied when you complete an application, but a few need to be asked for before you will receive the discount.

- Homeowners Discount – Being a homeowner can help you save on auto insurance because of the fact that having a home shows financial diligence.

- Good Students Pay Less – Getting good grades can save 20 to 25%. The discount lasts up until you turn 25.

- Claim Free – Drivers with accident-free driving histories can earn big discounts as compared to frequent claim filers.

- Air Bag Discount – Factory air bags can qualify for discounts of 20% or more.

- Multiple Vehicles – Insuring multiple vehicles with the same company may reduce the rate for each vehicle.

Keep in mind that most of the big mark downs will not be given to all coverage premiums. Most only reduce the cost of specific coverages such as comp or med pay. Just because it seems like you could get a free auto insurance policy, auto insurance companies aren’t that generous. Any qualifying discounts will cut the amount you have to pay.

To see a list of companies with the best auto insurance discounts, click this link.

Tailor your coverage to you

When it comes to choosing the best insurance coverage for your personal vehicles, there really is no one size fits all plan. Everyone’s situation is unique so your insurance should reflect that For example, these questions can help discover if your insurance needs could use an agent’s help.

- What is covered by UM/UIM coverage?

- Will filing a claim cost me more?

- Do I need to file an SR-22 for a DUI in my state?

- Is my Jeep Renegade covered if I use it for business?

- Am I covered if my car is in a flood?

- Which is better, split liability limits or combined limits?

If you’re not sure about those questions, you might consider talking to an insurance agent. To find lower rates from a local agent, simply complete this short form or go to this page to view a list of companies.

Don’t be fooled by advertising claims

Progressive, Allstate and GEICO constantly bombard you with ads in print and on television. All the companies make an identical promise about savings if you switch your coverage to them. How can each company make the same claim?

Insurance companies have a certain “appetite” for the type of driver that is profitable for them. A good example of a preferred risk might be profiled as between the ages of 40 and 55, owns a home, and has a short commute. A customer getting a price quote who meets those qualifications is entitled to the best price and is almost guaranteed to pay quite a bit less when switching companies.

Potential customers who are not a match for the requirements will be charged higher premiums and ends up with the driver buying from a lower-cost company. The ads state “drivers who switch” not “everybody who quotes” save that much money. This is how insurance companies can confidently advertise the savings.

That is why it’s extremely important to quote coverage with many companies. You cannot predict which auto insurance company will provide you with the cheapest Jeep Renegade insurance rates.

The coverage is in the details

Knowing the specifics of car insurance can be of help when determining appropriate coverage and proper limits and deductibles. Policy terminology can be ambiguous and coverage can change by endorsement. Shown next are typical coverages found on the average car insurance policy.

Collision coverage

This coverage will pay to fix damage to your Renegade resulting from colliding with another vehicle or an object, but not an animal. A deductible applies then your collision coverage will kick in.

Collision coverage pays for things such as rolling your car, damaging your car on a curb, hitting a mailbox and backing into a parked car. This coverage can be expensive, so analyze the benefit of dropping coverage from lower value vehicles. Another option is to increase the deductible in order to get cheaper collision rates.

Auto liability insurance

Liability coverage can cover damage that occurs to other people or property. This insurance protects YOU against claims from other people, and does not provide coverage for your injuries or vehicle damage.

Liability coverage has three limits: bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. As an example, you may have policy limits of 25/50/25 that means you have a $25,000 limit per person for injuries, a per accident bodily injury limit of $50,000, and a limit of $25,000 paid for damaged property. Another option is a combined limit which provides one coverage limit with no separate limits for injury or property damage.

Liability can pay for things like medical services, repair costs for stationary objects, legal defense fees and repair bills for other people’s vehicles. How much coverage you buy is your choice, but it’s cheap coverage so purchase higher limits if possible.

Uninsured and underinsured coverage

Your UM/UIM coverage gives you protection from other drivers when they either have no liability insurance or not enough. It can pay for injuries sustained by your vehicle’s occupants and also any damage incurred to your Jeep Renegade.

Since many drivers only purchase the least amount of liability that is required, it only takes a small accident to exceed their coverage. For this reason, having high UM/UIM coverages should not be overlooked. Most of the time these coverages do not exceed the liability coverage limits.

Comprehensive coverages

Comprehensive insurance coverage pays for damage from a wide range of events other than collision. A deductible will apply then your comprehensive coverage will pay.

Comprehensive coverage pays for things like damage from getting keyed, vandalism, rock chips in glass and damage from flooding. The maximum payout a car insurance company will pay at claim time is the cash value of the vehicle, so if it’s not worth much more than your deductible consider removing comprehensive coverage.

Coverage for medical payments

Med pay and PIP coverage pay for immediate expenses for things like ambulance fees, doctor visits, hospital visits, dental work and X-ray expenses. They are often used in conjunction with a health insurance plan or if you lack health insurance entirely. Medical payments and PIP cover you and your occupants as well as if you are hit as a while walking down the street. Personal Injury Protection is not universally available and gives slightly broader coverage than med pay

In the end, you save

Discount 2015 Jeep Renegade insurance can be sourced both online and also from your neighborhood agents, and you should be comparing both to have the best chance of lowering rates. There are still a few companies who may not provide online price quotes and most of the time these small, regional companies sell through independent agents.

When trying to cut insurance costs, make sure you don’t buy less coverage just to save a little money. In many cases, someone sacrificed full coverage to discover at claim time that the few dollars in savings costed them thousands. The proper strategy is to purchase plenty of coverage for the lowest price while not skimping on critical coverages.

Much more information about auto insurance is located on the following sites:

- Prom Night Tips for Teen Drivers (State Farm)

- When is the Right Time to Switch Car Insurance Companies? (Allstate)

- Uninsured Motorists: Threats on the Road (Insurance Information Institute)

- Smart Auto Insurance Tips (Insurance Information Institute)

- Young Drivers: The High Risk Years Video (iihs.org)

- Uninsured Motorist Statistics (Insurance Information Institute)

Frequently Asked Questions

What factors affect the insurance rates for a 2015 Jeep Grand Cherokee?

Several factors can influence the insurance rates for a 2015 Jeep Grand Cherokee. The key factors include the driver’s age and driving history, the location where the vehicle is primarily driven and parked, the level of coverage desired, the deductible amount chosen, and the insurance company’s individual pricing policies. Additionally, the specific trim level, features, and safety ratings of the Grand Cherokee can also impact insurance rates.

Are Jeep Grand Cherokees generally expensive to insure?

Insurance rates for Jeep Grand Cherokees can vary depending on several factors. While SUVs like the Grand Cherokee typically have higher insurance rates than smaller cars, it’s important to compare quotes from different insurance providers to find the best rate for your specific circumstances. The specific model year, trim level, and features of the Grand Cherokee can also affect insurance costs.

Can I find affordable insurance rates for a 2015 Jeep Grand Cherokee?

Yes, it is possible to find affordable insurance rates for a 2015 Jeep Grand Cherokee. Insurance rates can vary significantly between insurance companies, so it’s crucial to compare quotes from multiple providers to find the best rate for your needs. Factors such as maintaining a clean driving record, choosing higher deductibles, and exploring available discounts can also help lower your insurance costs.

How can I get the cheapest insurance rates for my 2015 Jeep Grand Cherokee?

To secure the cheapest insurance rates for your 2015 Jeep Grand Cherokee, consider the following tips:

- Obtain quotes from multiple insurance companies and compare their rates.

- Maintain a clean driving record and avoid traffic violations.

- Choose higher deductibles, as they can lower your premium.

- Inquire about available discounts, such as multi-policy or safe driver discounts.

- Consider installing safety features like anti-theft devices or car alarms.

- Check with your insurance provider for any specific programs or incentives they offer.

Are there any specific insurance providers known for offering lower rates on Jeep Grand Cherokee coverage?

Insurance rates can vary significantly between providers, and there isn’t a single insurance company that consistently offers the lowest rates for Jeep Grand Cherokee coverage. It’s recommended to obtain quotes from multiple providers and compare the coverage options and premiums to find the best rate for your 2015 Jeep Grand Cherokee.

Are there any specific coverages I should consider for my 2015 Jeep Grand Cherokee to keep insurance costs down?

When considering coverage for your 2015 Jeep Grand Cherokee, it’s essential to strike a balance between adequate protection and affordable premiums. Some coverage options to consider include liability coverage, which is typically required by law, and comprehensive and collision coverage, which protect against damages to your vehicle. However, the coverage levels and deductibles you choose will affect your premiums. Consulting with insurance providers and evaluating your specific needs can help you determine the best coverage options for your budget.

Can modifications to my 2015 Jeep Grand Cherokee affect my insurance rates?

Yes, modifications to your 2015 Jeep Grand Cherokee can impact your insurance rates. Some modifications, such as performance upgrades or changes to the vehicle’s appearance, may increase the risk profile and result in higher premiums. It’s important to notify your insurance provider about any modifications made to your vehicle to ensure you have the appropriate coverage and accurate rates. Failure to disclose modifications could lead to coverage gaps or potential claim denials.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Rav4 Insurance

- Ford F-150 Insurance

- Nissan Rogue Insurance

- Honda CR-V Insurance

- Nissan Altima Insurance

- Chevrolet Silverado Insurance

- Toyota Sienna Insurance

- Honda Odyssey Insurance

- Toyota Camry Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area