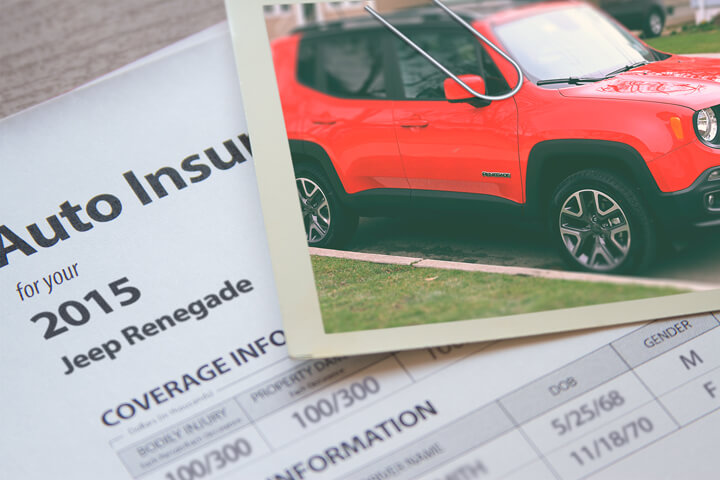

Jeep Renegade Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 11, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Shopping for auto insurance through online providers can be fast and easy and there is a good chance you might just save a little. The most important part is to take the time to get as many rate quotes as possible in order to accurately compare the lowest priced insurance.

If shopping for auto insurance online is new to you, you can be overwhelmed by the hoards of auto insurance companies vying for your business. Getting better Jeep Renegade insurance cost is surprisingly easy. Just take time to get quotes provided by online insurance companies. This is very easy and can be done by getting a quick quote here.

Auto insurance rates for a Jeep Renegade can vary widely depending on several factors. Some of these factors include:

- A clean driving record keeps rates low

- Credit rating

- Your gender can raise or lower rates

- The deductible you choose

- Safety rating of your Renegade

- Claims drive up premiums

- No coverage lapses saves money

- Whether you own your home

A final factor that will help determine Jeep Renegade insurance rates is the model year. Older cars and trucks cost less in comparison to older models so repair costs tend to be lower which may result in lower rates. Conversely, newer models may have a trim level with safety features such as all-wheel drive, a telematics system, and autonomous braking which can help offset higher rates.

Liability auto insurance - damage that occurs to things like legal defense fees, bail bonds, and repair bills for other people's vehicles. .

Collision coverage - another car or object. . , . .

Comprehensive auto insurance - OTHER than collision with another vehicle or object. . you'll receive from a claim , .

Uninsured/Underinsured Motorist coverage - Your UM/UIM coverage . , . .

Medical expense insurance - short-term medical expenses nursing services, prosthetic devices, and dental work. . .

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2024

- Cheapest Jeep Insurance Rates in 2024

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Nissan Rogue Insurance

- Chevrolet Traverse Insurance

- Ford Focus Insurance

- Toyota Camry Insurance

- Chevrolet Cruze Insurance

- Chevrolet Silverado Insurance

- Ford F-150 Insurance

- Honda CR-V Insurance

- Ford Fusion Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area