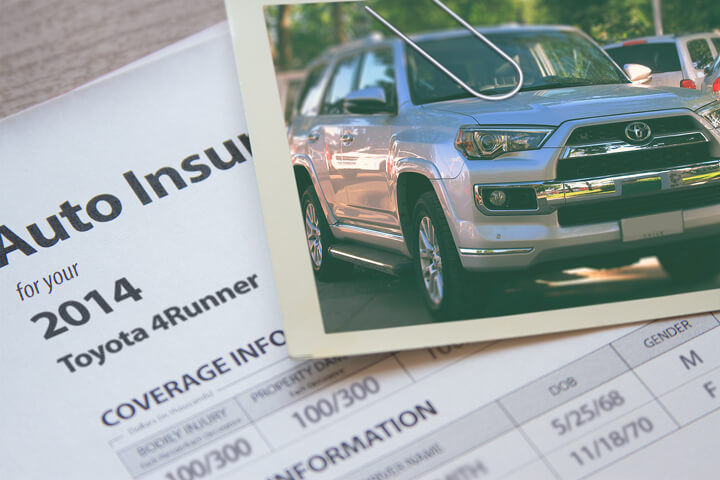

Cheapest 2014 Toyota 4Runner Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Are you tired of scraping the payment together to buy car insurance? You’re in the same situation as most other car owners.

Because you have many companies to choose from, it is very difficult to choose the right insurance company.

Discounts to lower Toyota 4Runner insurance rates

Insurance can be prohibitively expensive, but there are discounts available that many people don’t even know exist. Most are applied at the time of quoting, but a few need to be specially asked for prior to getting the savings.

- Safe Driver Discount – Drivers who don’t get into accidents can get discounts for up to 45% lower rates on 4Runner coverage than drivers with accidents.

- Discount for New Cars – Putting insurance coverage on a new car can save up to 30% compared to insuring an older model.

- No Charge for an Accident – A handful of insurance companies allow you one accident before your rates go up so long as you haven’t had any claims for a particular time prior to the accident.

- Auto/Home Discount – If you have multiple policies with the same company you could get a discount of approximately 10% to 15%.

- Homeowners Pay Less – Being a homeowner may trigger a car insurance policy discount due to the fact that maintaining a home shows financial diligence.

- Multiple Vehicles – Having multiple vehicles on one policy may reduce the rate for each vehicle.

- Payment Method – If you pay your bill all at once rather than paying monthly you may reduce your total bill.

- Claim Free – Drivers who don’t have accidents can save substantially compared to bad drivers.

- Military Discounts – Being on active duty in the military may qualify for rate reductions.

Drivers should understand that most credits do not apply the whole policy. Some only apply to individual premiums such as comp or med pay. So when the math indicates all those discounts means the company will pay you, car insurance companies aren’t that generous. But any discount will cut your premiums.

Companies that may offer these benefits may include but are not limited to:

Before buying, ask all companies you are considering which discounts you may be entitled to. All car insurance discounts might not apply in your area.

Tailor your coverage to you

When it comes to choosing the right insurance coverage for your vehicles, there is no perfect coverage plan. Every insured’s situation is different and a cookie cutter policy won’t apply. These are some specific questions can aid in determining if you would benefit from professional advice.

- Which is better, split liability limits or combined limits?

- Does my policy pay for OEM or aftermarket parts?

- Does coverage extend to my business vehicle?

- Do I have newly-acquired coverage?

- Does coverage extend to Mexico or Canada?

- Will my rates increase for filing one claim?

- When should I drop full coverage on my 2014 Toyota 4Runner?

If you don’t know the answers to these questions but you think they might apply to your situation, you may need to chat with an insurance agent. If you want to speak to an agent in your area, fill out this quick form or go to this page to view a list of companies.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Specific coverage details

Having a good grasp of a insurance policy helps when choosing the right coverages at the best deductibles and correct limits. The terms used in a policy can be confusing and reading a policy is terribly boring. Listed below are typical coverage types found on most insurance policies.

Protection from uninsured/underinsured drivers – Your UM/UIM coverage protects you and your vehicle from other drivers when they either are underinsured or have no liability coverage at all. Covered claims include medical payments for you and your occupants as well as your vehicle’s damage.

Because many people have only the minimum liability required by law, their limits can quickly be used up. So UM/UIM coverage is a good idea. Most of the time your uninsured/underinsured motorist coverages are identical to your policy’s liability coverage.

Coverage for liability – Liability coverage will cover damage or injury you incur to other’s property or people in an accident. This insurance protects YOU against claims from other people. It does not cover your own vehicle damage or injuries.

It consists of three limits, bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You commonly see policy limits of 100/300/100 that means you have $100,000 bodily injury coverage, a total of $300,000 of bodily injury coverage per accident, and a limit of $100,000 paid for damaged property. Another option is one number which is a combined single limit that pays claims from the same limit with no separate limits for injury or property damage.

Liability coverage pays for claims like structural damage, medical expenses, pain and suffering and repair costs for stationary objects. How much coverage you buy is a personal decision, but consider buying as much as you can afford.

Collision – Collision coverage pays for damage to your 4Runner from colliding with another car or object. You have to pay a deductible then your collision coverage will kick in.

Collision coverage protects against things like crashing into a ditch, crashing into a building and sustaining damage from a pot hole. Collision is rather expensive coverage, so you might think about dropping it from older vehicles. Drivers also have the option to raise the deductible to get cheaper collision coverage.

Comprehensive (Other than Collision) – This pays for damage OTHER than collision with another vehicle or object. You first must pay your deductible and then insurance will cover the rest of the damage.

Comprehensive insurance covers things such as hail damage, damage from a tornado or hurricane, theft and a broken windshield. The highest amount a insurance company will pay at claim time is the market value of your vehicle, so if your deductible is as high as the vehicle’s value consider dropping full coverage.

Medical expense insurance – Coverage for medical payments and/or PIP pay for immediate expenses such as pain medications, rehabilitation expenses, nursing services, EMT expenses and dental work. They are utilized in addition to your health insurance program or if there is no health insurance coverage. It covers not only the driver but also the vehicle occupants and will also cover getting struck while a pedestrian. Personal Injury Protection is not universally available but it provides additional coverages not offered by medical payments coverage

Make an honest buck

When you buy insurance online, it’s very important that you do not sacrifice coverage to reduce premiums. There are many occasions where an insured dropped comprehensive coverage or liability limits only to discover later they didn’t purchase enough coverage. The proper strategy is to buy enough coverage at the best price while not skimping on critical coverages.

We covered some good ideas how to shop for 2014 Toyota 4Runner insurance online. The key thing to remember is the more times you quote, the higher the chance of saving money. Consumers may even find the lowest premiums are with a lesser-known regional company. These companies can often insure niche markets at a lower cost as compared to the big name companies such as Allstate, GEICO and Progressive.

Use our FREE quote tool to compare rates now!

Additional information

- Prom Night Tips for Teen Drivers (State Farm)

- Preventing Carjacking and Theft (Insurance Information Institute)

- Rental Reimbursement Coverage (Allstate)

- Side Impact Crash Tests (iihs.org)

- Eight Auto Insurance Myths (Insurance Information Institute)

Frequently Asked Questions

How can I find the cheapest auto insurance rates for my 2014 Toyota 4Runner in 2023?

To find the cheapest auto insurance rates for your 2014 Toyota 4Runner in 2023, simply enter your ZIP code on this page to use our free quote tool. It will provide you with a list of companies that offer cheap auto insurance rates in your area. Remember to compare quotes from multiple companies to increase your chances of saving money.

Are there any discounts available to lower my Toyota 4Runner insurance rates?

Yes, there are discounts available that can help lower your Toyota 4Runner insurance rates. While most discounts are applied automatically at the time of quoting, some may require you to specifically ask for them. It’s important to inquire about available discounts from the insurance companies you’re considering. These discounts can vary, so make sure to ask about any that may apply to your situation.

How can I tailor my coverage to suit my needs?

When it comes to choosing the right insurance coverage for your vehicles, it’s important to understand that there is no one-size-fits-all policy. Every insured individual’s situation is different. To determine the coverage that best suits your needs, ask yourself specific questions related to your situation. If you’re unsure about the answers, it may be helpful to consult with an insurance agent who can provide personalized advice and guidance.

What are the different types of coverage included in most insurance policies?

Most insurance policies include various types of coverage. Here are some typical coverage types found in most policies:

- Liability coverage: This covers damage or injury you cause to others in an accident.

- Uninsured/underinsured motorist coverage: This protects you and your vehicle when involved in an accident with a driver who has insufficient or no liability coverage.

- Collision coverage: This pays for damage to your 4Runner resulting from colliding with another vehicle or object.

- Comprehensive coverage: This covers damage to your 4Runner from incidents other than collisions, such as theft, vandalism, or natural disasters.

- Medical expense insurance: This covers immediate medical expenses for you, your passengers, and pedestrians involved in an accident.

Should I prioritize reducing premiums or maintaining adequate coverage when buying insurance online?

When buying insurance online, it’s crucial not to sacrifice coverage solely to reduce premiums. While it’s understandable to want to save money, it’s important to ensure that you have enough coverage to protect yourself adequately. The key is to find a balance between price and coverage. Comparing quotes from multiple insurance companies can help you find the best price for the coverage you need.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Nissan Rogue Insurance

- Hyundai Elantra Insurance

- Toyota Camry Insurance

- Chevrolet Silverado Insurance

- Dodge Ram Insurance

- Hyundai Tucson Insurance

- Honda Civic Insurance

- Toyota Sienna Insurance

- Ford Focus Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area