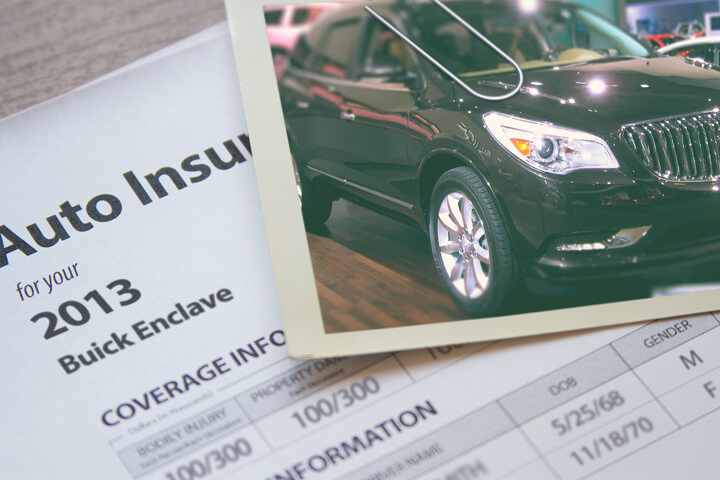

Cheapest 2013 Buick Enclave Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Trying to find lower insurance coverage rates? Buyers have lots of choices when searching for the best price on Buick Enclave insurance. You can either waste hours calling around to compare prices or save time using the internet to make rate comparisons. There is a right way and a wrong way to find insurance coverage online so we’re going to tell you the proper way to compare rates for a new or used Buick and locate the cheapest rates.

You should make it a habit to get comparison quotes on a regular basis because prices are constantly changing. Despite the fact that you may have had the best deal on Enclave insurance two years ago a different company probably has better rates today. Forget all the misinformation about insurance coverage because you’re about to learn the proper way to find great coverage at a great price.

If you are insured now or need new coverage, you can use these techniques to get lower rates and still get good coverage. The purpose of this article is to help educate you on how to effectively get price quotes. Drivers only need to know the proper way to compare price quotes online.

The best way to compare rate quotes is to know the fact most insurance companies will pay a fee to give free rates quotes. All consumers are required to do is give them rating details like whether or not you need a SR-22, how much coverage you want, the ages of drivers, and how much school you completed. Your details gets sent immediately to multiple different insurance companies and you get price estimates very quickly.

To find the cheapest Buick Enclave insurance rates, click here and find out if you can get cheaper insurance.

Car insurance is unique, just like you

When buying the best auto insurance coverage for your vehicles, there really is not a “perfect” insurance plan. Everyone’s situation is unique.

These are some specific questions can aid in determining if your insurance needs may require specific advice.

- Who is covered when they drive my 2013 Buick Enclave?

- If my 2013 Buick Enclave is totaled, can I afford another vehicle?

- Are all vehicle passengers covered by medical payments coverage?

- Am I missing any policy discounts?

- Can I get a multi-policy discount for packaging my home and auto coverage?

- Is my teen driver covered when they drive my company car?

- Am I insured when driving a different vehicle?

- Does liability extend to a camper or trailer?

- How much liability insurance is required?

- Am I covered when driving a rental car?

If you can’t answer these questions then you might want to talk to an agent. If you want to speak to an agent in your area, simply complete this short form. It’s fast, doesn’t cost anything and can provide invaluable advice.

Coverages available on your insurance policy

Learning about specific coverages of insurance helps when choosing the best coverages and proper limits and deductibles. Insurance terms can be ambiguous and even agents have difficulty translating policy wording.

Coverage for uninsured or underinsured drivers

This coverage protects you and your vehicle when other motorists either have no liability insurance or not enough. Covered losses include medical payments for you and your occupants and also any damage incurred to your Buick Enclave.

Since a lot of drivers have only the minimum liability required by law, it only takes a small accident to exceed their coverage. So UM/UIM coverage is a good idea.

Coverage for medical expenses

Coverage for medical payments and/or PIP pay for immediate expenses like rehabilitation expenses, surgery, prosthetic devices and hospital visits. They can be used in conjunction with a health insurance policy or if you do not have health coverage. They cover both the driver and occupants as well as getting struck while a pedestrian. Personal Injury Protection is not universally available and may carry a deductible

Coverage for liability

This protects you from damage or injury you incur to other people or property. This insurance protects YOU against other people’s claims, and does not provide coverage for damage sustained by your vehicle in an accident.

Liability coverage has three limits: per person bodily injury, per accident bodily injury, and a property damage limit. You commonly see liability limits of 25/50/25 which means a $25,000 limit per person for injuries, $50,000 for the entire accident, and a total limit of $25,000 for damage to vehicles and property.

Liability coverage protects against claims like funeral expenses, legal defense fees, bail bonds and repair bills for other people’s vehicles. How much coverage you buy is up to you, but consider buying higher limits if possible.

Comprehensive insurance

This will pay to fix damage OTHER than collision with another vehicle or object. A deductible will apply then your comprehensive coverage will pay.

Comprehensive can pay for claims such as rock chips in glass, hitting a deer, fire damage and damage from flooding. The maximum payout you’ll receive from a claim is the actual cash value, so if the vehicle is not worth much consider removing comprehensive coverage.

Auto collision coverage

Collision coverage pays to fix your vehicle from damage resulting from a collision with a stationary object or other vehicle. You first must pay a deductible and then insurance will cover the remainder.

Collision coverage pays for claims such as hitting a parking meter, colliding with another moving vehicle, backing into a parked car and sideswiping another vehicle. Collision coverage makes up a good portion of your premium, so you might think about dropping it from older vehicles. Another option is to choose a higher deductible to get cheaper collision coverage.

Frequently Asked Questions

What factors can affect the insurance rates for a 2013 Buick Enclave?

Several factors can influence the insurance rates for a 2013 Buick Enclave. These factors include the driver’s age, driving record, location, annual mileage, coverage options selected, and the insurance company’s individual pricing policies. Additionally, the Enclave’s model, trim level, engine size, and value can also impact insurance rates.

Is the 2013 Buick Enclave considered an expensive vehicle to insure?

The 2013 Buick Enclave is generally considered a midsize luxury SUV, which can typically lead to higher insurance rates compared to non-luxury vehicles. Luxury vehicles often come with higher repair costs and replacement parts, which insurers take into consideration when determining rates. However, insurance rates can still vary depending on other factors such as the driver’s profile and the insurance company’s pricing policies.

Are there any specific discounts available to help reduce the insurance rates for a 2013 Buick Enclave?

Insurance companies often offer various discounts that can help lower insurance rates. Some common discounts that may apply to a 2013 Buick Enclave include safe driver discounts, multi-policy discounts (insuring multiple vehicles or having other policies with the same company), and discounts for safety features such as anti-lock brakes, airbags, and advanced driver assistance systems. It’s advisable to inquire with your insurance provider about the available discounts.

How can I find the cheapest insurance rates for a 2013 Buick Enclave?

To find the most affordable insurance rates for a 2013 Buick Enclave, it is recommended to obtain quotes from multiple insurance companies. Contact insurers directly or use online comparison tools to gather quotes and compare coverage options. Providing accurate information when requesting quotes is important to ensure the rates are as precise as possible.

Are there any specific insurance companies known for offering competitive rates on 2013 Buick Enclave insurance?

Insurance rates can vary significantly between companies, so it is advisable to obtain quotes from multiple insurers to find the best rates for a 2013 Buick Enclave. Some insurers that are often recognized for offering competitive rates on midsize luxury SUV insurance include Geico, Progressive, State Farm, and Allstate. However, it’s important to compare quotes from different insurers to find the best deal for your specific circumstances.

Can I adjust my coverage options to lower the insurance rates for my 2013 Buick Enclave?

Adjusting your coverage options can potentially help lower insurance rates. However, it is important to carefully consider the impact on your financial protection. Lowering coverage limits or removing optional coverages may result in less protection in the event of an accident or other covered incidents. It is advisable to evaluate your coverage needs and consult with your insurance provider to find the right balance between cost and coverage.

Are there any aftermarket modifications that can help reduce insurance rates for a 2013 Buick Enclave?

While some modifications, such as installing safety features or anti-theft devices, may reduce the risk of theft or accidents and potentially lead to lower insurance premiums, it is advisable to consult with your insurance provider. Some modifications may not directly affect insurance rates, and others may even increase rates if they alter the performance or value of the vehicle. It’s crucial to discuss any modifications with your insurer to understand their impact on your insurance premiums.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Honda Accord Insurance

- Chevrolet Equinox Insurance

- Ford Fusion Insurance

- Honda Civic Insurance

- Subaru Forester Insurance

- Chevrolet Silverado Insurance

- Toyota Camry Insurance

- Honda CR-V Insurance

- Nissan Rogue Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area