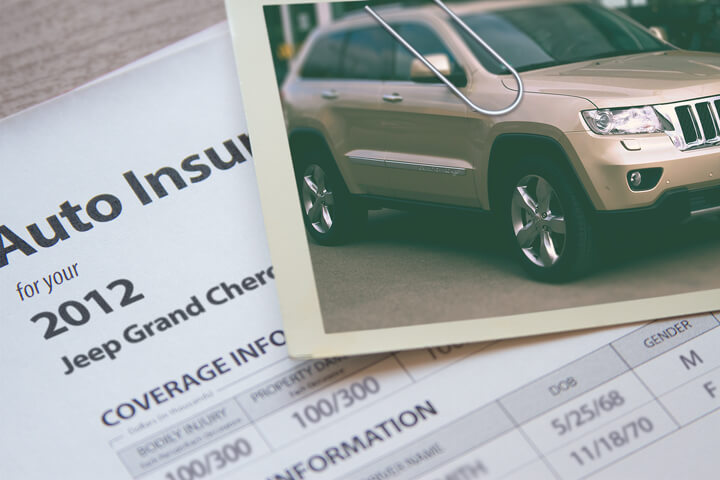

Cheapest 2012 Jeep Grand Cherokee Insurance Rates in 2026

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 8, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Comparison shopping for insurance coverage is nearly impossible for consumers new to shopping for insurance online. Drivers have so many choices that it can quickly become a real hassle to find lower rates.

If you are paying for car insurance now, you should be able to cut costs considerably using this information. This information will let you in on the best way to quote coverages and some money-saving tips. Nevertheless, vehicle owners should learn how big insurance companies market on the web because it can help you find the best coverage.

Jeep Grand Cherokee insurance premiums are calculated by many factors

Smart consumers have a good feel for the rating factors that play a part in calculating the rates you pay for insurance coverage. Having a good understanding of what determines base rates empowers consumers to make smart changes that will entitle you to lower insurance coverage prices.

Shown below are some of the items used by your company to calculate prices.

- Battle of the sexes – Statistics have proven women are more cautious behind the wheel. That doesn’t necessarily mean that men are WORSE drivers than women. They both are in accidents in similar percentages, but the men cause more damage. Men also statistically get more serious tickets such as reckless driving. Teenage male drivers are the most expensive to insure and are penalized with high insurance coverage rates.

- Choose a safe vehicle and save – Safer cars get lower rates. Safe vehicles protect occupants better and lower injury rates translates into savings for insurance companies and more competitive rates for policyholders. If the Jeep Grand Cherokee has ratings of a minimum an “acceptable” rating on the Insurance Institute for Highway Safety website you are probably receiving a discount.

- Lower rates with optional equipment – Purchasing a vehicle with a theft deterrent system can save you a little every year. Anti-theft features like LoJack tracking devices, vehicle tamper alarm systems or GM’s OnStar system all aid in stopping car theft.

- Marriage brings a discount – Getting married helps lower the price on your policy. Having a significant other usually means you are more responsible and it’s statistically proven that drivers who are married are more cautious.

- Clean credit earns discounts – Having a bad credit score is a important factor in calculating your insurance coverage rates. Therefore, if your credit history is lower than you’d like, you could potentially save money when insuring your 2012 Jeep Grand Cherokee by repairing your credit. Drivers with high credit scores tend to file fewer claims and have better driving records than drivers with poor credit.

Policy discounts you shouldn’t miss

Companies do not list every available discount very well, so the following is a list of some of the more common as well as the least known discounts you could be receiving.

- Homeowners Savings – Being a homeowner can save you money because maintaining a house shows financial diligence.

- Defensive Driving Course – Completing a course teaching defensive driving skills can save you 5% or more depending on where you live.

- Seat Belts Save more than Lives – Using a seat belt and requiring all passengers to use their safety belts can save 10% or more off the personal injury premium cost.

- Discount for New Cars – Putting insurance coverage on a new car can save up to 30% compared to insuring an older model.

- Air Bag Discount – Vehicles with factory air bags or automatic seat belts may earn rate discounts up to 30%.

- Multi-policy Discount – If you insure your home and vehicles with one company you could get a discount of approximately 10% to 15%.

A little note about advertised discounts, most credits do not apply to your bottom line cost. A few only apply to individual premiums such as medical payments or collision. So despite the fact that it appears all those discounts means the company will pay you, it just doesn’t work that way.

Companies that possibly offer these benefits may include but are not limited to:

- State Farm

- GEICO

- SAFECO

- Farmers Insurance

- AAA

- USAA

Check with each company what discounts are available to you. All car insurance discounts may not apply everywhere.

Insurance agents can help

When choosing the best insurance coverage for your personal vehicles, there isn’t really a cookie cutter policy. Every situation is different.

For example, these questions could help you determine whether you could use an agent’s help.

- Is my state a no-fault state?

- How high should my medical payments coverage be?

- Can I get a multi-policy discount?

- Am I covered when driving someone else’s vehicle?

- Do I need PIP coverage since I have good health insurance?

- Am I covered by my spouse’s policy after a separation?

- I have a DUI can I still get coverage?

If you’re not sure about those questions but one or more may apply to you, you may need to chat with a licensed insurance agent. If you want to speak to an agent in your area, complete this form.

The coverage is in the details

Having a good grasp of your policy aids in choosing the best coverages and the correct deductibles and limits. Insurance terms can be impossible to understand and coverage can change by endorsement.

UM/UIM Coverage – This coverage protects you and your vehicle when other motorists either are underinsured or have no liability coverage at all. This coverage pays for injuries sustained by your vehicle’s occupants as well as your vehicle’s damage.

Due to the fact that many drivers have only the minimum liability required by law, their limits can quickly be used up. For this reason, having high UM/UIM coverages is important protection for you and your family.

Collision coverages – This coverage will pay to fix damage to your Grand Cherokee resulting from a collision with another vehicle or an object, but not an animal. You will need to pay your deductible and the rest of the damage will be paid by collision coverage.

Collision can pay for things such as crashing into a building, hitting a mailbox, damaging your car on a curb, sustaining damage from a pot hole and sideswiping another vehicle. This coverage can be expensive, so consider dropping it from vehicles that are 8 years or older. It’s also possible to bump up the deductible to bring the cost down.

Liability insurance – This protects you from injuries or damage you cause to a person or their property. This insurance protects YOU against other people’s claims. Liability doesn’t cover your own vehicle damage or injuries.

Liability coverage has three limits: bodily injury for each person injured, bodily injury for the entire accident and a property damage limit. You commonly see liability limits of 100/300/100 which stand for a limit of $100,000 per injured person, $300,000 for the entire accident, and a total limit of $100,000 for damage to vehicles and property.

Liability insurance covers claims such as medical expenses, loss of income and pain and suffering. How much coverage you buy is a personal decision, but consider buying as large an amount as possible.

Comprehensive or Other Than Collision – This coverage pays for damage from a wide range of events other than collision. You first have to pay a deductible and then insurance will cover the rest of the damage.

Comprehensive can pay for things like a tree branch falling on your vehicle, rock chips in glass, fire damage and hitting a bird. The maximum amount you can receive from a comprehensive claim is the ACV or actual cash value, so if it’s not worth much more than your deductible consider dropping full coverage.

Medical costs insurance – Coverage for medical payments and/or PIP kick in for short-term medical expenses for things like X-ray expenses, hospital visits, pain medications and ambulance fees. They are used to fill the gap from your health insurance policy or if you do not have health coverage. Medical payments and PIP cover not only the driver but also the vehicle occupants and will also cover getting struck while a pedestrian. PIP coverage is not available in all states but it provides additional coverages not offered by medical payments coverage

Smart shoppers get results

Consumers who switch companies do it for a number of reasons such as extreme rates for teen drivers, high rates after DUI convictions, delays in responding to claim requests or even not issuing a premium refund. Whatever your reason, finding the right auto insurance provider is actually quite simple.

Cheap 2012 Jeep Grand Cherokee insurance can be found from both online companies in addition to many insurance agents, so compare prices from both to have the best rate selection. Some auto insurance companies do not provide you the ability to get quotes online and usually these regional insurance providers provide coverage only through local independent agents.

We covered a lot of ways to shop for insurance online. The key concept to understand is the more companies you get rates for, the better your chances of lowering your rates. Consumers could even find that the best prices are with some of the lesser-known companies.

To read more, feel free to visit the resources below:

- Determining Auto Insurance Rates (GEICO)

- Think You’re a Safe Driver? (State Farm)

- Teen Driving Statistics (iihs.org)

- Auto Crash Statistics (Insurance Information Institute)

Frequently Asked Questions

How can I find the cheapest insurance for my 2012 Jeep Grand Cherokee?

To find the cheapest insurance for your 2012 Jeep Grand Cherokee, consider the following steps:

- Shop around: Obtain quotes from multiple insurance providers to compare rates and coverage options.

- Opt for higher deductibles: Choosing a higher deductible can lower your insurance premium, but make sure you can afford to pay the deductible if you need to make a claim.

- Maintain a clean driving record: Having a history of safe driving can help you secure lower insurance rates.

- Explore available discounts: Inquire about any discounts you may be eligible for, such as multi-policy, multi-vehicle, or good driver discounts.

- Consider usage-based insurance: Some insurance companies offer programs where your rates are based on your driving habits, potentially resulting in lower premiums if you have good driving behavior.

What factors influence the cost of insurance for a 2012 Jeep Grand Cherokee?

Several factors can affect the cost of insurance for a 2012 Jeep Grand Cherokee, including:

- Age and driving experience: Younger and inexperienced drivers typically pay higher insurance premiums.

- Location: Insurance rates can vary based on your location due to factors like crime rates and accident frequency in the area.

- Vehicle usage: The intended use of your Jeep Grand Cherokee, such as personal or business, can impact insurance rates.

- Coverage and deductible: The type and level of coverage you choose, as well as your deductible amount, can affect your insurance premium.

- Driving record: A history of accidents or traffic violations can result in higher insurance rates.

- Credit history: Some insurance providers consider credit history when determining premiums.

- Safety features: The presence of safety features in your 2012 Jeep Grand Cherokee, such as anti-lock brakes, airbags, or an anti-theft system, can potentially lower your insurance costs.

Are there any specific insurance providers known for offering affordable rates for a 2012 Jeep Grand Cherokee?

While specific insurance rates can vary based on individual circumstances, it’s generally a good idea to consider obtaining quotes from various insurance providers. Some well-known insurance companies often offer competitive rates for auto insurance, including:

- Progressive

- GEICO

- State Farm

- Allstate

- Nationwide

- USAA (for military personnel and their families)

Are there any insurance discounts available specifically for a 2012 Jeep Grand Cherokee?

Insurance discounts can vary depending on the insurance provider, but some common discounts that may apply to a 2012 Jeep Grand Cherokee (or any vehicle) include:

- Multi-policy discount: If you insure your Grand Cherokee and other policies, such as home or renters insurance, with the same provider, you may qualify for a discount.

- Multi-vehicle discount: If you insure multiple vehicles on the same policy, you may be eligible for a discount.

- Good driver discount: Maintaining a clean driving record with no accidents or traffic violations can often lead to discounted rates.

- Safety features discount: If your 2012 Jeep Grand Cherokee is equipped with safety features like anti-lock brakes, airbags, or an anti-theft system, you may qualify for a discount.

- Low mileage discount: If you don’t drive your Grand Cherokee extensively, you may be eligible for a discount.

- Good student discount: If you have a student driver with good grades, you may qualify for discounted rates.

- Pay-in-full discount: Some insurers offer discounts if you pay your premium in full rather than in installments.

Are there any additional tips to lower the cost of insurance for my 2012 Jeep Grand Cherokee?

- Here are some additional tips to potentially reduce the cost of insurance for your 2012 Jeep Grand Cherokee:

- Take a defensive driving course: Successfully completing a defensive driving course can sometimes qualify you for discounted rates.

- Maintain a good credit score: Some insurance companies consider credit history when determining premiums, so maintaining a good credit score may help lower your rates.

- Remove unnecessary coverage: Review your insurance policy to ensure you’re not paying for coverage you don’t need, but be cautious to maintain adequate protection.

- Avoid filing small claims: Consider handling minor damages out of pocket instead of filing a claim, as multiple claims can lead to higher premiums.

- Regularly review your policy: As your circumstances change, such as moving or adding safety features, update your insurance provider to see if it affects your rates.

- Bundle insurance policies: If you have multiple insurance needs, bundling them with one provider may result in discounted rates.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Corolla Insurance

- Toyota Rav4 Insurance

- Chevrolet Silverado Insurance

- Ford F-150 Insurance

- Jeep Grand Cherokee Insurance

- Ford Focus Insurance

- Chevrolet Traverse Insurance

- Honda Civic Insurance

- Honda CR-V Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area