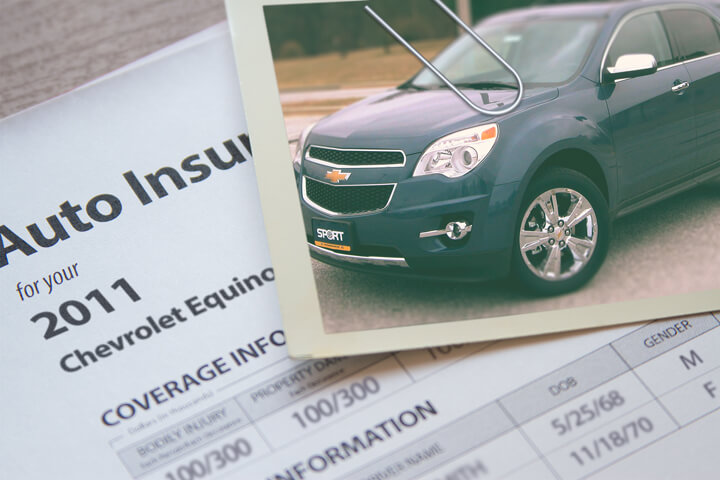

Cheapest 2011 Chevrolet Equinox Insurance Rates in 2025

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

No one enjoys paying for car insurance, especially knowing the cost is way too high.

You have multiple car insurance companies to buy insurance from, and although it’s nice to have multiple companies, having more insurers makes it harder to get the best deal.

Smart consumers take time to get comparison quotes quite often since insurance rates are usually higher with each renewal. If you had the best deal for Equinox insurance six months ago the chances are good that you can find a lower rate today. Ignore everything you know about car insurance because you’re about to learn how to use online quotes to eliminate unnecessary coverages and save money.

Save money by taking advantage of these discounts

Insurance can cost an arm and a leg, but discounts can save money and there are some available to help offset the cost. A few discounts will automatically apply at the time you complete a quote, but a few must be asked for in order for you to get them.

- Low Mileage – Low mileage vehicles could be rewarded with a substantially lower rate.

- Drivers Education – Cut your cost by having your teen driver complete a driver education course if offered at their school.

- Accident Forgiveness – Certain companies will allow you to have one accident without raising rates as long as you don’t have any claims for a certain period of time.

- Senior Discount – Mature drivers may qualify for reduced rates for Equinox insurance.

- Good Students Pay Less – Getting good grades can be rewarded with saving of up to 25%. This discount can apply up to age 25.

- Discount for Life Insurance – Select insurance companies reward you with a break if you buy life insurance from them.

- Defensive Driver – Taking part in a course teaching defensive driving skills could cut 5% off your bill depending on where you live.

- Military Rewards – Being on active duty in the military may qualify for rate reductions.

- Safe Drivers – Drivers who don’t get into accidents can pay as much as 50% less for Equinox insurance than less cautious drivers.

- Homeowners Savings – Owning a house may trigger a auto insurance policy discount because maintaining a house is proof that your finances are in order.

A little note about advertised discounts, most of the big mark downs will not be given to the overall cost of the policy. Most only apply to individual premiums such as comp or med pay. Just because you may think all the discounts add up to a free policy, you won’t be that lucky. But all discounts will bring down your premiums.

A partial list of companies that may have these benefits are:

- Farm Bureau

- State Farm

- Progressive

- Allstate

- Nationwide

- MetLife

Check with every prospective company how you can save money. Discounts may not be available in your state.

Free Quotes for Car Insurance

The are a couple different ways to compare quotes from local car insurance companies. The fastest way to find the lowest 2011 Chevy Equinox rates consists of shopping online. This can be done using a couple different methods.

- The recommended way to compare a lot of rates at once is to use a rate comparison form like this one (opens in new window). This easy form keeps you from doing separate quotation requests to each individual car insurance company. One simple form gets you coverage quotes from many national carriers.

- A more difficult way to get comparison quotes consists of going to each individual company website and complete a new quote form. For sake of this example, let’s say you want to compare rates from Auto-Owners, State Farm and Allstate. To get each rate you have to spend time on each company’s site and enter your policy data, and that’s why the first method is more popular. For a list of links to companies insuring cars in your area, click here.

- The least efficient way of comparing rate quotes is to spend time driving to insurance agents’ offices. The ability to buy insurance online makes this process obsolete unless you prefer the trained guidance only provided by licensed agents. However, consumers can price shop online but buy from a local insurance agent and we’ll talk about that later.

Whichever method you choose, make absolute certain that you use the exact same coverages and limits with each company. If you compare different liability limits you will not be able to truly determine the lowest rate. Just a small difference in insurance coverages can result in a big premium difference. And when quoting car insurance, remember that comparing more company’s prices provides better odds of finding the best price.

Your Chevy Equinox insurance rate is a complex equation

Smart consumers have a good feel for the rating factors that come into play when calculating your car insurance rates. Understanding what controls the rates you pay helps enable you to make changes that could result in lower car insurance prices.

The list below includes a partial list of the pieces that factor into premiums.

- More claims means more premium – Car insurance companies award cheaper rates to drivers who do not file claims often. If you tend to file frequent claims, you can expect either a policy non-renewal or much higher rates. Car insurance is intended to be relied upon for larger claims.

- Marriage brings a discount – Having a spouse helps lower the price on your policy. Marriage means you’re more mature and responsible it has been statistically shown that being married results in fewer claims.

- Never allow your policy to lapse – Driving with no insurance can get your license suspended and car insurance companies will penalize you for letting your insurance expire. And not only will your rates increase, failure to provide proof of insurance can result in a hefty fine and possibly a revoked license.

- What are your deductibles? – Your deductibles represent how much money you are willing to pay before your car insurance pays a claim. Coverage for physical damage, termed comprehensive and collision coverage on your policy, protects your car from damage. A few examples of covered claims could be colliding with a building, collision with an animal, and burglary. The higher the amount you have to pay, the less your company will charge you for insurance for Equinox insurance.

- Liability coverage is cheap – The liability section of your policy provides coverage when a jury decides you are liable for personal injury or accident damage. It will provide legal defense which can cost thousands of dollars. Liability insurance is quite affordable compared to insuring for physical damage coverage, so drivers should carry high limits.

- Tickets mean higher rates – Your driving citation history has a huge affect on how much you pay. Just one speeding ticket can boost insurance rates by as much as thirty percent. Careful drivers receive lower rates than bad drivers. Drivers who have serious citations such as reckless driving, hit and run or driving under the influence may need to file a proof of financial responsibility form (SR-22) with the DMV in their state in order to continue driving.

- Better crash test results mean better rates – Safer cars can get you lower premiums. These vehicles have better occupant injury protection and better occupant protection translates into savings for insurance companies and thus lower rates. If the Chevy Equinox has ratings of a minimum an “acceptable” rating on the Insurance Institute for Highway Safety website or four stars on the National Highway Traffic Safety Administration website it is probably cheaper to insure.

- Occupation reflects on rates – Did you know your car insurance rates can be affected by your occupation? Jobs such as lawyers, social workers and dentists are shown to have the highest average rates due to job stress and lengthy work days. Other jobs such as actors, historians and performers pay the least for Equinox insurance.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

When should I use an insurance agent?

When it comes to choosing coverage, there really is no single plan that fits everyone. Coverage needs to be tailored to your specific needs so this has to be addressed. For instance, these questions may help you determine whether you may require specific advice.

- What is the minimum liability in my state?

- What is the difference between comprehensive and collision coverage?

- Should I sign the liability waiver when renting a car?

- Is my custom paint covered by insurance?

- If my pet gets injured in an accident are they covered?

- Is motor club coverage worth it?

- Am I getting all the discounts available?

- Do I need replacement cost coverage on my 2011 Chevy Equinox?

If you’re not sure about those questions but one or more may apply to you, you may need to chat with an agent. To find an agent in your area, fill out this quick form or click here for a list of auto insurance companies in your area.

Save $426 a year? Really?

State Farm and Allstate regularly use ads on TV and radio. All the companies make an identical promise about savings if you move to their company. How does each company make the same claim?

All the different companies are able to cherry pick for the driver that is profitable for them. For example, a profitable customer could be a mature driver, has no prior claims, and chooses high deductibles. A driver who fits that profile is entitled to the best price and is almost guaranteed to save quite a bit of money when switching.

Consumers who don’t qualify for the “perfect” profile must pay a higher premium which leads to business going elsewhere. The ad wording is “customers who switch” not “everybody who quotes” save that kind of money. That is how companies can make the claims of big savings.

This illustrates why drivers should compare as many rates as you can. You cannot predict the company that will have the lowest Chevy Equinox insurance rates.

Car insurance coverage basics

Learning about specific coverages of a car insurance policy helps when choosing the right coverages and proper limits and deductibles. The terms used in a policy can be confusing and nobody wants to actually read their policy. Below you’ll find the usual coverages offered by car insurance companies.

Collision coverages – Collision coverage covers damage to your Equinox resulting from colliding with an object or car. You will need to pay your deductible then the remaining damage will be paid by your insurance company.

Collision coverage protects against claims such as crashing into a ditch, hitting a mailbox, rolling your car, backing into a parked car and colliding with another moving vehicle. Collision coverage makes up a good portion of your premium, so consider dropping it from vehicles that are older. Drivers also have the option to bump up the deductible to bring the cost down.

Liability auto insurance – This provides protection from damage or injury you incur to other’s property or people. It protects YOU from claims by other people. It does not cover damage sustained by your vehicle in an accident.

Liability coverage has three limits: per person bodily injury, per accident bodily injury, and a property damage limit. As an example, you may have liability limits of 25/50/25 which stand for $25,000 bodily injury coverage, a limit of $50,000 in injury protection per accident, and a total limit of $25,000 for damage to vehicles and property. Some companies may use a combined single limit or CSL that pays claims from the same limit rather than limiting it on a per person basis.

Liability coverage protects against claims like medical services, bail bonds and pain and suffering. How much liability coverage do you need? That is up to you, but it’s cheap coverage so purchase as much as you can afford.

UM/UIM Coverage – This coverage gives you protection from other motorists when they either have no liability insurance or not enough. This coverage pays for hospital bills for your injuries and also any damage incurred to your Chevy Equinox.

Due to the fact that many drivers only purchase the least amount of liability that is required, their liability coverage can quickly be exhausted. This is the reason having UM/UIM coverage is very important. Normally these coverages do not exceed the liability coverage limits.

Medical costs insurance – Coverage for medical payments and/or PIP kick in for expenses for hospital visits, funeral costs, dental work, EMT expenses and nursing services. They are often used to cover expenses not covered by your health insurance program or if you are not covered by health insurance. Coverage applies to you and your occupants in addition to getting struck while a pedestrian. PIP coverage is not an option in every state and gives slightly broader coverage than med pay

Comprehensive or Other Than Collision – This will pay to fix damage OTHER than collision with another vehicle or object. You first must pay your deductible and then insurance will cover the rest of the damage.

Comprehensive can pay for things such as damage from a tornado or hurricane, hitting a deer and hail damage. The most a car insurance company will pay at claim time is the ACV or actual cash value, so if your deductible is as high as the vehicle’s value consider dropping full coverage.

A penny earned…

Discount 2011 Chevy Equinox insurance is definitely available both online and also from your neighborhood agents, so you should compare both so you have a total pricing picture. A few companies may not provide the ability to get a quote online and these small insurance companies work with independent agents.

As you restructure your insurance plan, it’s not a good idea to buy poor coverage just to save money. There are many occasions where someone sacrificed physical damage coverage and discovered at claim time that a couple dollars of savings turned into a financial nightmare. The proper strategy is to get the best coverage possible at an affordable rate while not skimping on critical coverages.

Use our FREE quote tool to compare rates now!

For more information, take a look at the articles below:

- Collision Insurance Coverage (Nationwide)

- Who Has Cheap Car Insurance Rates for a Chevrolet Equinox in Virginia Beach? (VBInsure.com)

- Side Impact Crash Tests (iihs.org)

- Choosing a Car for Your Teen (State Farm)

- Uninsured Motorists: Threats on the Road (Insurance Information Institute)

Frequently Asked Questions

What factors can affect the insurance rates for a 2011 Chevrolet Equinox?

Several factors can influence the insurance rates for a 2011 Chevrolet Equinox. These may include the driver’s age, driving history, location, coverage options, deductible amount, the value of the vehicle, and the cost of repairs and replacement parts.

Are there any specific safety features in the 2011 Chevrolet Equinox that could lower insurance rates?

The 2011 Chevrolet Equinox comes equipped with various safety features that could potentially lower insurance rates. These features may include anti-lock brakes, airbags, traction control, stability control, and anti-theft devices. Insurance providers often consider these features when calculating premiums.

How can I find the cheapest insurance rates for a 2011 Chevrolet Equinox?

To find the cheapest insurance rates for a 2011 Chevrolet Equinox, consider following these steps:

- Shop around: Obtain quotes from multiple insurance providers to compare prices and coverage options.

- Maintain a good driving record: A clean driving history without accidents or traffic violations can help you secure lower insurance rates.

- Increase deductibles: Opting for a higher deductible can reduce your premium, but make sure you can afford the deductible amount in case of a claim.

- Explore discounts: Ask the insurance company about any available discounts, such as safe driver discounts, multi-policy discounts, or discounts for vehicle safety features.

- Consider usage-based insurance: Some insurance companies offer programs that track your driving behavior and provide discounts based on safe driving habits.

Are there any specific insurance providers known for offering affordable rates on a 2011 Chevrolet Equinox?

Insurance rates can vary significantly between providers and depend on various factors. It is recommended to obtain quotes from multiple insurance companies to determine which one offers the most competitive rates for a 2011 Chevrolet Equinox. Some well-known insurance providers that may be worth considering include GEICO, Progressive, State Farm, Allstate, and Farmers.

Does the color of a 2011 Chevrolet Equinox affect insurance rates?

No, the color of a vehicle, including a 2011 Chevrolet Equinox, does not typically impact insurance rates. Insurance companies base their rates on factors like the vehicle’s make, model, age, safety features, and the driver’s profile, but not the color of the car.

Can I lower insurance rates for a 2011 Chevrolet Equinox by taking a defensive driving course?

While taking a defensive driving course can improve your driving skills and make you a safer driver, it may not necessarily lead to lower insurance rates for a 2011 Chevrolet Equinox. It’s best to check with your insurance provider to see if they offer any discounts for completing a defensive driving course.

Is it possible to qualify for any loyalty or long-term customer discounts on insurance for a 2011 Chevrolet Equinox?

Many insurance providers offer loyalty or long-term customer discounts to encourage customer retention. If you have been insured with the same company for a significant period or have multiple policies with them, it’s worth inquiring about any available loyalty discounts for your 2011 Chevrolet Equinox.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2025

- Cheapest Jeep Insurance Rates in 2025

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Camry Insurance

- Chevrolet Malibu Insurance

- Ford F-150 Insurance

- Ford Explorer Insurance

- Nissan Rogue Insurance

- Honda Civic Insurance

- Chevrolet Silverado Insurance

- Toyota Corolla Insurance

- Toyota Rav4 Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area