Volvo C30 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Even though shopping for insurance on a Volvo C30 can feel overwhelming at times, finding affordable rates doesn’t have to be that difficult.

Insurance quotes for these compact hatchbacks can vary based on a variety of reasons such as the safety ratings of the vehicle, fair market pricing, and more.

This comprehensive article is designed to provide you with all of this information so you can take the first step towards securing an affordable insurance policy for a Volvo C30.

When you’re ready to start comparing quotes, enter your five-digit ZIP code in the box above.

The average insurance prices for a Volvo C30 are $1,414 every 12 months for full coverage. Comprehensive costs on average $322 each year, collision costs $562, and liability costs $372. Liability-only coverage costs as little as $438 a year, with high-risk coverage costing around $3,052. 16-year-old drivers cost the most to insure at $5,196 a year or more.

Average premium for full coverage: $1,414

Policy rates by type of insurance:

Rates are based on $500 policy deductibles, 30/60 liability coverage, and includes both medical and UM/UIM coverage. Prices are averaged for all states and C30 models.

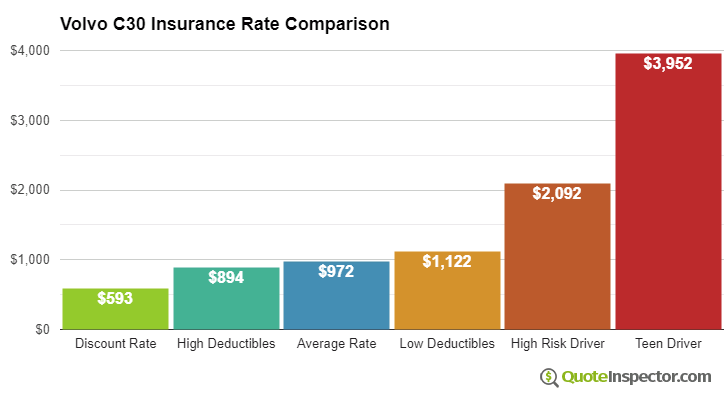

Price Range Variability

For the average 40-year-old driver, Volvo C30 insurance rates go from the cheapest price of $438 for basic liability insurance to a high rate of $3,052 for a policy for a high-risk driver.

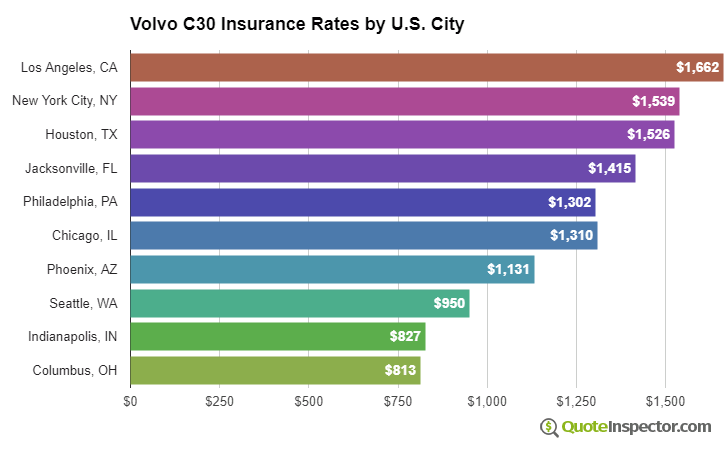

Urban vs. Rural Price Range

Your location can make a big difference on car insurance rates. Rural areas are shown to have more infrequent accident claims than congested cities.

The graphic below illustrates the difference location can make on car insurance rates.

The examples above show why all drivers should compare rates based on a specific location and their own driving history, instead of making a decision based on rate averages.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Rate Comparisons

The chart below shows estimated Volvo C30 insurance rates for different risk profiles and scenarios.

- The best full coverage rate is $815

- Drivers who choose higher $1,000 deductibles will pay around $200 a year

- The average price for a good driver age 40 with $500 deductibles is $1,414

- Buying low deductibles for comprehensive and collision insurance increases the price to $1,804

- Drivers with multiple tickets or accidents could pay upwards of $3,052 or more

- Policy cost to insure a 16-year-old driver may cost $5,196 a year

Insurance rates for a Volvo C30 also range considerably based on liability limits and deductibles, your driver profile, and the trim level of your C30.

Opting for high physical damage deductibles could save up to $590 annually, whereas increasing liability limits will cost you more. Going from a 50/100 liability limit to a 250/500 limit will raise rates by up to $335 more each year. View Rates by Deductible or Liability Limit

More mature drivers with no violations or accidents and higher deductibles may pay as low as $1,300 per year on average, or $108 per month, for full coverage. Rates are highest for teenagers, since even excellent drivers should be prepared to pay upwards of $5,100 a year. View Rates by Age

If you have a few points on your driving record or you were responsible for an accident, you could be paying at a minimum $1,700 to $2,300 additional every year, depending on your age. Insurance for high-risk drivers can cost from 44% to 134% more than the average rate. View High Risk Driver Rates

Your home state makes a big difference in Volvo C30 insurance prices. A 40-year-old driver could pay as low as $930 a year in states like Idaho, Maine, and Iowa, or at least $2,020 on average in Michigan, Louisiana, and New York.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,278 | -$136 | -9.6% |

| Alaska | $1,086 | -$328 | -23.2% |

| Arizona | $1,174 | -$240 | -17.0% |

| Arkansas | $1,414 | -$0 | 0.0% |

| California | $1,612 | $198 | 14.0% |

| Colorado | $1,354 | -$60 | -4.2% |

| Connecticut | $1,454 | $40 | 2.8% |

| Delaware | $1,602 | $188 | 13.3% |

| Florida | $1,772 | $358 | 25.3% |

| Georgia | $1,308 | -$106 | -7.5% |

| Hawaii | $1,016 | -$398 | -28.1% |

| Idaho | $958 | -$456 | -32.2% |

| Illinois | $1,056 | -$358 | -25.3% |

| Indiana | $1,064 | -$350 | -24.8% |

| Iowa | $956 | -$458 | -32.4% |

| Kansas | $1,346 | -$68 | -4.8% |

| Kentucky | $1,930 | $516 | 36.5% |

| Louisiana | $2,096 | $682 | 48.2% |

| Maine | $874 | -$540 | -38.2% |

| Maryland | $1,168 | -$246 | -17.4% |

| Massachusetts | $1,134 | -$280 | -19.8% |

| Michigan | $2,458 | $1,044 | 73.8% |

| Minnesota | $1,186 | -$228 | -16.1% |

| Mississippi | $1,696 | $282 | 19.9% |

| Missouri | $1,256 | -$158 | -11.2% |

| Montana | $1,520 | $106 | 7.5% |

| Nebraska | $1,118 | -$296 | -20.9% |

| Nevada | $1,696 | $282 | 19.9% |

| New Hampshire | $1,020 | -$394 | -27.9% |

| New Jersey | $1,582 | $168 | 11.9% |

| New Mexico | $1,252 | -$162 | -11.5% |

| New York | $1,490 | $76 | 5.4% |

| North Carolina | $816 | -$598 | -42.3% |

| North Dakota | $1,158 | -$256 | -18.1% |

| Ohio | $976 | -$438 | -31.0% |

| Oklahoma | $1,454 | $40 | 2.8% |

| Oregon | $1,296 | -$118 | -8.3% |

| Pennsylvania | $1,350 | -$64 | -4.5% |

| Rhode Island | $1,886 | $472 | 33.4% |

| South Carolina | $1,284 | -$130 | -9.2% |

| South Dakota | $1,194 | -$220 | -15.6% |

| Tennessee | $1,240 | -$174 | -12.3% |

| Texas | $1,706 | $292 | 20.7% |

| Utah | $1,048 | -$366 | -25.9% |

| Vermont | $968 | -$446 | -31.5% |

| Virginia | $848 | -$566 | -40.0% |

| Washington | $1,094 | -$320 | -22.6% |

| West Virginia | $1,296 | -$118 | -8.3% |

| Wisconsin | $980 | -$434 | -30.7% |

| Wyoming | $1,262 | -$152 | -10.7% |

Because rates have so much variability, the only way to know exactly what you will pay is to do a rate comparison from multiple companies. Every company utilizes a different rate formula, and rates will be varied.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Volvo C30 T5 | $1,370 | $114 |

| Volvo C30 T5 R-Design | $1,414 | $118 |

Rates assume 2025 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2008 Volvo C30 | $152 | $188 | $460 | $958 |

Rates are averaged for all Volvo C30 models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Shop for the Best Cheap Volvo C30 Insurance

Finding cheaper rates on insurance for a Volvo C30 not only requires avoiding accidents and claims, but also having above-average credit, avoid buying unnecessary coverage, and insuring your home and auto with the same company. Make time to compare rates every year by quoting rates from direct carriers, and also from local independent and exclusive agents.

The points below are a quick review of the coverage data touched on in this article.

- Drivers can save as much as $170 per year simply by quoting online in advance

- Increasing comprehensive and collision deductibles could save as much as $600 each year

- Drivers under the age of 20 pay higher rates, costing up to $433 each month if full coverage is included

- Drivers considered higher risk with a DUI or reckless driving violation pay an average of $1,640 more each year to insure a Volvo C30

After reviewing this information, it’s clear to see that a number of factors ultimately determine insurance rates for this Swedish hatchback.

For example, the average insurance rate for people who live in rural areas is $959. This is far more affordable than city-dwellers who have an average premium rate of $1,725.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does the size and class of the Volvo C30 affect liability rates?

In the auto world, liability insurance is a form of coverage that pays for damages that were your fault. Most states require you to carry a minimum amount of coverage on your policy in order to pay for things like medical expenses and lost wages for the other person involved.

Since this is the most basic form of coverage, you are likely curious to know how these rates are calculated. Any insurance provider that offers you a quote will look at the size and class of the Volvo C30 to determine your liability rate.

The Insurance Institute for Highway Safety (IIHS) classifies the Volvo C30 as a midsize two-door hatchback. Other comparable models include the Honda Civic Type-R and Hyundai Veloster N.

There is plenty of upside to having a midsized car with a rear liftgate. These types of hatchbacks, like the Volvo C30, are great on gas mileage while still providing the versatility to use the rear seats and cargo area like an SUV.

However, the Volvo C30 is still smaller and lighter than any SUV, which means that it is more prone to severe damage in the event of a collision. Insurance providers know that this means that you are at greater risk of getting injured in this type of car, and take that into account when factoring your liability rates.

Despite the fact that smaller cars at a disadvantage to heavier vehicles in overall safety, there is still a silver lining. So long as a particular model scores well for its class, you can still obtain a reasonable insurance rate. And the good news is that the Volvo C30 performed well in crash tests.

As you can see from the video, the Volvo C30 handled itself well during its IIHS evaluation. While the preceding clip only measured the moderate overlap front part of the vehicle, the Volvo C30 received an overall score of “Good.”

What does liability insurance cost for a Volvo C30?

Now that we’ve learned how liability rates are calculated, the next logical step is to see how this translates to actual dollars and cents. As it turns out, how much you pay for liability insurance on a Volvo C30 depends on the level of coverage you want to get.

Generally speaking, the minimum legal amount of coverage is up to $25,000. However, you might be curious to be insured for up to $50,000 or $100,000. Take a look at the following liability rates for the Volvo C30 based on which level of coverage you want to receive.

- Low ($25,000/$50,000): $109.68

- Medium ($50,000/$100,000): $133.08

- High ($100,000/$200,000): $146.25

While these quotes are general, it still provides us with an accurate picture of what you can expect to pay. Ultimately, the difference between low to high coverage is $36.57, and the highest form of coverage provides you with a lot more protection.

Another form of coverage that will be included in your liability policy is property damage insurance. This type of insurance will pay for any damage that was done to the other party’s property, including their vehicle. This is helpful in the event that the other driver’s vehicle suffers major damage or gets totaled.

Take a look at the following property damage liability quotes on the Volvo C30 based on the level of coverage.

- Low ($25,000): $118.97

- Medium ($50,000): $125.52

- High ($100,000): $129.69

As an itemized cost, the property damage insurance on a Volvo C30 will only cost $10.72 more from the lowest to the highest level, yet the policy covers you for up to $95,000 more in damages. If you are a person who calculates risk-reward ratios, it’s clear to see that getting more coverage is a safer bet.

What are the safety features and ratings of the Volvo C30?

Beyond the structural design of a vehicle, auto manufacturers also include a number of features that contribute to a model’s overall safety. These safety features evolve over time, which is why there are vehicles on the road today that have driver-assist technology, something that was unheard of years ago.

In the case of the Volvo C30, AutoBlog.com provided a list of helpful safety features on the model that contribute to its overall safety rating. These features include the following:

- Stability Control – This feature automatically senses when the vehicle’s handling limits have been exceeded and reduces engine power and applies select brakes to help prevent the driver from losing control.

- Anti-Whiplash – These head restraints actively react to rear collision forces and cradle the occupants’ head in an effort to reduce the likelihood of a whiplash injury.

- Anti-Theft Security – This technology anticipates and detects unwanted vehicle intrusion. The vehicle is equipped with an ignition-disable device that will prevent the engine from starting if the correct original manufacturer key is not used.

While these are only three of the Volvo C30’s many safety features, you can see how this technology contributes to the overall safety ratings of the hatchback. And even though the safety efforts of the car itself are impressive, insurance rates on the Volvo C30 are still tied to its size and class as a whole.

The IIHS reports that out of 9,736,590 registered midsized cars, a total of 396 deaths have been reported for this class. Broken down, that is a fatality rate of 41 per one million registered people who drive a model like the Volvo C30.

Furthermore, fatality statistics for midsize cars vary based on the point of impact from which the crash occurred. Take a look at the following data to see how different parts of the vehicle yield varying results in real crashes that occur on public roadways:

- Frontal Impact: 7,433 deaths

- Side Impact: 3,568 deaths

- Rear Impact: 834 deaths

- Other (mostly rollovers): 1,303 deaths

These figures suggest that frontal impact crashes, such as a head-to-head collision, are the deadliest. This is not only true of midsized cars like the Volvo C30, but all vehicle types due to the sheer amount of force that is generated when a car comes face-first with another object.

What is the MSRP of the Volvo C30?

The Manufacturer’s Suggested Retail Price (MSRP) is used to determine a fair purchasing price for any particular model. Odds are you will see this acronym on dealership websites and third-party evaluators like Kelley Blue Book.

Since the last model-year for the Volvo C30 was 2013, there is not an official MSRP listed for this model anymore. Still, there are plenty of these models available for sale if you look around. So in order to figure out what you can expect to pay for this car, we will look at the fair market range of the vehicle.

According to Kelley Blue Book, the fair market value for a Volvo C30 is $5,547 to $7,456, with a typical listing price of $6,892.

Now that you know how much the vehicle costs, you might be wondering how that impacts other forms of insurance, such as collision and comprehensive policies.

- Collision car insurance is a type of coverage that will pay for any costs associated with repairing or even replacing your vehicle if it gets damaged after colliding with another car or object.

- Comprehensive car insurance protects you from any damage sustained to your vehicle that is outside of your control, such as a tree falling on top of your C30 when it is parked on the street.

Why is this important to know?

Insurance providers will look at how many claims are made on the Volvo C30 for both collision and comprehensive policies. If the model shows an unfavorable loss percentage, your rates for either form of coverage will be higher.

As it turns out, the IIHS reports a loss ratio of -3 percent for collision and 4 percent for comprehensive on the Volvo C30. Both of these percentages are considered average for its size and class, meaning that you won’t be paying more than you should for either form of coverage.

How much will it cost to repair my Volvo C30?

Experts from RepairPal report that the average cost to repair a Volvo C30 is $720 per year. This includes regularly scheduled maintenance appointments like tire rotations and oil changes.

Anybody who regularly drives understands the importance of vehicle upkeep. But even the most attentive drivers sometimes run into more serious mechanical problems.

In order to have a clear understanding of which parts of the Volvo C30 are more expensive to repair than others, take a look at the following rates taken from Instant Estimator:

- Front Bumper: $469.80

- Rear Bumper: $479.80

- Hood: $441

- Roof: $525

- Front Door: $442.20

- Back Door: $429

- Fender: $399

- Quarter Panel: $413

Since the rear bumper is the most expensive part of the vehicle to repair with an average repair bill of $479.80, getting rear-ended is going to hurt your bank account the most.

However, if you sign up with an effective insurance policy with an adequate level of coverage, you won’t have to keep double-checking your rearview mirror every time you come upon a stoplight.

Now that we have gone into depth about how insurance quotes are calculated for the Volvo C30, is there anything we might have missed? If not, you are in an excellent position to obtain an effective quote for the right rate. Get started now by taking advantage of our free online quote tool.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,196 |

| 20 | $3,256 |

| 30 | $1,482 |

| 40 | $1,414 |

| 50 | $1,292 |

| 60 | $1,266 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,804 |

| $250 | $1,624 |

| $500 | $1,414 |

| $1,000 | $1,214 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,414 |

| 50/100 | $1,488 |

| 100/300 | $1,581 |

| 250/500 | $1,823 |

| 100 CSL | $1,526 |

| 300 CSL | $1,730 |

| 500 CSL | $1,879 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $7,418 |

| 20 | $5,170 |

| 30 | $3,122 |

| 40 | $3,052 |

| 50 | $2,910 |

| 60 | $2,882 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $75 |

| Multi-vehicle | $72 |

| Homeowner | $20 |

| 5-yr Accident Free | $105 |

| 5-yr Claim Free | $91 |

| Paid in Full/EFT | $66 |

| Advance Quote | $70 |

| Online Quote | $100 |

| Total Discounts | $599 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area