Jeep Gladiator Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

The average insurance rates for a Jeep Gladiator are $1,588 a year including full coverage. Comprehensive costs approximately $310 each year, collision costs $612, and liability insurance is $486. Liability-only insurance costs around $548 a year, with high-risk driver insurance costing around $3,452. Teens cost the most to insure at $6,000 a year or more.

Average premium for full coverage: $1,588

Policy rates by type of insurance:

Estimates include $500 deductible amounts, split liability limits of 30/60, and includes additional medical/uninsured motorist coverage. Prices are averaged for all 50 U.S. states and Gladiator models.

Price Range Variability

For the average driver, Jeep Gladiator insurance rates go from as low as $548 for just the minimum liability insurance to a high rate of $3,452 for coverage for higher-risk drivers.

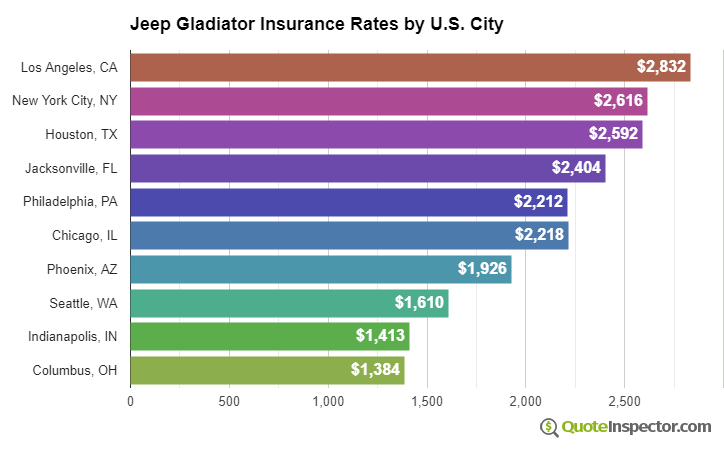

Urban vs. Rural Price Range

Choosing to live in a large city has a significant impact on car insurance prices. Rural locations are shown to have a lower frequency of comprehensive and collision claims than cities with more traffic congestion.

The graphic below illustrates how location impacts auto insurance prices.

The examples above highlight why all drivers should compare rates quotes using their specific location and risk profile, rather than relying on averaged prices.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Additional Rate Analysis

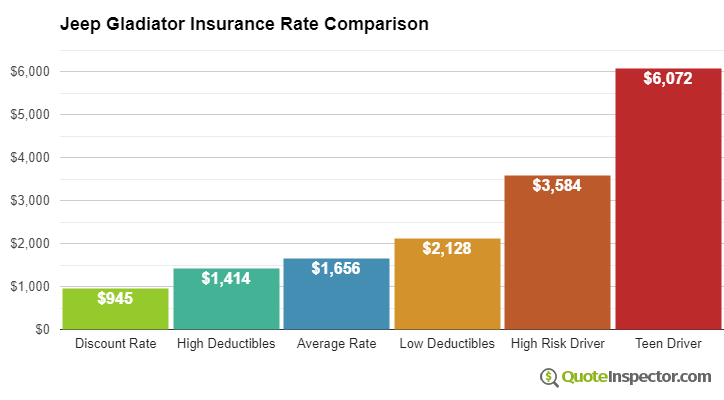

The chart below breaks down estimated Jeep Gladiator insurance rates for additional coverage and risk scenarios.

- The cheapest rate after discounts is $909

- Raising to $1,000 deductibles will save $208 every year

- The average rate for a good driver age 40 who chooses $500 deductibles is $1,588

- Selecting low deductibles will increase the cost to $1,998

- Higher-risk drivers with serious driving violations could pay around $3,452 or more

- Policy cost for full coverage for a teen driver can cost $6,000

Auto insurance rates for a Jeep Gladiator also range considerably based on your risk profile, the model of your Gladiator, and physical damage deductibles and liability limits.

More mature drivers with a good driving record and high deductibles could pay as little as $1,500 every 12 months on average, or $125 per month, for full coverage. Rates are much higher for teenagers, where even good drivers will have to pay in the ballpark of $6,000 a year. View Rates by Age

Your home state also has a big influence on Jeep Gladiator insurance rates. A middle-age driver might find rates as low as $1,220 a year in states like Vermont, New Hampshire, and Missouri, or have to pay at least $2,260 on average in Louisiana, New York, and Michigan.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,434 | -$154 | -9.7% |

| Alaska | $1,218 | -$370 | -23.3% |

| Arizona | $1,316 | -$272 | -17.1% |

| Arkansas | $1,588 | -$0 | 0.0% |

| California | $1,806 | $218 | 13.7% |

| Colorado | $1,516 | -$72 | -4.5% |

| Connecticut | $1,630 | $42 | 2.6% |

| Delaware | $1,796 | $208 | 13.1% |

| Florida | $1,984 | $396 | 24.9% |

| Georgia | $1,466 | -$122 | -7.7% |

| Hawaii | $1,138 | -$450 | -28.3% |

| Idaho | $1,076 | -$512 | -32.2% |

| Illinois | $1,180 | -$408 | -25.7% |

| Indiana | $1,198 | -$390 | -24.6% |

| Iowa | $1,070 | -$518 | -32.6% |

| Kansas | $1,506 | -$82 | -5.2% |

| Kentucky | $2,164 | $576 | 36.3% |

| Louisiana | $2,350 | $762 | 48.0% |

| Maine | $980 | -$608 | -38.3% |

| Maryland | $1,310 | -$278 | -17.5% |

| Massachusetts | $1,268 | -$320 | -20.2% |

| Michigan | $2,754 | $1,166 | 73.4% |

| Minnesota | $1,328 | -$260 | -16.4% |

| Mississippi | $1,902 | $314 | 19.8% |

| Missouri | $1,406 | -$182 | -11.5% |

| Montana | $1,704 | $116 | 7.3% |

| Nebraska | $1,250 | -$338 | -21.3% |

| Nevada | $1,902 | $314 | 19.8% |

| New Hampshire | $1,144 | -$444 | -28.0% |

| New Jersey | $1,774 | $186 | 11.7% |

| New Mexico | $1,404 | -$184 | -11.6% |

| New York | $1,672 | $84 | 5.3% |

| North Carolina | $914 | -$674 | -42.4% |

| North Dakota | $1,302 | -$286 | -18.0% |

| Ohio | $1,094 | -$494 | -31.1% |

| Oklahoma | $1,628 | $40 | 2.5% |

| Oregon | $1,454 | -$134 | -8.4% |

| Pennsylvania | $1,510 | -$78 | -4.9% |

| Rhode Island | $2,116 | $528 | 33.2% |

| South Carolina | $1,440 | -$148 | -9.3% |

| South Dakota | $1,340 | -$248 | -15.6% |

| Tennessee | $1,386 | -$202 | -12.7% |

| Texas | $1,910 | $322 | 20.3% |

| Utah | $1,172 | -$416 | -26.2% |

| Vermont | $1,086 | -$502 | -31.6% |

| Virginia | $950 | -$638 | -40.2% |

| Washington | $1,224 | -$364 | -22.9% |

| West Virginia | $1,454 | -$134 | -8.4% |

| Wisconsin | $1,098 | -$490 | -30.9% |

| Wyoming | $1,414 | -$174 | -11.0% |

Choosing higher comprehensive and collision insurance deductibles can reduce rates by up to $620 each year, whereas increasing liability limits will push rates upward. Changing from a 50/100 limit to a 250/500 limit will raise rates by up to $438 extra every year. View Rates by Deductible or Liability Limit

If you have a few points on your driving record or tend to cause accidents, you are likely paying anywhere from $1,900 to $2,600 in extra premium every year, depending on your age. Insurance for high-risk drivers is expensive and can cost anywhere from 43% to 133% more than the average policy. View High Risk Driver Rates

Because rates have so much variability, the best way to figure out who has the best auto insurance rates is to do a rate comparison from as many companies as possible. Every auto insurance company calculates rates differently, and quoted rates will be varied from one company to the next.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Jeep Gladiator | $332 | $656 | $450 | $1,618 |

| 2023 Jeep Gladiator | $320 | $640 | $470 | $1,610 |

| 2022 Jeep Gladiator | $310 | $612 | $486 | $1,588 |

| 2021 Jeep Gladiator | $292 | $592 | $500 | $1,564 |

| 2020 Jeep Gladiator | $282 | $548 | $510 | $1,520 |

Rates are averaged for all Jeep Gladiator models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Find Low Cost Jeep Gladiator Insurance

Finding cheaper rates on Jeep Gladiator insurance consists of having a good driving record, having good credit, paying for small claims out-of-pocket, and not having any coverage lapses. Spend time shopping around at least once a year by requesting quotes from direct car insurance companies like GEICO, Progressive, and Esurance, and also from insurance agencies where you live.

The next list is a review of the primary concepts that were touched on above.

- You may be able to save around $190 per year simply by quoting online in advance

- High-risk drivers who have several accidents or serious violations could be forced to pay on average $1,860 more per year to buy Jeep Gladiator insurance

- Increasing comprehensive and collision deductibles can save around $625 each year

- Drivers age 20 and younger have the highest car insurance rates, with premiums being up to $500 each month if they have full coverage

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $6,000 |

| 20 | $3,688 |

| 30 | $1,650 |

| 40 | $1,588 |

| 50 | $1,452 |

| 60 | $1,424 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,998 |

| $250 | $1,806 |

| $500 | $1,588 |

| $1,000 | $1,380 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,588 |

| 50/100 | $1,685 |

| 100/300 | $1,807 |

| 250/500 | $2,123 |

| 100 CSL | $1,734 |

| 300 CSL | $2,001 |

| 500 CSL | $2,196 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $8,566 |

| 20 | $5,878 |

| 30 | $3,524 |

| 40 | $3,452 |

| 50 | $3,296 |

| 60 | $3,270 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $84 |

| Multi-vehicle | $85 |

| Homeowner | $24 |

| 5-yr Accident Free | $118 |

| 5-yr Claim Free | $103 |

| Paid in Full/EFT | $73 |

| Advance Quote | $79 |

| Online Quote | $113 |

| Total Discounts | $679 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area