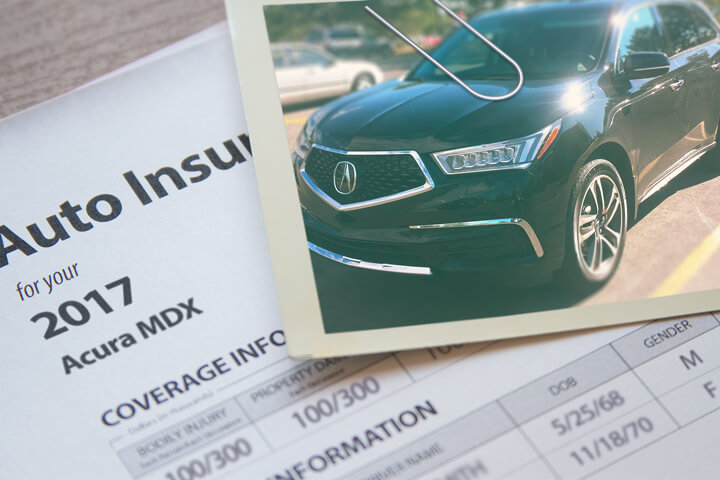

Cheapest 2017 Acura MDX Insurance Rates in 2026

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Buying the lowest price insurance coverage can appear to be intimidating for consumers new to quoting and comparing prices on the web. With a ridiculous number of online companies available, how are we expected to have a chance to compare every one to find the best pricing?

Finding the best rates is easy if you know what you’re doing. Essentially everyone who has to buy insurance coverage will be able to reduce their rates. Although consumers need to learn the way insurance companies determine prices and apply this information to your search.

Compare free insurance rate quotes

Shopping for lower insurance rates can be a lot of work if you aren’t aware of the easiest way. You could waste time driving to agents in your area, or you could save time and use online quotes to get the quickest rates.

Most major companies participate in a marketplace where prospective buyers send in one quote, and every company can give them a price based on that information. This saves time by eliminating form submissions to each company. To find out how much you’re overpaying now click here (opens in new window).

One minor caveat to using this type of form is that you can’t choose which companies you want pricing from. So if you prefer to choose from a list of companies to request quotes from, we have a listing of companies who write insurance in your area. Click here to view list.

It doesn’t matter which method you choose, just be sure to compare exactly the same coverages and limits on every price quote you get. If the quotes have different deductibles it will be impossible to make a fair rate comparison. Just a small difference in insurance coverages or limits may cause a big price difference. It’s important to know that comparing all the rates in your area provides better odds of finding the best rates. Some regional insurers cannot provide price estimates online, so you also need to get quotes from those companies as well.

Take policy discounts and save

Insurance can be prohibitively expensive, but discounts can save money and there are some available that many consumers don’t even know exist. A few discounts will be applied at the time you complete a quote, but some need to be asked about in order for you to get them.

- Save over 55 – Older drivers may receive lower premium rates on MDX insurance.

- Clubs and Organizations – Having an affiliation with certain professional organizations could trigger savings when getting a insurance quote.

- Auto/Life Discount – Select companies reward you with a discount if you purchase a life policy as well.

- Federal Employees – Active or former government employment can save as much as 8% on MDX insurance with certain companies.

- Defensive Driver Discounts – Taking part in a course teaching driver safety skills is a good idea and can lower rates if you qualify.

- Theft Prevention Discount – Vehicles equipped with anti-theft or alarm systems can help prevent theft and earn discounts up to 10% off your insurance quote.

- Paperless Signup – Some insurance companies may give you up to $50 for signing up digitally online.

- Accident Waiver – This isn’t a discount exactly, but companies like GEICO and Liberty Mutual will forgive one accident before raising your premiums so long as you haven’t had any claims for a specific time period.

- Full Payment Discount – If you pay your bill all at once instead of paying each month you could save up to 5%.

You should keep in mind that some credits don’t apply to your bottom line cost. Most cut the cost of specific coverages such as comp or med pay. So when the math indicates having all the discounts means you get insurance for free, company stockholders wouldn’t be very happy.

The best insurance companies and their possible discounts are included below.

- GEICO has discounts for military active duty, anti-theft, multi-policy, membership and employees, anti-lock brakes, federal employee, and air bags.

- SAFECO may offer discounts for multi-car, anti-lock brakes, anti-theft, teen safe driver, drive less, bundle discounts, and homeowner.

- State Farm has savings for defensive driving training, accident-free, driver’s education, good driver, Drive Safe & Save, and multiple policy.

- MetLife offers premium reductions for accident-free, claim-free, multi-policy, defensive driver, good driver, and good student.

- 21st Century policyholders can earn discounts including homeowners, driver training, automatic seat belts, air bags, teen driver, anti-lock brakes, and 55 and older.

- Progressive offers discounts for multi-vehicle, continuous coverage, online quote discount, online signing, and multi-policy.

Check with each company or agent which credits you are entitled to. Some discounts may not be available in every state. To locate insurance companies with discount rates, click here to view.

Which policy gives me the best coverage?

When it comes to choosing the best auto insurance coverage for your personal vehicles, there is no cookie cutter policy. Everyone’s needs are different.

For example, these questions may help highlight whether your personal situation may require specific advice.

- Do I need more liability coverage?

- Is rental equipment covered for theft or damage?

- Do I pay less if my vehicle is kept in my garage?

- Is my teen driver covered when they drive my company car?

- What if I don’t agree with a claim settlement offer?

- How does medical payments coverage work?

- Is a fancy paint job covered?

- How do I file an SR-22 for a DUI in my state?

If it’s difficult to answer those questions, you might consider talking to an agent. To find lower rates from a local agent, fill out this quick form.

Free Auto Insurance Comparison

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Car insurance 101

Understanding the coverages of your policy helps when choosing which coverages you need and proper limits and deductibles. The coverage terms in a policy can be confusing and even agents have difficulty translating policy wording.

UM/UIM (Uninsured/Underinsured Motorist) coverage

This gives you protection when the “other guys” are uninsured or don’t have enough coverage. Covered claims include hospital bills for your injuries and damage to your Acura MDX.

Since a lot of drivers only purchase the least amount of liability that is required, it doesn’t take a major accident to exceed their coverage limits. For this reason, having high UM/UIM coverages should not be overlooked.

Coverage for collisions

This coverage will pay to fix damage to your MDX resulting from a collision with another vehicle or an object, but not an animal. You first must pay a deductible then the remaining damage will be paid by your insurance company.

Collision can pay for things like backing into a parked car, rolling your car, driving through your garage door, crashing into a building and scraping a guard rail. Paying for collision coverage can be pricey, so analyze the benefit of dropping coverage from vehicles that are older. You can also increase the deductible to bring the cost down.

Medical payments and PIP coverage

Medical payments and Personal Injury Protection insurance reimburse you for expenses like surgery, hospital visits, ambulance fees and rehabilitation expenses. The coverages can be used in conjunction with a health insurance program or if you lack health insurance entirely. Coverage applies to both the driver and occupants in addition to being hit by a car walking across the street. PIP coverage is not available in all states but can be used in place of medical payments coverage

Liability coverages

This provides protection from injuries or damage you cause to a person or their property that is your fault. This coverage protects you against claims from other people, and does not provide coverage for damage to your own property or vehicle.

Coverage consists of three different limits, bodily injury for each person, bodily injury for the entire accident, and a limit for property damage. As an example, you may have liability limits of 50/100/50 which stand for a limit of $50,000 per injured person, $100,000 for the entire accident, and property damage coverage for $50,000.

Liability can pay for claims such as pain and suffering, funeral expenses and attorney fees. How much liability should you purchase? That is a personal decision, but buy as large an amount as possible.

Comprehensive auto coverage

This covers damage OTHER than collision with another vehicle or object. You first have to pay a deductible then the remaining damage will be covered by your comprehensive coverage.

Comprehensive can pay for claims such as damage from a tornado or hurricane, damage from flooding and hitting a bird. The highest amount you can receive from a comprehensive claim is the actual cash value, so if the vehicle is not worth much it’s not worth carrying full coverage.

Knowledge is power

Affordable 2017 Acura MDX insurance is available online and with local insurance agents, so you should be comparing quotes from both to have the best selection. There are still a few companies who may not offer online rate quotes and many times these small, regional companies sell through local independent agencies.

As you quote insurance, it’s not a good idea to buy poor coverage just to save money. There have been many situations where consumers will sacrifice liability coverage limits only to regret that the savings was not a smart move. The goal is to buy the best coverage you can find at the best cost, but do not skimp to save money.

In this article, we presented quite a bit of information on how to reduce 2017 Acura MDX insurance rates online. The key thing to remember is the more providers you compare, the better likelihood of getting cheaper insurance. You may even discover the lowest rates come from a lesser-known regional company.

Use our FREE quote tool to compare rates now!

Other information

- Get the Right Protection (InsureUonline.org)

- Vehicle Insurance (Wikipedia)

- Young Drivers: The High Risk Years Video (iihs.org)

- When is the Right Time to Switch Car Insurance Companies? (Allstate)

- Preventing Carjacking and Theft (Insurance Information Institute)

- How to Avoid Common Accidents (State Farm)

Frequently Asked Questions

What factors determine the cost of insurance for a 2017 Acura MDX?

The cost of insurance for a 2017 Acura MDX depends on various factors. These include the driver’s age, driving history, location, annual mileage, coverage options, deductible amount, and insurance company’s policies.

Can I find affordable insurance rates for a 2017 Acura MDX?

Yes, it is possible to find affordable insurance rates for a 2017 Acura MDX. By comparing quotes from different insurance providers, you can find the best rates that suit your budget and coverage needs.

Is it cheaper to insure a 2017 Acura MDX compared to other vehicles?

Insurance rates for a 2017 Acura MDX can vary depending on various factors. While it’s challenging to make a direct comparison with other vehicles, the MDX is generally considered a luxury SUV, which can result in slightly higher insurance premiums compared to smaller, less expensive cars.

Are there any specific insurance discounts available for insuring a 2017 Acura MDX?

Yes, there are potential discounts available for insuring a 2017 Acura MDX. These can include multi-policy discounts, safe driver discounts, anti-theft device discounts, and discounts for insuring multiple vehicles with the same provider.

Can I negotiate the insurance premium for my 2017 Acura MDX?

While insurance premiums are generally based on specific factors and company policies, you can sometimes negotiate with insurance providers to obtain a better rate. It’s worth discussing your situation with the insurer or seeking quotes from different companies to find the most favorable premium.

Does the location where I live affect the insurance cost for my 2017 Acura MDX?

Yes, the location where you live can impact the insurance cost for your 2017 Acura MDX. Areas with higher crime rates, congestion, or a higher incidence of accidents can result in higher insurance premiums. Conversely, living in a low-risk area can potentially lead to lower rates.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Toyota Rav4 Insurance

- Dodge Grand Caravan Insurance

- Jeep Grand Cherokee Insurance

- Toyota Camry Insurance

- Toyota Prius Insurance

- Toyota Corolla Insurance

- Ford F-150 Insurance

- Hyundai Tucson Insurance

- Honda Civic Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area