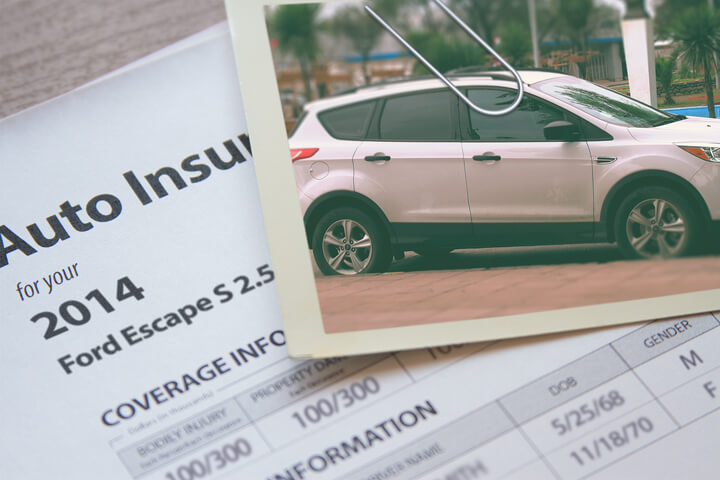

Cheapest 2014 Ford Escape Insurance Rates in 2026

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jun 5, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Trying to find the cheapest insurance 2014 Ford Escape insurance rates? or you may be asking are Ford Escapes expensive to insure? The average 2014 Ford Fiesta insurance rates are $1,088 per year for full coverage or $90.66 per month. Searching for the cheapest insurance for a new or used Ford Escape could be a painful process, but you can use a few tricks to make it easier.

There is a better way to compare insurance rates so we’re going to tell you the proper way to price shop coverage for a new or used Ford and locate the lowest possible price from local insurance agents and online providers.

It’s a great practice to compare prices yearly because prices change regularly. Even if you got the lowest price for Escape coverage on your last policy you can probably find a lower rate today. You can find a lot of misleading information regarding insurance on the web, but we’re going to give you some great ways to quit paying high insurance rates.

If you are insured now or are shopping for new coverage, you can learn to shop for the lowest rates and still get good coverage. Locating the best insurance is quite easy. Drivers only need to know the most effective way to compare price quotes over the internet.

Quit paying too much for your 2014 Ford Fiesta insurance costs and starting comparing 2014 Ford Fiesta insurance quotes. Enter your zip code into our tool above to get started.

Auto Insurance Comparison Rates

Finding a better price on auto insurance can be quick and easy. The only thing you need to do is invest a little time comparing rate quotes online from several insurance companies. This can be done in a couple of different ways.

The easiest and least time consuming way to find the lowest comparison rates is to use a rate comparison form (click to open form in new window). This form prevents you from having to do a different quote to each individual auto insurance company. A single form gets you coverage quotes from multiple low-cost companies. Just one form and you’re done.

Another way to get comparison quotes is to take the time to go to each company website and request a quote. For sake of this example, we’ll pretend you want rates from GEICO, Allstate and American Family. You would have to go to every website and enter your policy data, and that’s why the first method is more popular. For a handy list of car insurance company links in your area, click here.

Whichever method you choose, compare the exact same coverages for each price quote. If each company quotes different limits and deductibles on each one it will be next to impossible to determine which rate is truly the best.

You May Need Specialized Coverage

When it comes to buying the best auto insurance coverage for your personal vehicles, there really is no perfect coverage plan. Everyone’s situation is a little different.

For example, these questions may help highlight whether you might need an agent’s assistance.

- Does my medical payments coverage pay my health insurance deductible?

- Can I get a multi-policy discount for packaging my home and auto coverage?

- Do I get a pro-rated refund if I cancel my policy early?

- Do I need rental car coverage?

- How much underlying liability do I need for an umbrella policy?

- How can I get high-risk coverage after a DUI?

If you don’t know the answers to these questions, you might consider talking to a licensed insurance agent. To find lower rates from a local agent, fill out this quick form. It’s fast, doesn’t cost anything and can provide invaluable advice.

Auto Insurance Coverage Considerations

Understanding the coverages of your policy aids in choosing the best coverages for your vehicles. The terms used in a policy can be ambiguous and coverage can change by endorsement.

Liability coverage

This protects you from injuries or damage you cause to a person or their property that is your fault. This insurance protects YOU against claims from other people. It does not cover damage to your own property or vehicle.

Coverage consists of three different limits, bodily injury per person, bodily injury per accident and property damage. You might see liability limits of 50/100/50 that translate to $50,000 bodily injury coverage, $100,000 for the entire accident, and a total limit of $50,000 for damage to vehicles and property. Another option is one limit called combined single limit (CSL) which combines the three limits into one amount with no separate limits for injury or property damage.

Liability coverage pays for claims such as structural damage, court costs, repair costs for stationary objects, bail bonds and legal defense fees. How much coverage you buy is a decision to put some thought into, but buy as much as you can afford.

Protection from uninsured/underinsured drivers

This protects you and your vehicle from other motorists when they either are underinsured or have no liability coverage at all. Covered claims include medical payments for you and your occupants as well as your vehicle’s damage.

Since many drivers have only the minimum liability required by law, it only takes a small accident to exceed their coverage. So UM/UIM coverage is important protection for you and your family. Frequently your uninsured/underinsured motorist coverages are identical to your policy’s liability coverage.

Collision protection

Collision insurance will pay to fix damage to your Escape resulting from colliding with another vehicle or an object, but not an animal. You first must pay a deductible and then insurance will cover the remainder.

Collision coverage protects against claims such as colliding with a tree, driving through your garage door, sideswiping another vehicle and hitting a parking meter. Collision coverage makes up a good portion of your premium, so consider dropping it from older vehicles. Drivers also have the option to choose a higher deductible to bring the 2014 Ford Escape insurance costs down.

Comprehensive (Other than Collision)

This covers damage OTHER than collision with another vehicle or object. You first must pay your deductible and the remainder of the damage will be paid by comprehensive coverage.

Comprehensive coverage pays for claims like hitting a bird, damage from getting keyed and a broken windshield. The highest amount you’ll receive from a claim is the actual cash value, so if the vehicle’s value is low it’s not worth carrying full coverage.

Medical expense insurance

Personal Injury Protection (PIP) and medical payments coverage provide coverage for short-term medical expenses for funeral costs, EMT expenses, doctor visits, pain medications and dental work. The coverages can be used to fill the gap from your health insurance plan or if there is no health insurance coverage. Coverage applies to you and your occupants in addition to being hit by a car walking across the street. PIP is not available in all states but can be used in place of medical payments coverage.

Frequently Asked Questions

- How much does a 2014 Ford Escape cost? It started around $23,600 but now it will depend on the condition and how well it’s been maintained.

- Is a 2014 Ford Escape a good car? It’s a great value for price and insurance cost.

Use our FREE quote tool to compare rates now!

Frequently Asked Questions

How can I find the cheapest insurance rates for a 2014 Ford Escape in 2023?

To find the cheapest insurance rates for a 2014 Ford Escape in 2023, you can use a few tricks to make the process easier. One effective way is to compare prices yearly because insurance prices change regularly. You can use online tools to compare quotes from multiple insurance companies, both local agents and online providers. By comparing quotes, you increase your chances of finding the lowest possible price for your Ford Escape insurance.

Are Ford Escapes expensive to insure?

The average 2014 Ford Escape insurance rates are $1,088 per year for full coverage or $90.66 per month. However, insurance rates can vary based on several factors, including your location, driving record, age, and coverage options. It’s always a good idea to compare insurance quotes from different providers to find the best rates for your specific circumstances.

How can I compare auto insurance rates for my 2014 Ford Escape?

Comparing auto insurance rates for your 2014 Ford Escape can be quick and easy. One way is to use a rate comparison form that allows you to receive quotes from multiple insurance companies with just one form. Another method is to visit each insurance company’s website and request a quote individually. When comparing rates, make sure to compare the exact same coverages from each provider to determine the best rate for your needs.

What coverages should I consider for my 2014 Ford Escape?

When considering auto insurance coverage for your 2014 Ford Escape, it’s important to understand the different types of coverages available. Some key coverages to consider include:

- Liability coverage: Protects you from injuries or damage you cause to others.

- Uninsured/underinsured motorist coverage: Protects you if you’re involved in an accident with a driver who has insufficient insurance.

- Collision coverage: Pays for damage to your vehicle in the event of a collision.

- Comprehensive coverage: Covers damage to your vehicle from incidents other than collisions.

- Medical expense insurance (such as PIP or medical payments coverage): Covers medical expenses for you and your passengers.

Where can I find companies with the cheapest auto insurance rates?

To find companies with the cheapest auto insurance rates, you can use online resources and tools. Enter your zip code into a free quote tool to view companies that offer cheap auto insurance rates in your area. It’s important to compare quotes from different companies to ensure you’re getting the best possible rate. Keep in mind that the cheapest rate may not always provide the best coverage, so consider factors beyond price when making your decision.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2026

- Cheapest Jeep Insurance Rates in 2026

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Popular Rate Quotes

- Chevrolet Equinox Insurance

- Chevrolet Silverado Insurance

- GMC Sierra Insurance

- Honda Civic Insurance

- Toyota Rav4 Insurance

- Jeep Grand Cherokee Insurance

- Honda Accord Insurance

- Dodge Ram Insurance

- Nissan Rogue Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area