Audi A3 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: May 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

An Audi can be expensive to insure, which makes shopping around for affordable Audi A3 car insurance rates even more important. If you aren’t sure where to start or how much Audi A3 insurance rates should be, don’t worry.

If you read this guide before you buy Audi A3 car insurance, you’ll be well on the way to finding an affordable Audi A3 car insurance company to fit your needs.

Our guide goes through Audi A3 insurance costs, as well as Audi A3 prices, Audi A3 maintenance costs, and much more so you can secure cheap car insurance.

If you want to start comparing Audi A3 auto insurance quotes right away, enter your five-digit ZIP code into our FREE tool above.

U.S. average auto insurance rates for an Audi A3 are $1,404 annually including full coverage. Comprehensive insurance costs on average $282, collision costs $566, and liability is $398. A policy with just liability insurance costs around $460 a year, with coverage for high-risk drivers costing $3,054 or more. Teen drivers pay the highest rates at $5,272 a year or more.

Average premium for full coverage: $1,404

Price estimates by individual coverage:

Estimates include $500 comprehensive and collision deductibles, minimum liability limits, and includes UM/UIM and medical coverage. Estimates are averaged for all 50 U.S. states and for all A3 models.

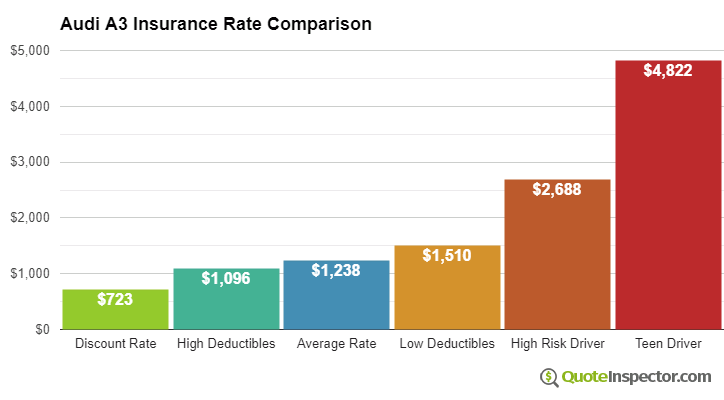

Price Range from Low to High

For a driver around age 40, Audi A3 insurance prices go from as cheap as $460 for a discount liability-only rate to the much higher price of $3,054 for high-risk insurance.

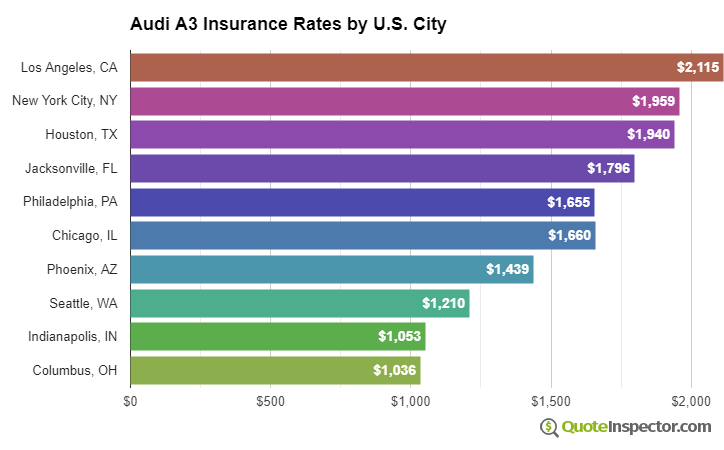

Geographic Price Range

Choosing to live in a large city can have significant affects on car insurance rates. Rural areas have fewer comprehensive and collision claims than larger metro areas.

The example below illustrates the difference between rural and urban areas on car insurance rates.

The ranges above highlight why everyone should compare rates quotes based on a specific location and their own personal driving habits, instead of using price averages.

Use the form below to get customized rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Rates by State, City, and Model

The chart below breaks down estimated Audi A3 insurance rates for different risk profiles and scenarios.

- The lowest rate with discounts is $801

- Raising to $1,000 deductibles will save around $192 every year

- The estimated rate for the average middle-age driver with $500 deductibles is $1,404

- Choosing pricier low deductibles costs an additional $376 every year

- At-risk drivers with multiple violations and an at-fault accident could pay upwards of $3,054 or more

- The price with full coverage for a teen driver for full coverage may cost $5,272

Insurance prices for an Audi A3 are also quite variable based on the trim level and model year, your driving characteristics, and policy deductibles and limits.

A more mature driver with a clean driving record and high physical damage deductibles may pay as little as $1,300 every 12 months on average for full coverage. Prices are highest for teenage drivers, where even without any violations or accidents they can expect to pay upwards of $5,200 a year. View Rates by Age

If you have some driving violations or you caused a few accidents, you are likely paying at a minimum $1,700 to $2,300 extra each year, depending on your age. Audi A3 insurance for high-risk drivers is expensive and can cost as much as 44% to 135% more than average. View High Risk Driver Rates

Choosing high deductibles can reduce prices by up to $570 every year, whereas buying more liability protection will cost you more. Changing from a 50/100 bodily injury limit to a 250/500 limit will increase prices by as much as $358 more per year. View Rates by Deductible or Liability Limit

The state you live in also has a big influence on Audi A3 insurance prices. A middle-age driver might find prices as low as $1,080 a year in states like Missouri, New Hampshire, and Vermont, or as much as $2,000 on average in Michigan, New York, and Louisiana.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,270 | -$134 | -9.5% |

| Alaska | $1,078 | -$326 | -23.2% |

| Arizona | $1,166 | -$238 | -17.0% |

| Arkansas | $1,404 | -$0 | 0.0% |

| California | $1,602 | $198 | 14.1% |

| Colorado | $1,340 | -$64 | -4.6% |

| Connecticut | $1,446 | $42 | 3.0% |

| Delaware | $1,588 | $184 | 13.1% |

| Florida | $1,758 | $354 | 25.2% |

| Georgia | $1,298 | -$106 | -7.5% |

| Hawaii | $1,008 | -$396 | -28.2% |

| Idaho | $950 | -$454 | -32.3% |

| Illinois | $1,048 | -$356 | -25.4% |

| Indiana | $1,058 | -$346 | -24.6% |

| Iowa | $948 | -$456 | -32.5% |

| Kansas | $1,336 | -$68 | -4.8% |

| Kentucky | $1,916 | $512 | 36.5% |

| Louisiana | $2,078 | $674 | 48.0% |

| Maine | $868 | -$536 | -38.2% |

| Maryland | $1,158 | -$246 | -17.5% |

| Massachusetts | $1,124 | -$280 | -19.9% |

| Michigan | $2,442 | $1,038 | 73.9% |

| Minnesota | $1,176 | -$228 | -16.2% |

| Mississippi | $1,684 | $280 | 19.9% |

| Missouri | $1,246 | -$158 | -11.3% |

| Montana | $1,508 | $104 | 7.4% |

| Nebraska | $1,108 | -$296 | -21.1% |

| Nevada | $1,686 | $282 | 20.1% |

| New Hampshire | $1,012 | -$392 | -27.9% |

| New Jersey | $1,570 | $166 | 11.8% |

| New Mexico | $1,246 | -$158 | -11.3% |

| New York | $1,480 | $76 | 5.4% |

| North Carolina | $810 | -$594 | -42.3% |

| North Dakota | $1,150 | -$254 | -18.1% |

| Ohio | $970 | -$434 | -30.9% |

| Oklahoma | $1,444 | $40 | 2.8% |

| Oregon | $1,286 | -$118 | -8.4% |

| Pennsylvania | $1,340 | -$64 | -4.6% |

| Rhode Island | $1,876 | $472 | 33.6% |

| South Carolina | $1,274 | -$130 | -9.3% |

| South Dakota | $1,186 | -$218 | -15.5% |

| Tennessee | $1,230 | -$174 | -12.4% |

| Texas | $1,694 | $290 | 20.7% |

| Utah | $1,040 | -$364 | -25.9% |

| Vermont | $962 | -$442 | -31.5% |

| Virginia | $840 | -$564 | -40.2% |

| Washington | $1,088 | -$316 | -22.5% |

| West Virginia | $1,288 | -$116 | -8.3% |

| Wisconsin | $972 | -$432 | -30.8% |

| Wyoming | $1,250 | -$154 | -11.0% |

Since prices can be so different, the best way to figure out exactly what you will pay is to regularly compare prices and see which company has the best price. Every auto insurance company uses a different rate calculation, so the prices may be quite different between companies.

Insurance Rates by Trim Level and Model Year

| Model and Trim | Annual Premium | Monthly Premium |

|---|---|---|

| Audi A3 2.0T Premium Package | $1,392 | $116 |

| Audi A3 2.0T Premium Plus Package | $1,404 | $117 |

| Audi A3 2.0T Quattro | $1,446 | $121 |

Rates assume 2024 model year, a 40-year-old male driver with no accidents or violations, $500 comprehensive and collision deductibles, minimum liability limits, and uninsured/under-insured motorist coverage included. Rates are for comparison only and are averaged for all 50 U.S. states.

| Model Year | Comprehensive | Collision | Liability | Total Premium |

|---|---|---|---|---|

| 2024 Audi A3 | $282 | $566 | $398 | $1,404 |

| 2023 Audi A3 | $272 | $552 | $416 | $1,398 |

| 2022 Audi A3 | $262 | $530 | $430 | $1,380 |

| 2021 Audi A3 | $248 | $512 | $442 | $1,360 |

| 2020 Audi A3 | $238 | $474 | $452 | $1,322 |

| 2019 Audi A3 | $230 | $446 | $456 | $1,290 |

| 2018 Audi A3 | $220 | $400 | $460 | $1,238 |

| 2017 Audi A3 | $206 | $368 | $460 | $1,192 |

| 2016 Audi A3 | $198 | $346 | $464 | $1,166 |

| 2015 Audi A3 | $194 | $322 | $474 | $1,148 |

| 2013 Audi A3 | $174 | $272 | $478 | $1,082 |

| 2012 Audi A3 | $162 | $248 | $474 | $1,042 |

| 2011 Audi A3 | $152 | $226 | $474 | $1,010 |

| 2010 Audi A3 | $148 | $202 | $468 | $976 |

| 2009 Audi A3 | $146 | $198 | $460 | $962 |

| 2008 Audi A3 | $144 | $188 | $452 | $942 |

| 2007 Audi A3 | $132 | $180 | $446 | $916 |

| 2006 Audi A3 | $126 | $170 | $442 | $896 |

Rates are averaged for all Audi A3 models and trim levels. Rates assume a 40-year-old male driver, full coverage with $500 deductibles, and a clean driving record.

How to Buy Low Cost Audi A3 Insurance

Getting lower rates on car insurance consists of having a decent driving record, having a good credit history, being claim-free, and bundling your home and auto policies. Set aside time to compare rates every couple of years by requesting rates from direct car insurance companies like GEICO, Progressive, and Esurance, and also from several local insurance agents.

The following items are a review of the material that was covered above.

- Policyholders who require additional liability coverage will pay about $440 per year to raise from a low limit to higher 250/500 limits

- 16 to 18-year-old drivers pay the highest prices, possibly costing $439 a month including comprehensive and collision insurance

- Higher risk drivers who have several accidents or serious violations pay on average $1,650 more each year than a driver with a clean driving record

- Increasing physical damage deductibles could save up to $575 each year

Simply by getting quotes early to find cheap Audi A3 car insurance, you could save about $170 a year. Use our free tool below to get started on comparing car insurance rates in your area.

Keep in mind that many factors can affect auto insurance rates. Audi A3 car insurance for an 18-year-old driver will be more expensive than Audi A3 insurance for a 21-year old.

Let’s look at some other things that play into calculating Audi A3 auto insurance rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How does the size and class of the Audi A3 affect liability rates?

What does liability insurance cover? Composed of two parts (property damage and bodily injury), liability insurance is coverage that pays for other parties’ accident costs if you caused the accident.

Since liability insurance covers other drivers’ costs, the size and class of a vehicle directly affect what you’ll pay for liability insurance. Why? If your car meets one of the criteria below, it may be classified as a high-risk vehicle and have higher liability rates.

- A car that is large and heavy (can inflict more damage on other vehicles).

- A car that crashes easily, such as a sports car or a car with poor safety features.

- A car model that has high insurance loss numbers, which is the average number of claims filed against a car.

The Audi A3 may be labeled as a high risk vehicle, as it is a midsize luxury car. Generally, this means it may be more prone to crashing because of its more powerful engine.

To check if the Audi A3 has higher liability losses, we are going to go through the Insurance Institute for Highway Safety’s (IIHS) data on insurance losses by make and model for Audi A3s.

In the table below, you view the Audi A3 insurance loss probability details.

Audi A3 Insurance Loss Probability| Insurance Coverage Category | Loss Rate |

|---|---|

| Collision | 52% |

| Property Damage | -10% |

| Comprehensive | 9% |

| Personal Injury | -15% |

| Medical Payment | no data |

| Bodily Injury | no data |

The lower the number, the better the insurance loss ratio. Let’s explore what these numbers mean in a little more detail.

The first set of losses below are for bodily injury losses (claims paid) from 2016 to 2018.

- Audi A3 four-door: 14 percent (average)

- Audi A3 four-door and four-wheel-drive: -28 percent (better than average)

The insurance losses for the Audi A3 with four-wheel-drive are considerably better than than the Audi A3 without four-wheel-drive. If you take a look at the property damage losses below, you can see that four-wheel-drives did better on losses.

- Audi A3 four-door: -2 percent (average)

- Audi A3 four-door and four-wheel-drive: -18 percent (average)

- Audi A3 convertible: 8 percent (average)

- Audi A3 convertible four-wheel-drive: -31 percent (substantially better than average)

- Audi A3 plug-in hybrid station wagon: -10 percent (average)

Most of the losses are average for midsize luxury cars, which suggests the Audi A3 will have normal rates. While you probably won’t earn a huge discount on liability insurance, you also won’t be paying extremely high rates.

What does liability insurance cost for the Audi A3?

Is Audi A3 insurance expensive? Exactly how much does insurance cost for an Audi A3? To find out, we pulled rates from a sample Geico quote for a 40-year-old male driver with a clean driving record who lives in Pennsylvania and owns his 2020 Audi A3 Sedan four-door.

The first set of rates you see below is for six months of bodily injury liability insurance.

- Low ($15,000/$30,000): $32.12

- Medium ($100,000/$200,000): $65.85

- High ($500,000/$500,000): $106.01

Low coverage is the bare minimum you must purchase to meet your state’s requirements. The coverage limits of low coverage won’t stretch far if you seriously injure someone, so we do recommend getting at least medium coverage.

Upgrading to medium bodily injury coverage will only cost about $5 more a month while upgrading to high will only cost about $12 more a month.

The extra upgrade costs for property damage liability coverage are even lower, which means you could upgrade both coverages for a reasonable price.

- Low ($5,000): $420.41

- Medium ($20,000): $445.35

- High ($100,000): $463.58

The upgrade to medium coverage will be an extra $4 a month, and the upgrade to high coverage will be an extra $7 a month. These are low price increases, which is great. Based on these sample rates, it shouldn’t be too hard to find an affordable insurance price for your Audi A3.

What are the safety features and ratings of the Audi A3?

Safety features reduce your risk of being in a crash and protect you in a crash, which means lower insurance rates. If you have a chance to upgrade to better safety features, you should do this if possible. More safety features mean a better discount, so the extra money you pay for upgrades should eventually pay itself off.

AutoBlog listed the following safety features for the 2020 Audi A3.

- Crash prevention: anti-lock brakes and stability control.

- Crash protection: front-impact airbags, side-impact airbags, overhead airbags, knee airbags, seatbelt pretensioners, and anti-whiplash headrests.

- Anti-theft: vehicle intrusion alarms and ignition disable device.

The multiple airbags in the Audi A3 are fantastic and will help protect you from life-threatening injuries in a crash. The knee airbags are a less common airbag, but they protect you from leg injuries (which are common in crashes).

Because the Audi A3 has a great array of safety features on the standard model, make sure your insurer is offering you a discount. The Audi A3 also has great safety ratings from the Insurance Institute for Highway Safety (IIHS).

Both the four-door sedan (2019 + 2020) and four-door wagon (2013) won Top Safety Pick awards from the IIHS. They both rated good in small overlap front crash tests (driver-side and passenger-side), moderate overlap front crash test, side tests, roof strength tests, and head restraints/seat tests.

Because good is the highest rating, the Audi A3 did fantastic in the IIHS’s crash tests. This is important, as cars have higher fatality rates, so good crash ratings ensure you won’t be paying higher rates just because you own a car rather than a pickup or SUV.

In the following table, see the Audi A3 crash test ratings as performed by the National Highway Traffic Safety Administration.

Audi A3 Crash Test Ratings| Vehicle Tested | Overall | Frontal | Side | Rollover |

|---|---|---|---|---|

| 2020 Audi A3 Cabriolet C FWD | N/R | N/R | N/R | N/R |

| 2020 Audi A3 Cabriolet C AWD | N/R | N/R | N/R | N/R |

| 2020 Audi A3 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2020 Audi A3 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Audi A3 Sportback e-tron FWD | N/R | N/R | N/R | N/R |

| 2019 Audi A3 C FWD | N/R | N/R | N/R | N/R |

| 2019 Audi A3 C AWD | N/R | N/R | N/R | N/R |

| 2019 Audi A3 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2019 Audi A3 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Audi A3 Sportback e-tron FWD | N/R | N/R | N/R | N/R |

| 2018 Audi A3 C FWD | N/R | N/R | N/R | N/R |

| 2018 Audi A3 C AWD | N/R | N/R | N/R | N/R |

| 2018 Audi A3 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2018 Audi A3 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Audi A3 C FWD | N/R | N/R | N/R | N/R |

| 2017 Audi A3 C AWD | N/R | N/R | N/R | N/R |

| 2017 Audi A3 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2017 Audi A3 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Audi A3 C FWD | N/R | N/R | N/R | N/R |

| 2016 Audi A3 C AWD | N/R | N/R | N/R | N/R |

| 2016 Audi A3 4 DR FWD | 5 stars | 4 stars | 5 stars | 4 stars |

| 2016 Audi A3 4 DR AWD | 5 stars | 4 stars | 5 stars | 4 stars |

A 5-star rating is the highest score given by the National Highway Traffic Safety Administration. Overall, the Audi A3 performed very well.

Just how much worse are car fatalities compared to pickups and SUVs? According to the IIHS’s 2018 study, out of driver fatalities per million vehicles, there were 48 car fatalities compared to only 34 pickup fatalities and 23 SUV fatalities.

All occupant fatalities per million vehicles also show cars have more fatalities, as they equal 69 car fatalities, 42 pickup fatalities, and 32 SUV fatalities.

Not sure how many total fatalities these numbers equal? The 2018 total fatalities amounted to 13,138 for cars, 5,035 for SUVs, and 4,369 for pickups. Below, you can see a breakdown of the 13,138 car fatalities by crash type.

- Frontal Impact: 7,433 fatalities

- Side Impact: 3,568 fatalities

- Rear Impact: 834 fatalities

- Other (mostly rollovers): 1,303 fatalities

Frontal impacts are the deadliest for cars, although side impacts also make up a huge chunk of the fatalities. It’s important to be aware of what the fatality breakdown is for your car type, as it can help you find a car that is safer in these types of crashes.

Since the Audi A3 has great safety ratings, it will be a good choice of car for crashes. Want to learn what else determines the price of car insurance? Keep reading to learn how the price of your Audi A3 can affect your car insurance rates.

What is the MSRP of the Audi A3?

The manufacturer suggested retail price (MSRP) is an important indicator of how much it will cost to repair or replace a car. Because the MSRP is a fixed price, insurers will often use the MSRP to determine collision and comprehensive rates rather than using the invoice price (the seller price) or the fair purchase price (what most people pay for the car).

Why are collision and comprehensive insurance affected by MSRP? These two coverages pay for your vehicle repairs, regardless of who caused the accident, so a high MSRP price means your insurer will have to pay more to repair or replace your vehicle. Because these coverages cover a variety of situations, most lenders will require you to carry them in what is called force-placed insurance.

Even if you aren’t required to carry these coverages, you should still have them. Collision coverage pays for your car repairs if you crash into another vehicle or object. Comprehensive coverage pays if you crash into an animal, or if there is weather damage, theft, or vandalism.

So what is the MSRP? Knowing the price will help us determine if collision and comprehensive rates will be high. Prices for the 2020 Audi A3, according to Kelley Blue Book (KBB), are as follows:

- MSRP: $34,295

- Invoice: $32,299

- Fair Purchase Price: $31,479

- Fair Market Range: $29,886 to $33,071

Because the Audi A3 is a luxury vehicle, the MSRP is higher. However, you should never pay the MSRP. Instead, shop around to find the fair purchase price in your area, which is usually a few thousand dollars less than the MSRP.

Another factor that helps us determine if collision and comprehensive rates will be high is insurance losses for these coverages. Let’s start by looking at collision losses for Audi A3s.

- Audi A3 four-door: 37 percent (substantially worse than average)

- Audi A3 four-door and four-wheel-drive: 30 percent (worse than average)

- Audi A3 convertible: 32 percent (substantially worse than average)

- Audi A3 convertible four-wheel-drive: 9 percent (average)

- Audi A3 plug-in hybrid station wagon: 37 percent (substantially worse than average)

Unfortunately, most of the losses for Audi A3s are poor. This means you could have a higher rate on your collision insurance. The good news is that the comprehensive rates for most of the Audi A3s are average, so your comprehensive rate should be normal.

- Audi A3 four-door: 3 percent (average)

- Audi A3 four-door and four-wheel-drive: 13 percent (average)

- Audi A3 convertible: -33 percent (substantially better than average)

- Audi A3 convertible four-wheel-drive: 9 percent (average)

- Audi A3 plug-in hybrid station wagon: 12 percent (average)

While your collision rates may be a little higher than average, shopping around for insurance can help keep your rates low.

How much will it cost to repair my Audi A3?

Is owning an Audi expensive? Knowing average repair costs beforehand can help you plan for maintenance costs, such as oil changes or engine repairs. According to RepairPal’s reliability rating of the Audi A3, the average annual repair cost is $741. This is slightly lower than the average for luxury compact cars, which is $801.

The Audi A3 also has a 3.5 out of 5 reliability rating, which is good. Because the Audi A3 has decent repair costs, the car insurance rates shouldn’t be too high.

To keep costs down, it is important to shop around for car insurance rates.

If you want to start comparing Audi A3 insurance costs today or just want to know what the cheapest Audi to insure is, just enter your five-digit ZIP code into our FREE tool.

Rate Tables and Charts

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $5,272 |

| 20 | $3,272 |

| 30 | $1,468 |

| 40 | $1,404 |

| 50 | $1,286 |

| 60 | $1,262 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $1,780 |

| $250 | $1,604 |

| $500 | $1,404 |

| $1,000 | $1,212 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,404 |

| 50/100 | $1,526 |

| 100/300 | $1,625 |

| 250/500 | $1,884 |

| 100 CSL | $1,565 |

| 300 CSL | $1,784 |

| 500 CSL | $1,944 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $7,528 |

| 20 | $5,206 |

| 30 | $3,124 |

| 40 | $3,054 |

| 50 | $2,918 |

| 60 | $2,894 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $75 |

| Multi-vehicle | $74 |

| Homeowner | $20 |

| 5-yr Accident Free | $106 |

| 5-yr Claim Free | $91 |

| Paid in Full/EFT | $66 |

| Advance Quote | $71 |

| Online Quote | $100 |

| Total Discounts | $603 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area