BMW M3 CI 2-Dr Coupe Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

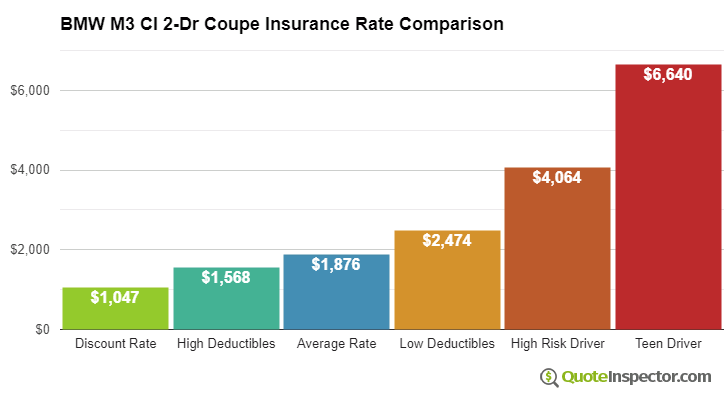

Estimated auto insurance rates for a BMW M3 CI 2-Dr Coupe are $1,876 annually including full coverage. Comprehensive insurance costs approximately $466 each year, collision costs $888, and liability coverage costs $364. A policy with only liability insurance costs as little as $430 a year, with a high-risk policy costing $4,064 or more. Teen drivers pay the most at $6,640 a year or more.

Annual premium for full coverage: $1,876

Premium estimates by individual coverage:

40-year-old driver, full coverage with $500 deductibles, and good driving record

Price Range for Insurance for this BMW M3 Trim Level

Using a 40-year-old driver as an example, insurance rates for a BMW M3 CI 2-Dr Coupe go from as cheap as $430 for liability-only coverage to a high rate of $4,064 for a policy for a high-risk driver.

These rate differences highlight why all drivers should compare rates using their specific location and their own personal driving habits, rather than using price averages.

Use the form below to get rates for your location.

Enter your zip code below to view companies based on your location that have cheap auto insurance rates.

Recommended Companies for Cheap BMW M3 CI 2-Dr Coupe Insurance

Car insurance rates for a BMW M3 CI 2-Dr Coupe also have a wide range based on the replacement cost of your M3, your driving characteristics, and physical damage deductibles and liability limits.

More mature drivers with no driving violations and high physical damage deductibles may only pay around $1,700 per year on average, or $142 per month, for full coverage. Prices are highest for drivers in their teens, where even without any violations or accidents they will be charged in the ballpark of $6,600 a year. View Rates by Age

If you have a few violations or you caused a few accidents, you are likely paying anywhere from $2,200 to $3,000 extra annually, depending on your age. Insurance for high-risk drivers can cost around 45% to 131% more than average. View High Risk Driver Rates

Choosing high deductibles could save up to $910 a year, whereas increasing liability limits will push prices upward. Changing from a 50/100 bodily injury limit to a 250/500 limit will cost up to $327 extra every 12 months. View Rates by Deductible or Liability Limit

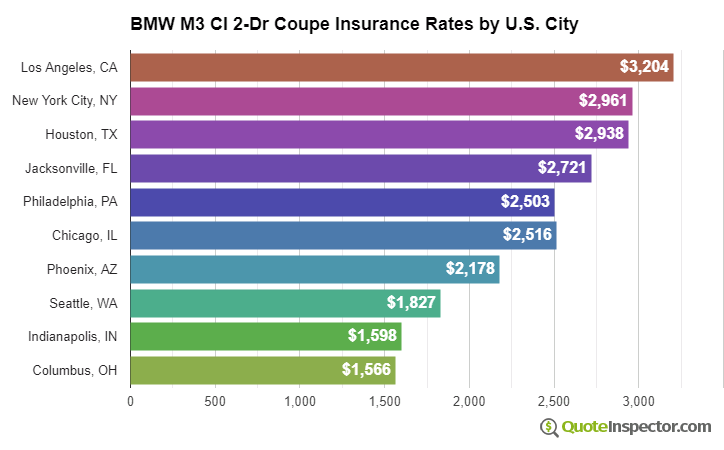

Where you choose to live makes a big difference in BMW M3 CI 2-Dr Coupe insurance rates. A 40-year-old driver could pay as low as $1,060 a year in states like North Carolina, Indiana, and , or as much as $1,950 on average in Louisiana, Montana, and Michigan. Rates by state and city are shown later in the article.

With such a large range of prices, the best way to figure out which car insurance is cheapest is to do a rate comparison and see how they stack up. Every company uses a different rate calculation, so rate quotes will be substantially different between companies.

The chart above shows average BMW M3 CI 2-Dr Coupe insurance prices for different situations. The cheapest price with discounts is $1,047. Drivers who choose higher $1,000 deductibles will pay about $1,568. The average price for a middle-aged driver with a clean driving record using $500 deductibles is $1,876. Using lower $100 deductibles for collision and other-than-collision coverage can cost as much as $2,474. High risk drivers could be charged up to $4,064. The policy rate for full coverage for a teenager is $6,640.

| State | Premium | Compared to U.S. Avg | Percent Difference |

|---|---|---|---|

| Alabama | $1,694 | -$182 | -9.7% |

| Alaska | $1,436 | -$440 | -23.5% |

| Arizona | $1,556 | -$320 | -17.1% |

| Arkansas | $1,876 | -$0 | 0.0% |

| California | $2,136 | $260 | 13.9% |

| Colorado | $1,792 | -$84 | -4.5% |

| Connecticut | $1,928 | $52 | 2.8% |

| Delaware | $2,122 | $246 | 13.1% |

| Florida | $2,346 | $470 | 25.1% |

| Georgia | $1,732 | -$144 | -7.7% |

| Hawaii | $1,348 | -$528 | -28.1% |

| Idaho | $1,270 | -$606 | -32.3% |

| Illinois | $1,398 | -$478 | -25.5% |

| Indiana | $1,414 | -$462 | -24.6% |

| Iowa | $1,266 | -$610 | -32.5% |

| Kansas | $1,784 | -$92 | -4.9% |

| Kentucky | $2,560 | $684 | 36.5% |

| Louisiana | $2,776 | $900 | 48.0% |

| Maine | $1,158 | -$718 | -38.3% |

| Maryland | $1,546 | -$330 | -17.6% |

| Massachusetts | $1,500 | -$376 | -20.0% |

| Michigan | $3,258 | $1,382 | 73.7% |

| Minnesota | $1,570 | -$306 | -16.3% |

| Mississippi | $2,248 | $372 | 19.8% |

| Missouri | $1,664 | -$212 | -11.3% |

| Montana | $2,014 | $138 | 7.4% |

| Nebraska | $1,478 | -$398 | -21.2% |

| Nevada | $2,248 | $372 | 19.8% |

| New Hampshire | $1,352 | -$524 | -27.9% |

| New Jersey | $2,096 | $220 | 11.7% |

| New Mexico | $1,660 | -$216 | -11.5% |

| New York | $1,974 | $98 | 5.2% |

| North Carolina | $1,082 | -$794 | -42.3% |

| North Dakota | $1,536 | -$340 | -18.1% |

| Ohio | $1,294 | -$582 | -31.0% |

| Oklahoma | $1,928 | $52 | 2.8% |

| Oregon | $1,718 | -$158 | -8.4% |

| Pennsylvania | $1,788 | -$88 | -4.7% |

| Rhode Island | $2,500 | $624 | 33.3% |

| South Carolina | $1,700 | -$176 | -9.4% |

| South Dakota | $1,582 | -$294 | -15.7% |

| Tennessee | $1,644 | -$232 | -12.4% |

| Texas | $2,260 | $384 | 20.5% |

| Utah | $1,390 | -$486 | -25.9% |

| Vermont | $1,282 | -$594 | -31.7% |

| Virginia | $1,124 | -$752 | -40.1% |

| Washington | $1,450 | -$426 | -22.7% |

| West Virginia | $1,718 | -$158 | -8.4% |

| Wisconsin | $1,298 | -$578 | -30.8% |

| Wyoming | $1,670 | -$206 | -11.0% |

Rate Tables and Charts

Not your model?

Choose a different trim level below

Rates by Driver Age

| Driver Age | Premium |

|---|---|

| 16 | $6,640 |

| 20 | $4,332 |

| 30 | $1,984 |

| 40 | $1,876 |

| 50 | $1,706 |

| 60 | $1,674 |

Full coverage, $500 deductibles

Rates by Deductible

| Deductible | Premium |

|---|---|

| $100 | $2,474 |

| $250 | $2,196 |

| $500 | $1,876 |

| $1,000 | $1,568 |

Full coverage, driver age 40

Rates by Liability Limit

| Liability Limit | Premium |

|---|---|

| 30/60 | $1,876 |

| 50/100 | $1,949 |

| 100/300 | $2,040 |

| 250/500 | $2,276 |

| 100 CSL | $1,985 |

| 300 CSL | $2,185 |

| 500 CSL | $2,331 |

Full coverage, driver age 40

Rates for High Risk Drivers

| Age | Premium |

|---|---|

| 16 | $9,556 |

| 20 | $6,890 |

| 30 | $4,186 |

| 40 | $4,064 |

| 50 | $3,874 |

| 60 | $3,840 |

Full coverage, $500 deductibles, two speeding tickets, and one at-fault accident

If a financial responsibility filing is required, the additional charge below may also apply.

Potential Rate Discounts

If you qualify for discounts, you may save the amounts shown below.

| Discount | Savings |

|---|---|

| Multi-policy | $103 |

| Multi-vehicle | $96 |

| Homeowner | $24 |

| 5-yr Accident Free | $151 |

| 5-yr Claim Free | $123 |

| Paid in Full/EFT | $96 |

| Advance Quote | $99 |

| Online Quote | $137 |

| Total Discounts | $829 |

Discounts are estimated and may not be available from every company or in every state.

Compare Rates and Save

Find companies with the cheapest rates in your area