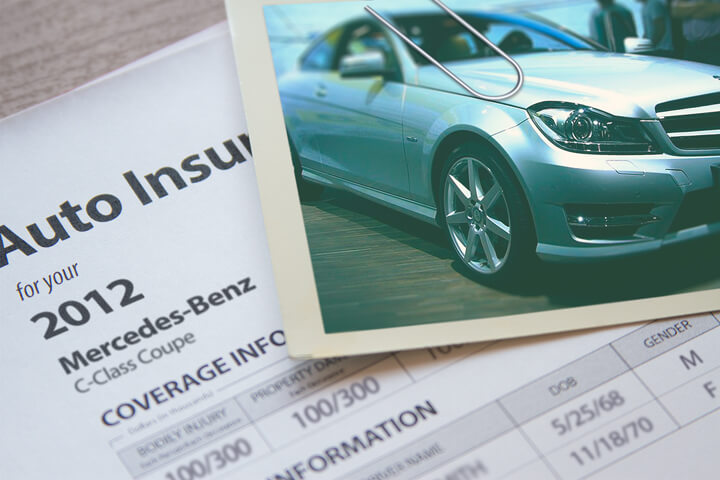

Mercedes C300 Insurance Rates

Enter your zip code below to view companies that have cheap auto insurance rates.

UPDATED: Jun 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

There are many options when comparing insurance rates on your Mercedes C300. You can buy direct from a local agent or shop online to compare rates from insurance carriers. Buying car insurance by getting online quotes is easy and there is a good chance you might just save a little.

People who are new to shopping for insurance may think finding low-cost Mercedes C300 insurance is nearly impossible. Finding a better price on car insurance can be relatively painless. Consumers just need to spend a few minutes to get quotes from different insurance companies. This can be accomplished by comparing rates here.

Auto insurance rates on a Mercedes C300 can fluctuate considerably based upon several criteria. Some of these factors include:

- The performance level of your C300

- Accidents raise premiums

- Multiple policies can save money

- Pleasure use vs. commuting use

- Extra coverages like towing and rental

- Claims drive up premiums

- No coverage lapses saves money

- Whether you own your home

A final factor that helps determine Mercedes C300 insurance rates is the model year. Newer models cost more in comparison to later models so repair costs are higher which may result in higher rates. Conversely, more recent C300 vehicles may have a trim level with safety features such as pedestrian detection, dual-stage airbags, a rollover prevention system, and automatic crash notification which may lower rates.

Liability - Liability insurance will cover damage that occurs to people or other property in an accident. Liability can pay for things like legal defense fees, bail bonds, and repair bills for other people's vehicles. Liability insurance is relatively cheap so consider buying as high a limit as you can afford.

Collision coverages - Collision insurance will pay to fix damage to your C300 resulting from a collision with another car or object. A deductible applies and then insurance will cover the remainder. Collision coverage for your Mercedes C300 can be pricey, so consider dropping it from vehicles that are older. You can also bump up the deductible to bring the cost down.

Comprehensive or Other Than Collision - This coverage pays for damage OTHER than collision with another vehicle or object. You first have to pay a deductible and the remainder of the damage will be paid by your Mercedes C300 comprehensive insurance. The most you'll receive from a claim is the actual cash value, so if it's not worth much more than your deductible it's not worth carrying full coverage.

Uninsured and underinsured coverage - Your UM/UIM coverage protects you and your vehicle's occupants from other drivers when they are uninsured or don't have enough coverage. Since many drivers only carry the minimum required liability limits, their limits can quickly be used up. So UM/UIM coverage is very important.

Medical costs insurance - Personal Injury Protection (PIP) and medical payments coverage provide coverage for short-term medical expenses (i.e. nursing services, prosthetic devices, and dental work). They are often used in conjunction with a health insurance program or if you do not have health coverage. PIP is only offered in select states and gives slightly broader coverage than med pay.

Frequently Asked Questions

- What is a named operator policy?

- Will Geico insure a car not in my name?

- What Is Covered in a Jeep Powertrain Warranty? 2024

- Cheapest Jeep Insurance Rates in 2024

- Do trucks cost more to insure?

- How long does a DUI stay on your record?

- Does the Porsche Club of America offer car insurance?

- View All Coverage Questions

Car Insurance By Model Year

- 2019 Mercedes-Benz GLC-Class

- 2018 Mercedes-Benz GLC-Class

- 2018 Mercedes-Benz C-Class

- 2017 Mercedes-Benz C-Class

- 2016 Mercedes-Benz C-Class

- 2015 Mercedes-Benz C-Class

- 2014 Mercedes-Benz C-Class

- 2013 Mercedes-Benz C-Class

- 2012 Mercedes-Benz C-Class

- 2011 Mercedes-Benz C-Class

Popular Rate Quotes

- Toyota Camry Insurance

- Kia Optima Insurance

- Ford F-150 Insurance

- Nissan Rogue Insurance

- Ford Edge Insurance

- Honda Accord Insurance

- Toyota Corolla Insurance

- Subaru Outback Insurance

- Dodge Ram Insurance

Compare Rates and Save

Find companies with the cheapest rates in your area